Inflation data may no longer be the big catalyst for stocks that it once was.

U.S. stocks bounced around to a higher close on Thursday, even though investors received some encouraging inflation news after the consumer-price index for December showed its first monthly decline since the pandemic swept across the globe in 2020.

To get a better sense of what led to such a muted reaction in stocks, despite the economic milestone, MarketWatch collected insights from market strategists on what happened. Instead, the core level, which omits volatile food and energy prices, rose 0.3%, matching the median forecast from economists polled by The Wall Street Journal.

Report didn’t move the needle Several markets commentators noted in the wake of the CPI report that the data didn’t fundamentally change expectations about where interest rates will peak, or how quickly the Fed will shift from hiking rates to cutting them. Signs of slowing wage growth in December helped inspire a 700-point gain for the Dow Jones Industrial Average when the monthly labor-market report was released a week ago Friday. The report showed the pace of average hourly earnings growth over the prior year slowed to 4.6% in December from 4.8% in November. But markets had already priced this in, strategists said.

Valuations still too high Finally, while lower inflation tends to benefit equity valuations, stocks still seem too richly priced based on previous periods of high inflation, said Greg Stanek, a portfolio manager at Gilman Hill Asset Management.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Why Thursday’s U.S. CPI report might kill stock market's hope of inflation melting awayA mild stock market rally to kick off the new year will be put to the test Thursday when investors face a highly-awaited inflation reading which could well...

Why Thursday’s U.S. CPI report might kill stock market's hope of inflation melting awayA mild stock market rally to kick off the new year will be put to the test Thursday when investors face a highly-awaited inflation reading which could well...

Baca lebih lajut »

As costs rise, Gov. Hochul proposes linking minimum wage to inflationGovernor Kathy Hochul's proposal would link New York's minimum wage with the inflation rate, triggering automatic wage increases as the cost of goods rises.

Baca lebih lajut »

Why Investors May Be Too Optimistic About InflationMany of the factors that once helped central banks control inflation have gone into reverse, and investors are ignoring them

Why Investors May Be Too Optimistic About InflationMany of the factors that once helped central banks control inflation have gone into reverse, and investors are ignoring them

Baca lebih lajut »

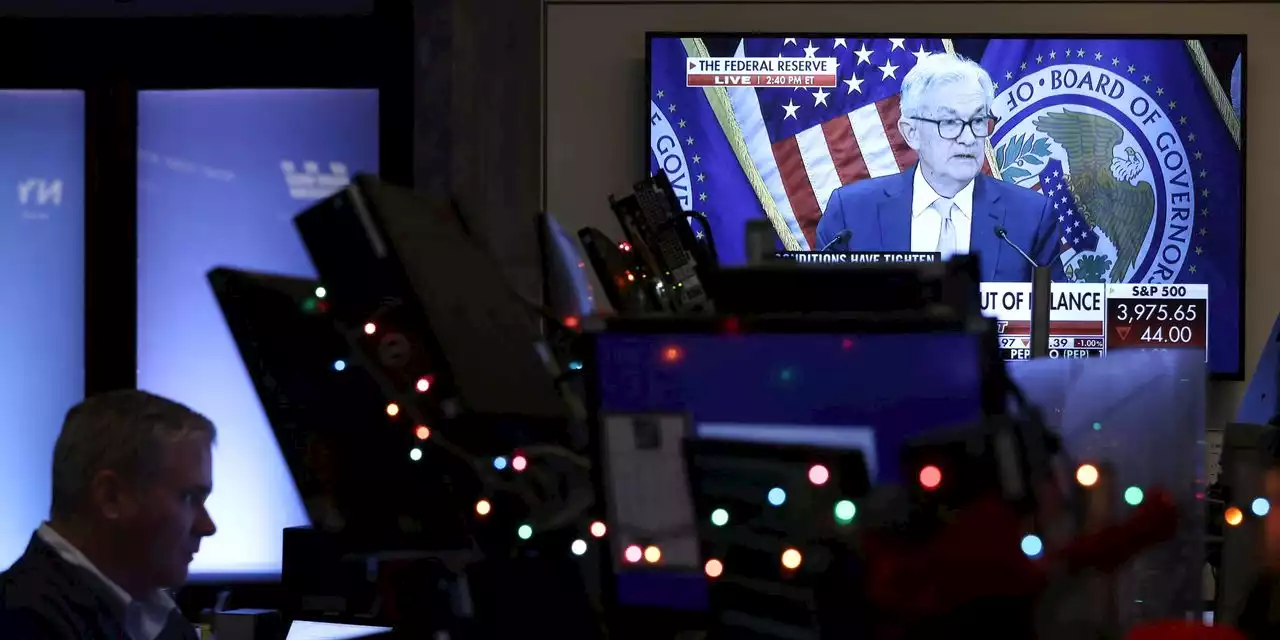

Why The Fed Thinks It Has To Bring Inflation Down NowThe Federal Reserve’s continued interest rate increases lead many to wonder, “What are they thinking?” The Fed pretty much mirrors professional economics opinions, which have evolved over time to a strong preference for low inflation.

Why The Fed Thinks It Has To Bring Inflation Down NowThe Federal Reserve’s continued interest rate increases lead many to wonder, “What are they thinking?” The Fed pretty much mirrors professional economics opinions, which have evolved over time to a strong preference for low inflation.

Baca lebih lajut »

Betting On Yourself: How to Do It and Why It's Important | HackerNoonWhy We Don't Bet On Ourselves (And Why We Should) - business entrepreneurship

Betting On Yourself: How to Do It and Why It's Important | HackerNoonWhy We Don't Bet On Ourselves (And Why We Should) - business entrepreneurship

Baca lebih lajut »

U.S. stock futures steady after solid start to year and as inflation data loomsFutures were little changed on Wednesday as caution prevailed after a steadily positive start to 2023 and with traders eyeing CPI report due Thursday.

U.S. stock futures steady after solid start to year and as inflation data loomsFutures were little changed on Wednesday as caution prevailed after a steadily positive start to 2023 and with traders eyeing CPI report due Thursday.

Baca lebih lajut »