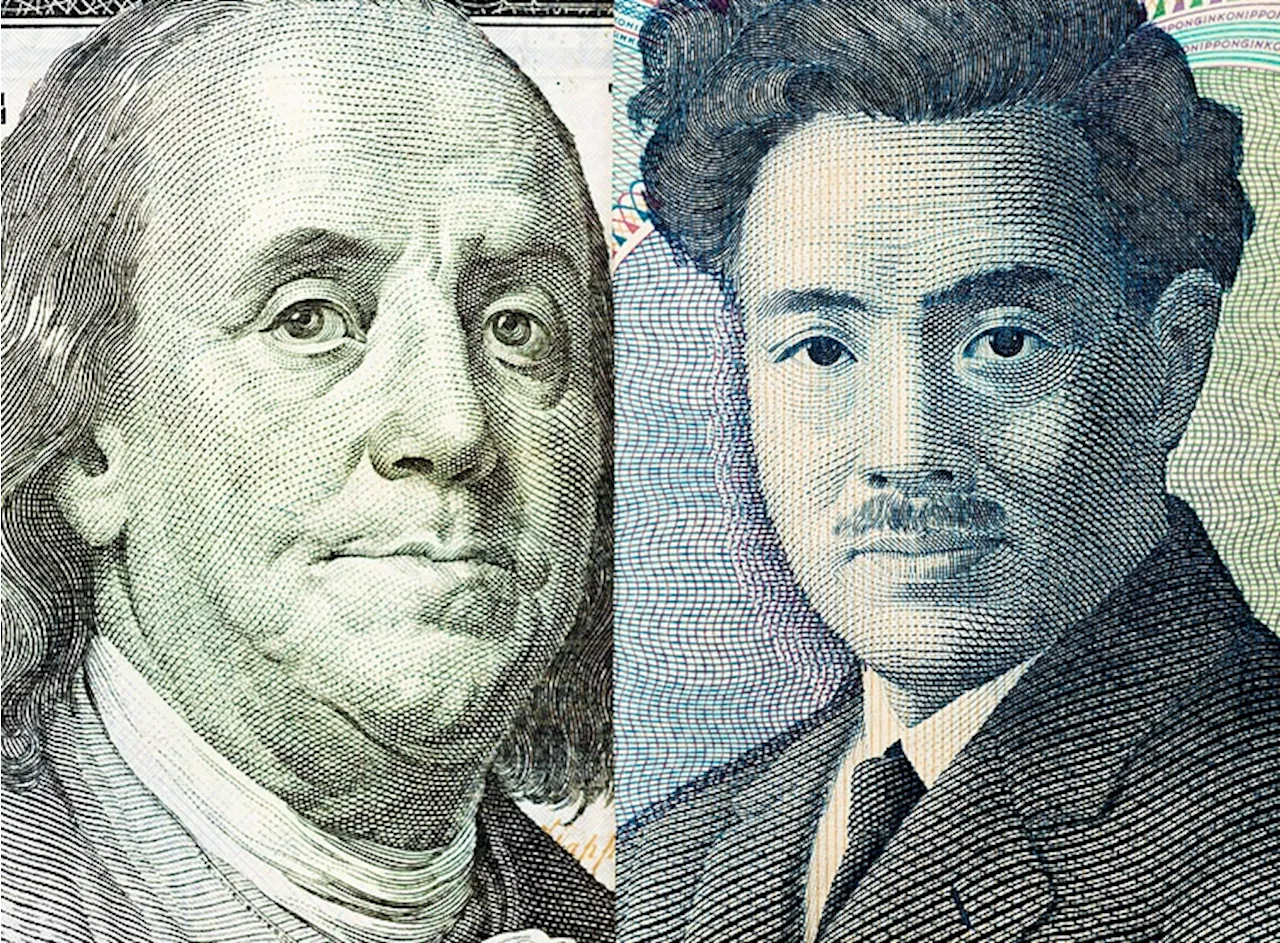

The USD/JPY registered losses of more than 0.20% on Monday, remaining near the top of the narrowest part of the Ichimoku Cloud (Kumo) as traders eye further downside.

USD/JPY trades below 157.00, near the Ichimoku Cloud’s narrowest top, signaling potential downside. Technical indicators show bearish momentum: Tenkan-Sen below Kijun-Sen, Chikou Span piercing below price action. Key support levels: 156.28 , 155.90/156.00 , 155.37 . The USD/JPY registered losses of more than 0.20% on Monday, remaining near the top of the narrowest part of the Ichimoku Cloud as traders eye further downside. As Tuesday’s Asian session begins, the pair trades at 156.

Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors. How do the decisions of the Bank of Japan impact the Japanese Yen? One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

USD/JPY Price Analysis: Remains bullish amid intervention threatsThe USD/JPY is flat but advanced steadily towards the 160.00 figure for the second time in 2024 and hit a two-month high of 159.93 before trimming some of earlier gains.

USD/JPY Price Analysis: Remains bullish amid intervention threatsThe USD/JPY is flat but advanced steadily towards the 160.00 figure for the second time in 2024 and hit a two-month high of 159.93 before trimming some of earlier gains.

Baca lebih lajut »

USD/JPY Price Analysis: Shies from 160.00 as Japan’s intervention fears intensifyThe USD/JPY pair exhibits a subdued performance slightly below the psychological resistance of 160.00 in Tuesday’s European session.

USD/JPY Price Analysis: Shies from 160.00 as Japan’s intervention fears intensifyThe USD/JPY pair exhibits a subdued performance slightly below the psychological resistance of 160.00 in Tuesday’s European session.

Baca lebih lajut »

USD/JPY Price Analysis: Subdued at around 159.60 amid intervention threatsThe USD/JPY is flat late in the North American session as US Treasury yields fell.

USD/JPY Price Analysis: Subdued at around 159.60 amid intervention threatsThe USD/JPY is flat late in the North American session as US Treasury yields fell.

Baca lebih lajut »

USD/JPY Price Analysis: Hits 38-year high at around 160.80sThe USD/JPY rallied sharply during Wednesday’s session after the pair hit a 38-year high past the 160.00 psychological figure, seen as the line of the sand for Japanese authorities and the Japanese Yen to intervene in the FX space.

USD/JPY Price Analysis: Hits 38-year high at around 160.80sThe USD/JPY rallied sharply during Wednesday’s session after the pair hit a 38-year high past the 160.00 psychological figure, seen as the line of the sand for Japanese authorities and the Japanese Yen to intervene in the FX space.

Baca lebih lajut »

USD/JPY Price Analysis: Looms near multi-year highs as bulls target 161.00The USD/JPY registers minimal loss after hitting a daily low of 160.28, yet the major remains approaching the 161.00 figure for the second consecutive day as the Japanese authority's verbal jawboning has failed to contain the Yen’s depreciation.

USD/JPY Price Analysis: Looms near multi-year highs as bulls target 161.00The USD/JPY registers minimal loss after hitting a daily low of 160.28, yet the major remains approaching the 161.00 figure for the second consecutive day as the Japanese authority's verbal jawboning has failed to contain the Yen’s depreciation.

Baca lebih lajut »

USD/JPY Price Analysis: Breaks 161.00 amid rising US yieldsThe USD/JPY has broken the 161.00 barrier as US Treasury bond yields climbed sharply on Monday after US economic data showed that manufacturing activity, as measured by the ISM PMI, contracted for the third straight month in June.

USD/JPY Price Analysis: Breaks 161.00 amid rising US yieldsThe USD/JPY has broken the 161.00 barrier as US Treasury bond yields climbed sharply on Monday after US economic data showed that manufacturing activity, as measured by the ISM PMI, contracted for the third straight month in June.

Baca lebih lajut »