Treasury yields fell on Tuesday after weak trade data out of China raised concerns about slowing global growth and encouraged buying of sovereign bonds.

What’s happeningWhat’s driving markets News that China’s exports fell in July by the most since the outbreak of the COVID-19 pandemic in February 2022 has increased fears of a global economic slowdown and sparked a traditional move into government bonds.

There will also be more Fedspeak, with Philadelphia Fed President Harker making comments at 8:15 a.m. and Richmond Fed President Barkin talking at 8:30 a.m. Markets are pricing in an 86% probability that the Fed will leave interest rates unchanged at a range of 5.25% to 5.50% after its next meeting on September 20, according to the CME FedWatch tool.

The central bank is not expected to take its Fed funds rate target back down to around 5% until May 2024, according to 30-day Fed Funds futures.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Treasury yields rise as investors consider inflation outlookU.S. Treasury yields climbed on Monday as investors weighed the state of the economy and awaited key inflation data due later in the week.

Treasury yields rise as investors consider inflation outlookU.S. Treasury yields climbed on Monday as investors weighed the state of the economy and awaited key inflation data due later in the week.

Baca lebih lajut »

Treasury yields rise as traders absorb hawkish FedspeakBond yields rose on Monday after some hawkish Fedspeak over the weekend.

Treasury yields rise as traders absorb hawkish FedspeakBond yields rose on Monday after some hawkish Fedspeak over the weekend.

Baca lebih lajut »

The Trade Pushing Long-Term Treasury Yields to 2023 HighsThe bear steepener trade is causing long-term Treasury yields to reach their highest levels since 2023, impacting equities and un-inverting the yield curve for unfavorable reasons.

The Trade Pushing Long-Term Treasury Yields to 2023 HighsThe bear steepener trade is causing long-term Treasury yields to reach their highest levels since 2023, impacting equities and un-inverting the yield curve for unfavorable reasons.

Baca lebih lajut »

Buffett and Ackman take opposing sides on Treasury yields — What does it mean for Bitcoin?Buffett and Ackman have opposing views on inflation and the U.S. economy, but how might their views on inflation relate to Bitcoin price. August 5, 2023 Buffett has been buying short-term Treasury bills, while Ackman has been shorting long-term Treasury bonds. Could both of these investors be right? Warren Buffett is the chairman and CEO of Berkshire Hathaway, one of the world's largest investment holding companies. Buffett’s worth is estimated to be over $100 billion

Buffett and Ackman take opposing sides on Treasury yields — What does it mean for Bitcoin?Buffett and Ackman have opposing views on inflation and the U.S. economy, but how might their views on inflation relate to Bitcoin price. August 5, 2023 Buffett has been buying short-term Treasury bills, while Ackman has been shorting long-term Treasury bonds. Could both of these investors be right? Warren Buffett is the chairman and CEO of Berkshire Hathaway, one of the world's largest investment holding companies. Buffett’s worth is estimated to be over $100 billion

Baca lebih lajut »

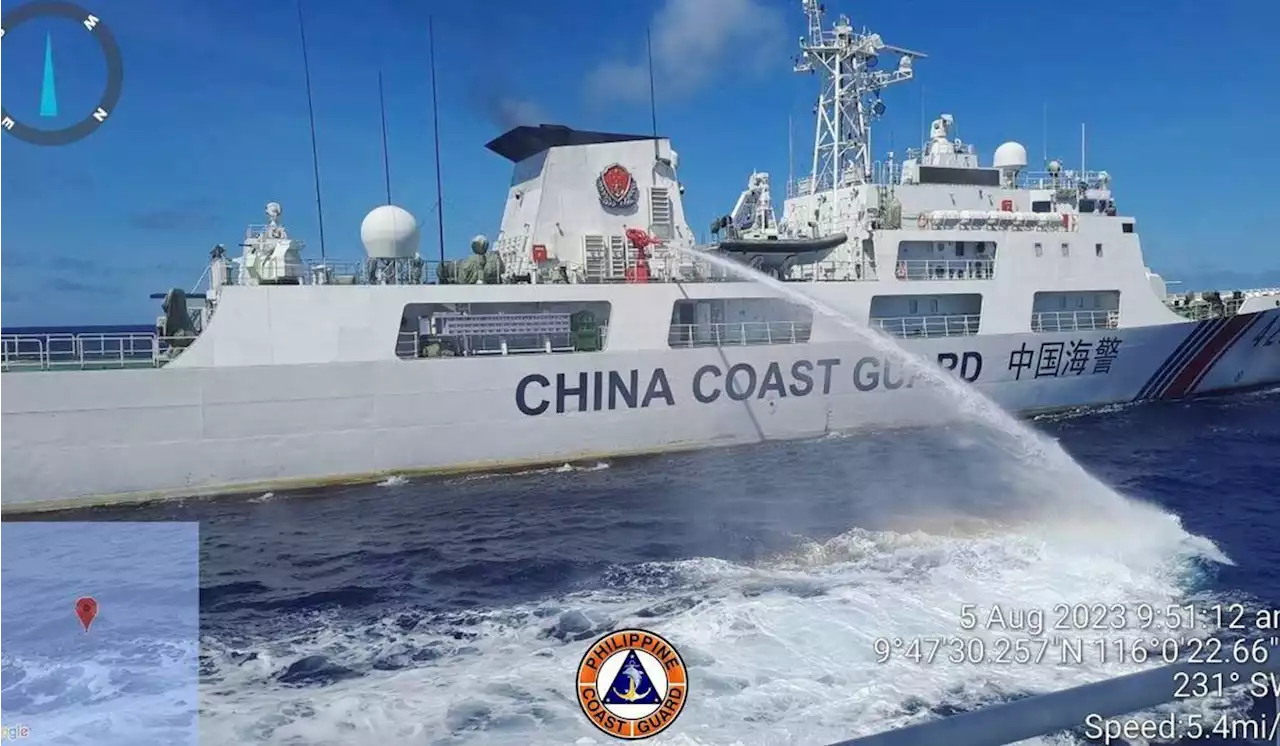

Philippines, US slam China for blocking resupply of disputed South China Sea siteThe State Department has joined the Philippines in condemning 'dangerous actions' by China's coast guard in the latest flare-up of tensions over clashing territorial claims in the South China Sea.

Philippines, US slam China for blocking resupply of disputed South China Sea siteThe State Department has joined the Philippines in condemning 'dangerous actions' by China's coast guard in the latest flare-up of tensions over clashing territorial claims in the South China Sea.

Baca lebih lajut »

Philippines, U.S. slam China for blocking resupply of disputed South China Sea siteThe State Department has joined the Philippines in condemning “dangerous actions” by China’s coast guard in the latest flare-up of tensions over clashing territorial claims in the South China Sea.

Philippines, U.S. slam China for blocking resupply of disputed South China Sea siteThe State Department has joined the Philippines in condemning “dangerous actions” by China’s coast guard in the latest flare-up of tensions over clashing territorial claims in the South China Sea.

Baca lebih lajut »