Increases to the Federal Reserve's policy rate usually take a few quarters to filter through to bank deposit rates, say Goldman Sachs economists.

A flood of cash going into money-market funds and other higher yielding cash-like assets has been a key focus in financial markets since March when Silicon Valley Bank and Signature Bank collapsed.

Those failures put a spotlight on the stability of the U.S. banking system, but also on alternative ways for savers and investors to earn yield as the Federal Reserve continues its work of the past year to tame inflation through higher rates. But even then, deposit rates and 1-year CD yields were seeing only a portion of the increases to short-term rates.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Here's why the Fed' reputation is shot, according to Mohamed El-ErianHere's everything the Fed has done wrong in handling the economy and why its reputation is in tatters, according to Mohamed El-Erian

Baca lebih lajut »

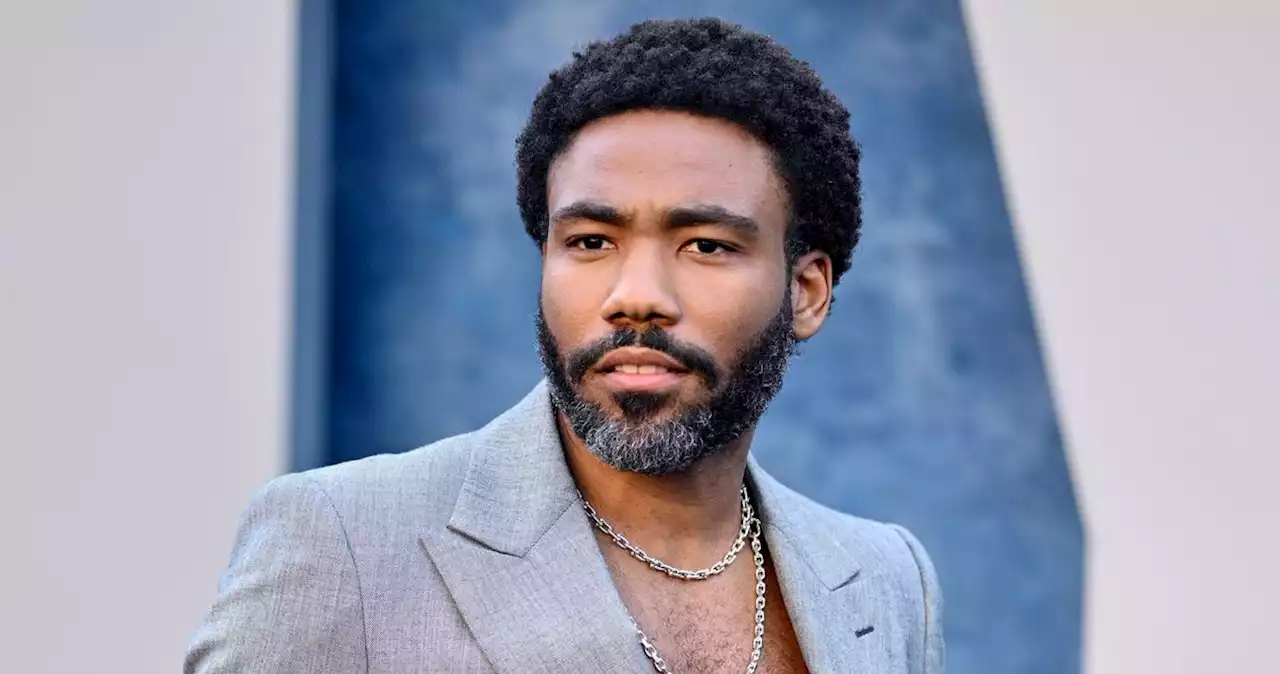

Donald Glover Explains Why He Didn’t Join SNL and Why That’s GoodFailure breeds character, first of all.

Donald Glover Explains Why He Didn’t Join SNL and Why That’s GoodFailure breeds character, first of all.

Baca lebih lajut »

Traders bet Fed won't raise rates further as job market coolsA key gauge of labor market tightness that Federal Reserve Chair Jerome Powell has cited throughout the central bank's aggressive interest-rate hike campaign dropped to its lowest level since late 2021, a sign that a long-awaited cooling is underway and easing concerns borrowing costs will have to move much higher to bring down inflation.

Traders bet Fed won't raise rates further as job market coolsA key gauge of labor market tightness that Federal Reserve Chair Jerome Powell has cited throughout the central bank's aggressive interest-rate hike campaign dropped to its lowest level since late 2021, a sign that a long-awaited cooling is underway and easing concerns borrowing costs will have to move much higher to bring down inflation.

Baca lebih lajut »

The worst thing the Fed can do is cut interest rates, El-Erian saysThe worst thing the Federal Reserve can do now is cut interest rates, top economist Mohamed El-Erian says

Baca lebih lajut »

Fed's Mester sees 'somewhat' higher interest rates aheadCleveland Fed President Loretta Mester said her forecasts includes 'monetary policy moves somewhat further into restrictive territory' this year.

Fed's Mester sees 'somewhat' higher interest rates aheadCleveland Fed President Loretta Mester said her forecasts includes 'monetary policy moves somewhat further into restrictive territory' this year.

Baca lebih lajut »

Treasury yields rise as investors weigh potential for higher Fed ratesU.S. Treasury yields rose Tuesday as traders assessed the likelihood of higher Federal Reserve rates in the future.

Treasury yields rise as investors weigh potential for higher Fed ratesU.S. Treasury yields rose Tuesday as traders assessed the likelihood of higher Federal Reserve rates in the future.

Baca lebih lajut »