The USD/CAD pair seems comfortable above the psychological resistance of 1.3500 in the European session on Monday.

USD/CAD exhibits strength above 1.3500 ahead of an eventful week. The Fed is widely anticipated to hold interest rates unchanged in the range of 5.25%-5.50%. The Canadian Dollar faces pressure ahead of consumer inflation data for February. The Loonie asset clings to gains amid uncertainty ahead of the interest rate decision by the Federal Reserve , which will be announced on Wednesday. While the Fed is certain to keep interest rates unchanged in the range of 5.25%-5.

Earlier, the Loonie asset rebounded from the upward-sloping border of the Ascending Triangle pattern formed on a daily timeframe, plotted from the December 27 low at 1.3177. The horizontal resistance of the aforementioned pattern is placed from December 7 high at 1.3620. The 50-day Exponential Moving Average near 1.3500 continues to support the US Dollar bulls. The 14-period Relative Strength Index oscillates inside the 40.00-60.00 region, which indicates indecisiveness among investors.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

USD/CAD Price Analysis: Reaches higher to near 1.3480 ahead of nine-day EMAUSD/CAD retraces its recent losses from the previous session, edging upwards to near 1.3480 during Thursday's European session.

USD/CAD Price Analysis: Reaches higher to near 1.3480 ahead of nine-day EMAUSD/CAD retraces its recent losses from the previous session, edging upwards to near 1.3480 during Thursday's European session.

Baca lebih lajut »

USD/CAD Price Analysis: Air-kissing the Ascending Wedge goodbyeUSD/CAD has recently broken out of the Ascending Wedge pattern which it has been forming since January.

USD/CAD Price Analysis: Air-kissing the Ascending Wedge goodbyeUSD/CAD has recently broken out of the Ascending Wedge pattern which it has been forming since January.

Baca lebih lajut »

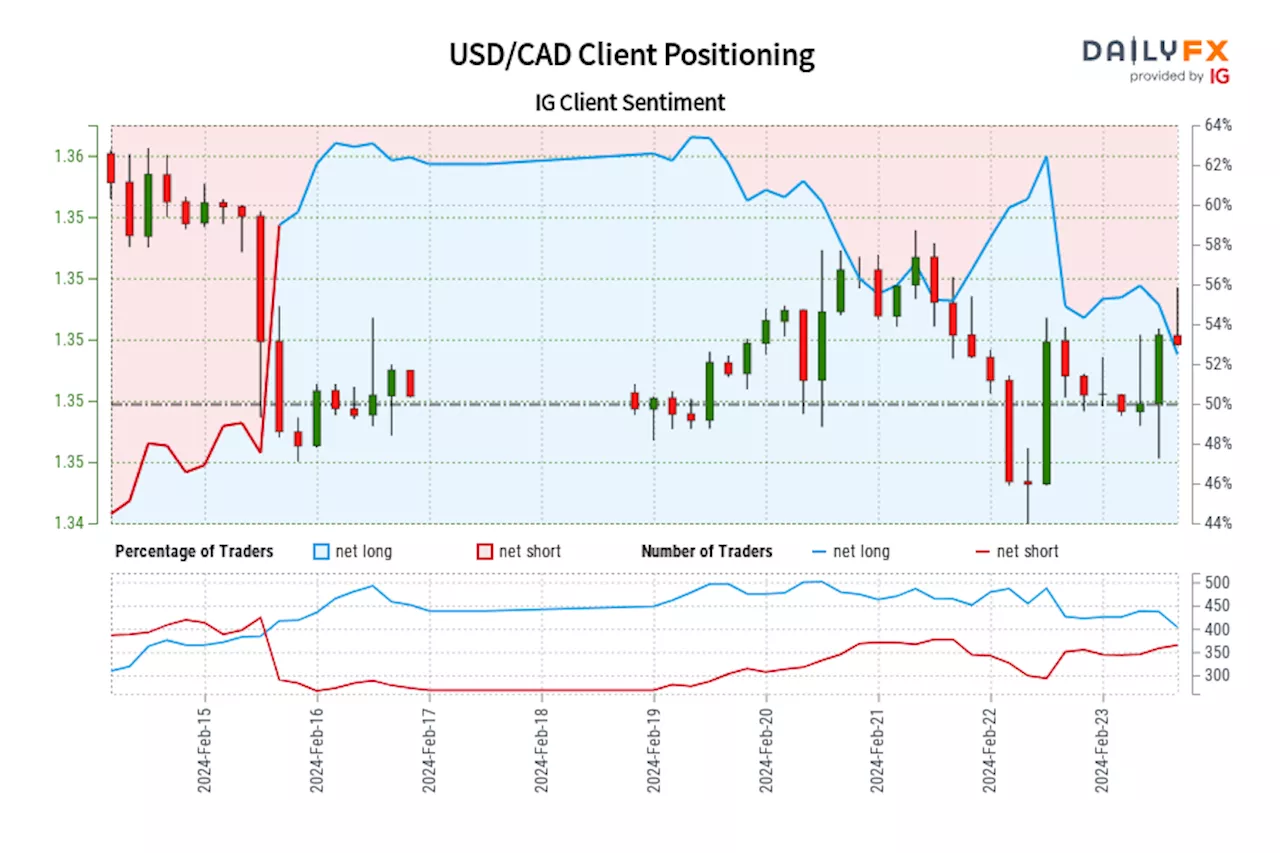

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Feb 15, 2024 14:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Feb 15, 2024 14:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

Baca lebih lajut »

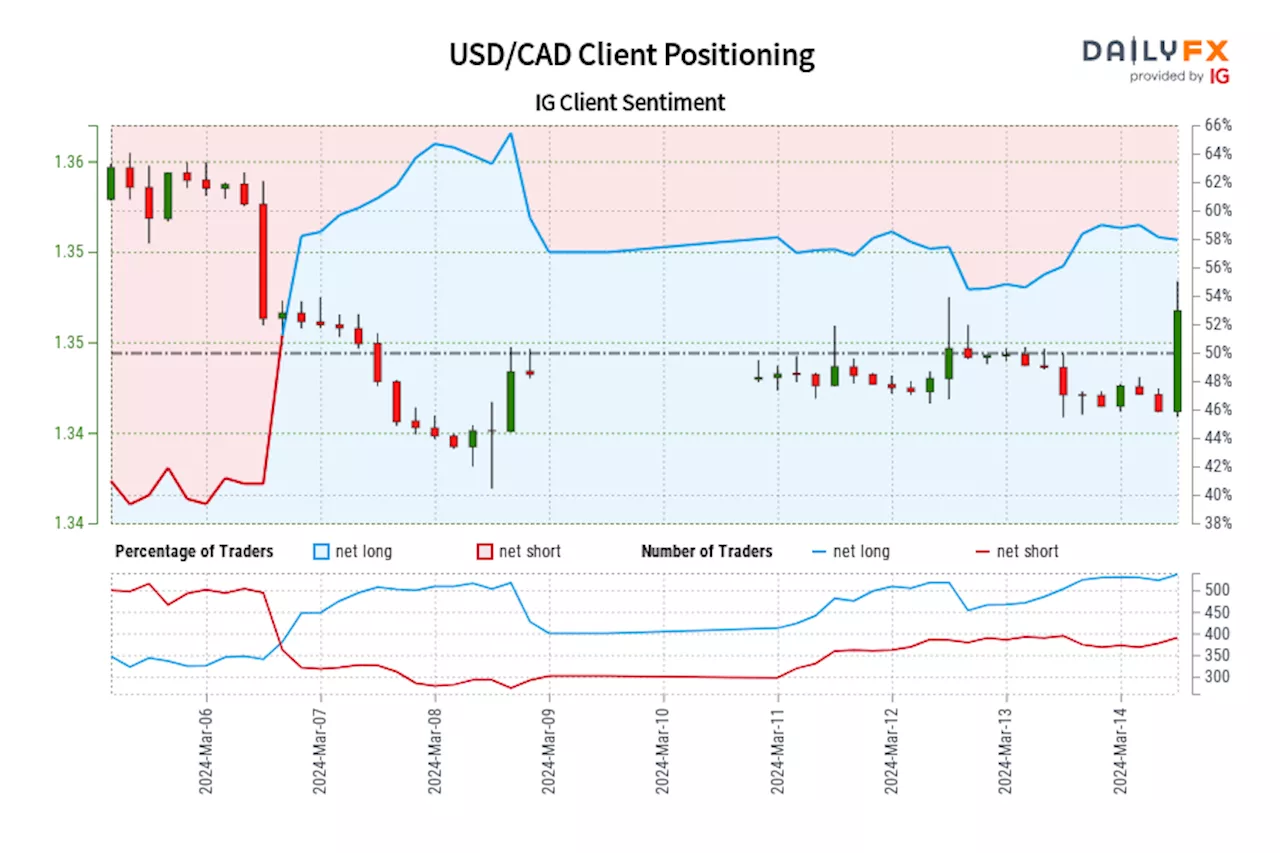

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Mar 06, 2024 15:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Mar 06, 2024 15:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

Baca lebih lajut »

Three dead in crash at Mountain View Corridor intersection near 3500 S in West Valley CityThree people have died following a crash on Mountain View Corridor in West Valley City.The crash happened around 8:30 p.m. on Friday near the intersection of Mo

Three dead in crash at Mountain View Corridor intersection near 3500 S in West Valley CityThree people have died following a crash on Mountain View Corridor in West Valley City.The crash happened around 8:30 p.m. on Friday near the intersection of Mo

Baca lebih lajut »

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

Baca lebih lajut »