US authorities unveiled sweeping measures Sunday to ease fears over the health of the banking system following the failure of Silicon Valley Bank, as regulators took over a second troubled lender.

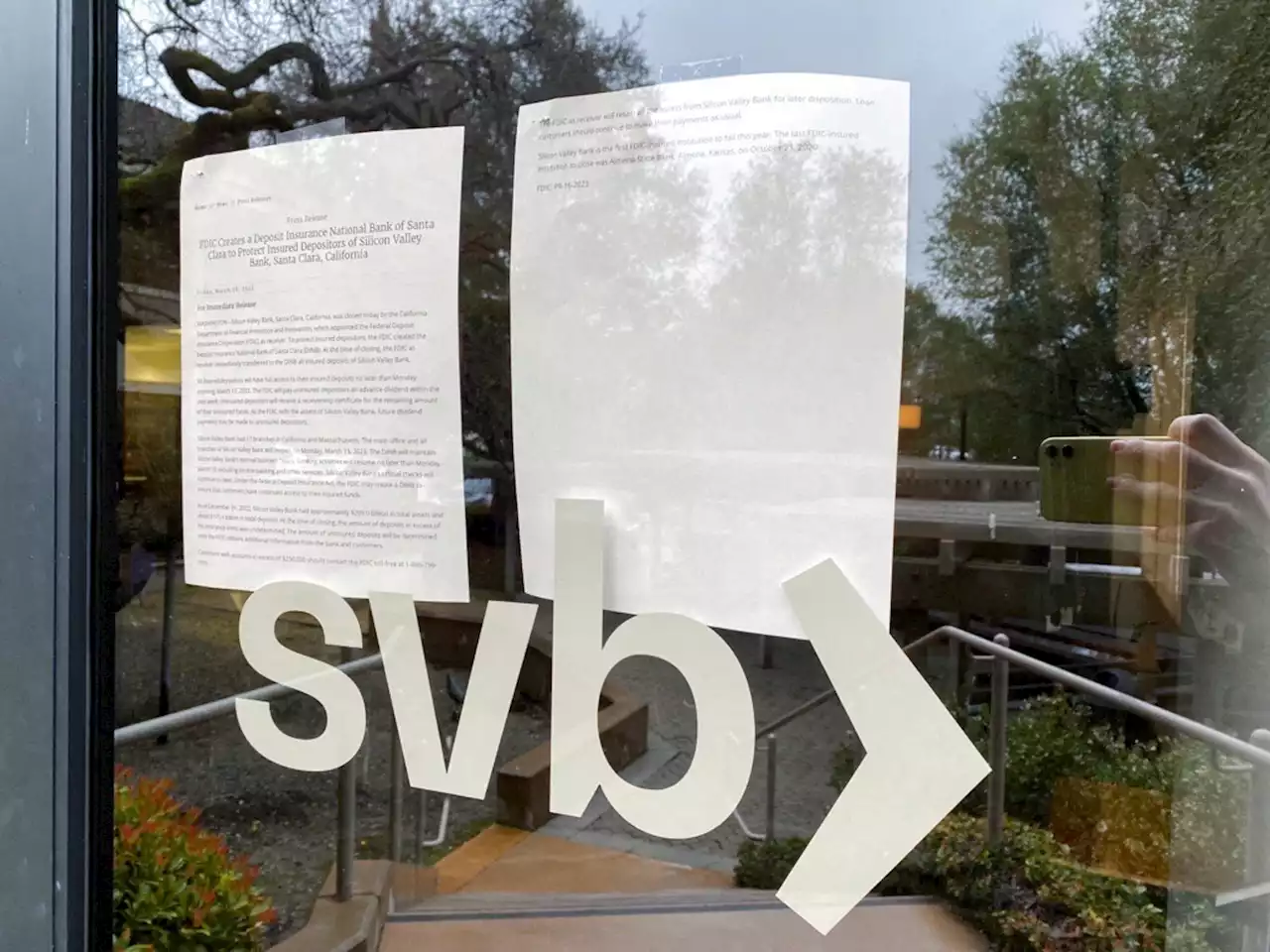

People line up outside of the shuttered Silicon Valley Bank headquarters on March 10, 2023 in Santa Clara, California. Silicon Valley Bank was shut down on Friday by California regulators and was put in control of the US Federal Deposit Insurance Corporation. Justin Sullivan/ Getty Images/ AFP

Amid fears over the wider sector, President Joe Biden vowed to hold "fully accountable" the people responsible for "this mess" and said he would deliver remarks on Monday morning on maintaining a resilient banking system. The Fed also announced it would make extra funding available to banks to help them meet the needs of depositors, which would include withdrawals.

"Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe."The FDIC move guarantees deposits—but only up to $250,000 per client and per bank. With the bank's future, and its billions in deposits up in the air, officials from the three agencies raced to craft a solution just hours before financial markets opened in Asia, and to avert a potential financial panic.

The BoE and the UK government stepped in after concluding that the "scale of the deterioration of liquidity and confidence means that... the position was not recoverable."Little known to the general public, SVB specialized in financing startups and had become the 16th largest US bank by assets: at the end of 2022, it had $209 billion in assets and approximately $175.4 billion in deposits.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Government vows aid for tech firms but Israel stocks slide on SVB collapseIsrael's tech sector is the country's main growth engine, and its relationship with the Silicon Valley region is strong.

Government vows aid for tech firms but Israel stocks slide on SVB collapseIsrael's tech sector is the country's main growth engine, and its relationship with the Silicon Valley region is strong.

Baca lebih lajut »

US preparing to stem SVB fallout with 'material action' – sourcesUS Treasury Secretary Janet Yellen rules out a government bailout for the collapsed Silicon Valley Bank.

US preparing to stem SVB fallout with 'material action' – sourcesUS Treasury Secretary Janet Yellen rules out a government bailout for the collapsed Silicon Valley Bank.

Baca lebih lajut »

After SVB failure, US guarantees all deposits to stem falloutThe move will not lead to losses by American taxpayers, and all depositors, including those whose funds exceed the maximum government-insured level, will be made whole.

After SVB failure, US guarantees all deposits to stem falloutThe move will not lead to losses by American taxpayers, and all depositors, including those whose funds exceed the maximum government-insured level, will be made whole.

Baca lebih lajut »

Signature Bank becomes next casualty of banking turmoil after SVB(1st UPDATE) The Signature Bank failure is the third largest in US banking history and comes only two days after the collapse of Silicon Valley Bank

Signature Bank becomes next casualty of banking turmoil after SVB(1st UPDATE) The Signature Bank failure is the third largest in US banking history and comes only two days after the collapse of Silicon Valley Bank

Baca lebih lajut »

Britain battles to limit SVB damage as would-be buyer for UK arm steps in(2nd UPDATE) Bank of London submits a formal proposal to the UK arm of Silicon Valley Bank

Britain battles to limit SVB damage as would-be buyer for UK arm steps in(2nd UPDATE) Bank of London submits a formal proposal to the UK arm of Silicon Valley Bank

Baca lebih lajut »

![]() SVB shutdown sends shockwaves through Silicon Valley as CEOs race to make payrollThe sudden collapse of Silicon Valley Bank on Friday sent shockwaves through the startup community, which has come to view the lender as a source of reliable capital and deposit partner, particularly for some of tech’s biggest moonshots. | Reuters

SVB shutdown sends shockwaves through Silicon Valley as CEOs race to make payrollThe sudden collapse of Silicon Valley Bank on Friday sent shockwaves through the startup community, which has come to view the lender as a source of reliable capital and deposit partner, particularly for some of tech’s biggest moonshots. | Reuters

Baca lebih lajut »