It’s no secret that the yen has depreciated significantly, seeing sharp moves lower against G7 currencies. Get your market update from RichardSnowFX here:

surprised to the upside but the 9.2% figure is the lowest reading since January this year. US PPI data is due on Thursday, forecast to print inline with the May 0.8% figure. However, the most important scheduled event risk this week appears in the form of US CPI. Should the forecasted number of 8.8% materialize it would mark a return to the trend of higher inflation prints after April’s relative drop – potentially spurring USD/JPY.

Honourable mentions, at least as far as the US growth story is concerned, goes to US retail sales data and the University of Michigan consumer sentiment report. This version of consumer sentiment dropped to a record low, stretching all the way back to the 1970s, and is anticipated to break into sub 50 territory. Even if we are to see downside surprises in these data prints, it is highly unlikely to have any bearing on the Fed and its aggressive pace of policy normalization.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

US Dollar Forecast: Fresh Yearly Highs for DXY Index, USD/JPYThe US Dollar continued its meteoric climb vs the GBP, EUR and JPY today. The strength comes ahead of the anticipated June US CPI which should provide more justification for the Fed to raise rates by 75-bps.

US Dollar Forecast: Fresh Yearly Highs for DXY Index, USD/JPYThe US Dollar continued its meteoric climb vs the GBP, EUR and JPY today. The strength comes ahead of the anticipated June US CPI which should provide more justification for the Fed to raise rates by 75-bps.

Baca lebih lajut »

Japan FinMin Suzuki to meet US Treasury Secretary Yellen on TuesdayJapanese Finance Minister Shunichi Suzuki is scheduled to meet US Treasury Secretary Janet Yellen on Tuesday from 0445 GMT, the Ministry of Finance sa

Japan FinMin Suzuki to meet US Treasury Secretary Yellen on TuesdayJapanese Finance Minister Shunichi Suzuki is scheduled to meet US Treasury Secretary Janet Yellen on Tuesday from 0445 GMT, the Ministry of Finance sa

Baca lebih lajut »

US, Japan vow joint efforts on Ukraine, trade, food crisisU.S. Treasury Secretary Janet Yellen and Japan’s finance minister vowed cooperation in maintaining effective economic sanctions on Russia over its invasion of Ukraine and curbing the war’s impact on gas and energy prices.

US, Japan vow joint efforts on Ukraine, trade, food crisisU.S. Treasury Secretary Janet Yellen and Japan’s finance minister vowed cooperation in maintaining effective economic sanctions on Russia over its invasion of Ukraine and curbing the war’s impact on gas and energy prices.

Baca lebih lajut »

US Dollar Index advances towards 107.20 on higher estimates for the US InflationUS Dollar Index advances towards 107.20 on higher estimates for the US Inflation – by Sagar_Dua24 DollarIndex Fed InterestRate Inflation Employment

US Dollar Index advances towards 107.20 on higher estimates for the US InflationUS Dollar Index advances towards 107.20 on higher estimates for the US Inflation – by Sagar_Dua24 DollarIndex Fed InterestRate Inflation Employment

Baca lebih lajut »

FX Week Ahead - Top 5 Events: Eurozone Economic Sentiment; UK GDP; US Inflation Rate; BOC Rate Decision; Australia Jobs ReportThe upcoming UK GDP is expected to show no growth for the three months through May. The June US CPI will give the ammunition the Fed needs to justify a 75-bps hike. The BoC will likely raise rates by 75-bps.

FX Week Ahead - Top 5 Events: Eurozone Economic Sentiment; UK GDP; US Inflation Rate; BOC Rate Decision; Australia Jobs ReportThe upcoming UK GDP is expected to show no growth for the three months through May. The June US CPI will give the ammunition the Fed needs to justify a 75-bps hike. The BoC will likely raise rates by 75-bps.

Baca lebih lajut »

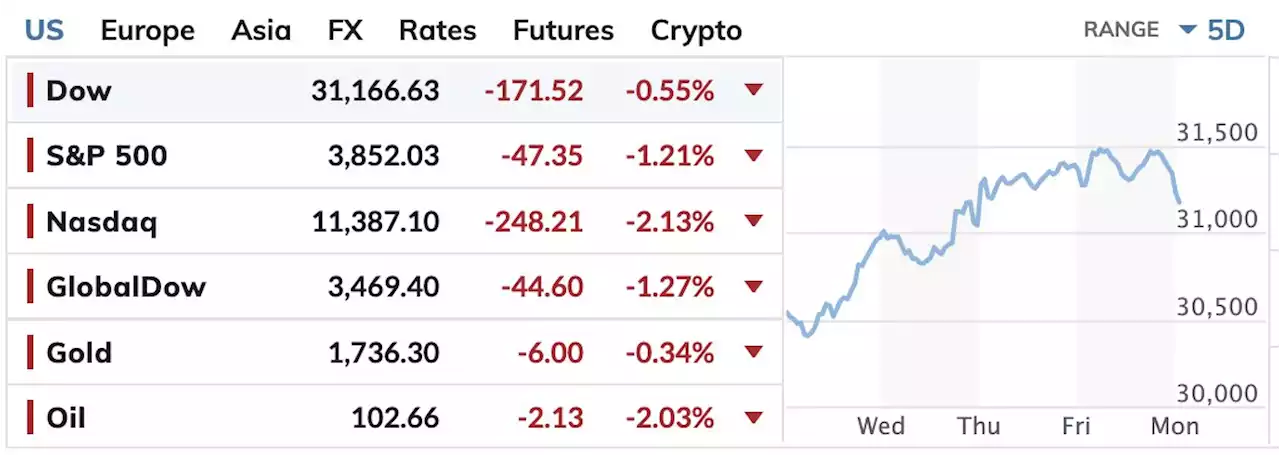

U.S. stocks open lower as China COVID restrictions biteU.S. stocks opened lower on Monday one session after the Nasdaq Composite cemented its longest win streak since November as another spate of COVID restrictions in China added to concerns about a global economic slowdown.

U.S. stocks open lower as China COVID restrictions biteU.S. stocks opened lower on Monday one session after the Nasdaq Composite cemented its longest win streak since November as another spate of COVID restrictions in China added to concerns about a global economic slowdown.

Baca lebih lajut »