The rollout of coin deposit machines (CoDMs) in various parts of Metro will help alleviate the coin shortage in the country and cut the government’s losses in minting coins, according to the Bangko Sentral ng Pilipinas (BSP). Know more:

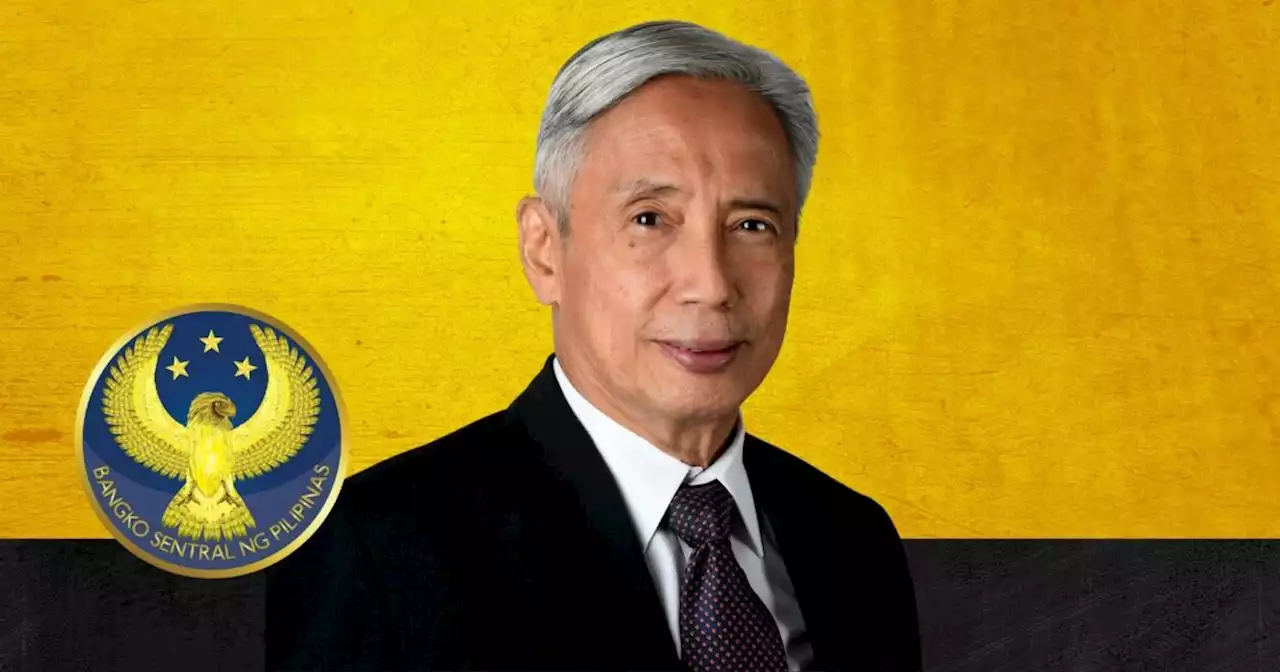

Governor Felipe Medalla of the Bangko Sentral ng Pilipinas stands in front of the newly launched coin deposit machine at the official launch of a groundbreaking initiative. In partnership with retailers, the BSP introduced the coin deposit machines program on Tuesday, June 20, 2023, to promote efficient coin re-circulation.

“Can you imagine, even just 300 pieces of coins, pagkasinuot mo yan malalaglag ang pantalon mo [if you wear that on your body, your pants will fall off]. Now, why is that a problem? Well, people come home with coins. When they leave home, they leave the coins behind,” Medalla said. This prompts the BSP to mint additional coins which can be very expensive. Medalla said the government only spends P7 to print 1,000 peso bills but can spend P10 to make a 20-peso coin.“We look forward to significantly cutting our cost because the number of prices per capita increased from just 120 to over 350, in less than eight years. So that means the problem is getting worse and worse and worse,” Medalla said.

There is no cost to customers when exchanging their coins for shopping vouchers or e-wallet credits. The BSP is also not paying any rent in using mall space for the CoDMs.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Investors step back from equities to assess BSP’s next movePhilippine stocks ended lower on Monday during a relatively quiet session as investors awaited the results of the upcoming Bangko Sentral ng Pilipinas policy meeting on Thursday. | miguelrcamusINQ /PDI

Investors step back from equities to assess BSP’s next movePhilippine stocks ended lower on Monday during a relatively quiet session as investors awaited the results of the upcoming Bangko Sentral ng Pilipinas policy meeting on Thursday. | miguelrcamusINQ /PDI

Baca lebih lajut »

BSP, BAP near accord on lower costs of e-payments | Cai U. OrdinarioTHE Bangko Sentral ng Pilipinas (BSP) and local banks are close to reaching an agreement on bringing down the transaction costs for electronic payments. The BSP had initially said banks would be amenable to reducing transaction fees in exchange for a cut in the reserve requirement ratio (RRR). (https://businessmirror.com.ph/2023/02/28/bap-open-to-scuttling-costs-for-small-transactions/) The…

BSP, BAP near accord on lower costs of e-payments | Cai U. OrdinarioTHE Bangko Sentral ng Pilipinas (BSP) and local banks are close to reaching an agreement on bringing down the transaction costs for electronic payments. The BSP had initially said banks would be amenable to reducing transaction fees in exchange for a cut in the reserve requirement ratio (RRR). (https://businessmirror.com.ph/2023/02/28/bap-open-to-scuttling-costs-for-small-transactions/) The…

Baca lebih lajut »

BSP set to launch Coin Deposit Machine project at Robinsons ErmitaThe Bangko Sentral ng Pilipinas is set to launch Tuesday its Coin Deposit Machine project at Robinsons Ermita in Manila to promote coin recirculation, financial inclusion and digitalization. READ MORE:

BSP set to launch Coin Deposit Machine project at Robinsons ErmitaThe Bangko Sentral ng Pilipinas is set to launch Tuesday its Coin Deposit Machine project at Robinsons Ermita in Manila to promote coin recirculation, financial inclusion and digitalization. READ MORE:

Baca lebih lajut »

BSP launches coin deposit machinesThe Bangko Sentral ng Pilipinas (BSP) and its partner retailers on Tuesday officially launched three coin deposit machines (CoDM), with six more set to be deployed in the next few days, in a bid to encourage the public to make use of their idle coins.

BSP launches coin deposit machinesThe Bangko Sentral ng Pilipinas (BSP) and its partner retailers on Tuesday officially launched three coin deposit machines (CoDM), with six more set to be deployed in the next few days, in a bid to encourage the public to make use of their idle coins.

Baca lebih lajut »

End-March external debt up 6.8% to $119B | Cai U. OrdinarioTHE national government’s borrowings to augment its financing requirements for pandemic response and infrastructure programs, among others, increased the country’s external debt as of March 2023, according to the Bangko Sentral ng Pilipinas (BSP). In a statement, the BSP said the country’s external debt increased to $118.8 billion as of…

End-March external debt up 6.8% to $119B | Cai U. OrdinarioTHE national government’s borrowings to augment its financing requirements for pandemic response and infrastructure programs, among others, increased the country’s external debt as of March 2023, according to the Bangko Sentral ng Pilipinas (BSP). In a statement, the BSP said the country’s external debt increased to $118.8 billion as of…

Baca lebih lajut »

Easing in PHL monetary policy seen in Q1 2024 | Cai U. OrdinarioTHE recent decision of the United States Federal Reserve to maintain its interest rates is not enough assurance that rate cuts are coming, according to the Bangko Sentral ng Pilipinas (BSP). BSP Governor Felipe M. Medalla said that while yield curves are showing signs that the US Fed will cut…

Easing in PHL monetary policy seen in Q1 2024 | Cai U. OrdinarioTHE recent decision of the United States Federal Reserve to maintain its interest rates is not enough assurance that rate cuts are coming, according to the Bangko Sentral ng Pilipinas (BSP). BSP Governor Felipe M. Medalla said that while yield curves are showing signs that the US Fed will cut…

Baca lebih lajut »