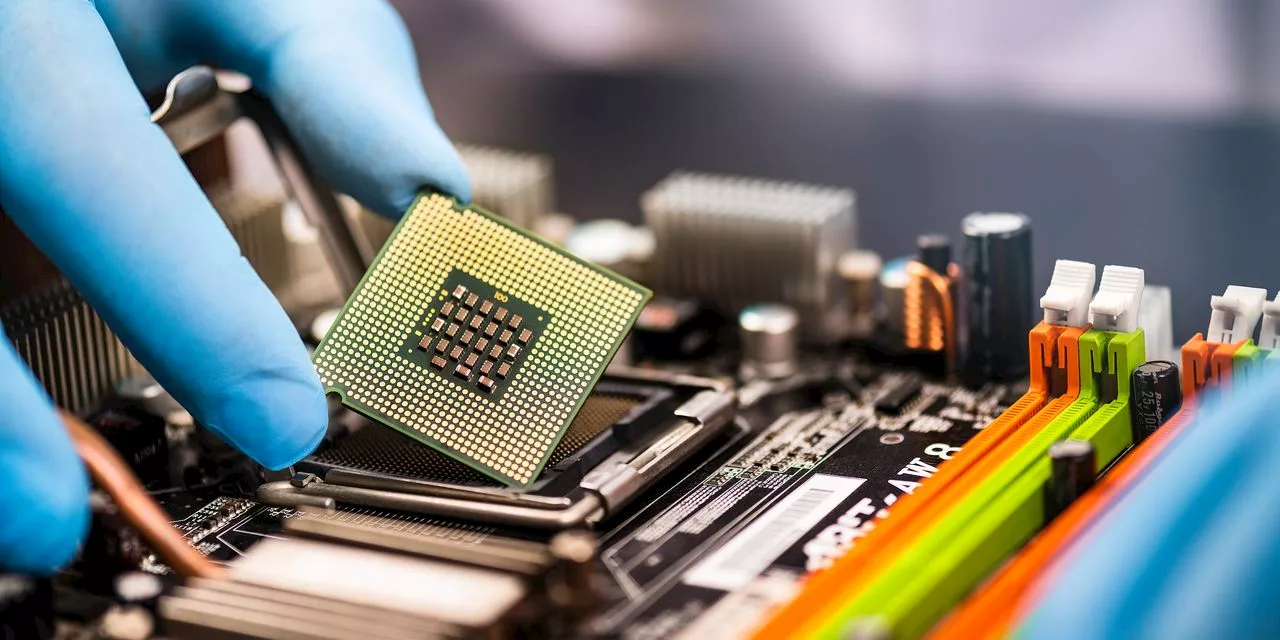

Fabless semiconductor companies may be hit hard if they can’t adapt to a major industry shift that’s now underway

A seismic shift is happening in the semiconductor industry right now. This transformation is not merely a technological evolution; it’s a financial game-changer that will significantly impact the portfolios of many investors.

Fabless companies are less needed Fabless semiconductor companies such as Broadcom AVGO, +1.14%, Qualcomm QCOM, +1.76% and Advanced Micro Devices AMD, +4.19% have four key attributes that combine to form their value proposition: intellectual property; software/integration; talent/know-how, and distribution. Yet as big tech companies grow in both scale and technological capability, the relative value of fabless companies diminishes in value.

Build or buy? Despite the huge incentive the tech giants have to switch to in-house silicon, it is not always a straightforward decision. Companies must consider scale, as the volume of chips needed must justify the cost and effort of in-house design. Capability is another crucial factor. Only the largest companies like Apple and Tesla have the talent, intellectual property, and capital to design their own chips.

Currently, only TSMC, Intel, and Samsung have the capabilities to manufacture the world’s most advanced chips. These companies are also making significant investments in additional foundries in the U.S. and Europe, and they are attempting to diversify geographically away from dependence on Taiwan.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Match Group stock plunges after decline in people paying for TinderMatch Group shares plummeted Wednesday after the company released its third-quarter earnings Tuesday.

Match Group stock plunges after decline in people paying for TinderMatch Group shares plummeted Wednesday after the company released its third-quarter earnings Tuesday.

Baca lebih lajut »

Stock Market Today: Dow holds gains, Treasury yields drop as Fed leaves rates unchangedLive coverage of a major day for the U.S. stock market with Treasury refunding and a Fed decision.

Stock Market Today: Dow holds gains, Treasury yields drop as Fed leaves rates unchangedLive coverage of a major day for the U.S. stock market with Treasury refunding and a Fed decision.

Baca lebih lajut »

Court Sends Stock-Buyback Rule Back to SECJudges give the agency 30 days to fix ‘defects’ in new rule aiming to help investors understand the reason for share repurchases

Court Sends Stock-Buyback Rule Back to SECJudges give the agency 30 days to fix ‘defects’ in new rule aiming to help investors understand the reason for share repurchases

Baca lebih lajut »

Computer-led equity hedge funds beat human stock-pickers in OctoberComputer-led equity hedge funds beat human stock-pickers in October

Computer-led equity hedge funds beat human stock-pickers in OctoberComputer-led equity hedge funds beat human stock-pickers in October

Baca lebih lajut »

E.l.f.’s stock jumps 10% on earnings, revenue beat; strong guidanceJon Swartz is a senior reporter for MarketWatch in San Francisco, covering many of the biggest players in tech, including Netflix, Facebook and Google. Jon has covered technology for more than 20 years, and previously worked for Barron's and USA Today. Follow him on Twitter jswartz.

E.l.f.’s stock jumps 10% on earnings, revenue beat; strong guidanceJon Swartz is a senior reporter for MarketWatch in San Francisco, covering many of the biggest players in tech, including Netflix, Facebook and Google. Jon has covered technology for more than 20 years, and previously worked for Barron's and USA Today. Follow him on Twitter jswartz.

Baca lebih lajut »

EA's stock rises on improved bottom line, revenue beatJon Swartz is a senior reporter for MarketWatch in San Francisco, covering many of the biggest players in tech, including Netflix, Facebook and Google. Jon has covered technology for more than 20 years, and previously worked for Barron's and USA Today. Follow him on Twitter jswartz.

EA's stock rises on improved bottom line, revenue beatJon Swartz is a senior reporter for MarketWatch in San Francisco, covering many of the biggest players in tech, including Netflix, Facebook and Google. Jon has covered technology for more than 20 years, and previously worked for Barron's and USA Today. Follow him on Twitter jswartz.

Baca lebih lajut »