Silicon Valley Bank was the bank for tech. Its collapse is everyone's problem.

Bloomberg previously reported that Blackstone and other private credit giants like Ares Management and Carlyle Group were involved in discussions with SVB over its loan book. As of Thursday, Blackstone was assessing what it may consider buying, though the process remained in its early stages, a person familiar with the matter said.

"We thought it was gonna be difficult to raise capital like a week ago," Stage's Morgan said,"well it just got worse and you just lost access to really high quality cheap debt."swirled for months behind the scenesVCs and founders were publically urging each other the next day to pull their money out of the bank on Twitter and Discord. By March 10, less than 48 hours after the initial panic, the bank was shut down by regulators.

"People like to say 'We have so many regulations in place after Dodd-Frank, and look a bank still failed' and that's not true," Kairong Xiao, a finance expert and professor at Columbia Business School, said."All of the remaining regulations are being gamed through the fine print as the public has lost interest since 2008,"

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

![]() Easy Loans, Great Service: Why Silicon Valley Loved Silicon Valley BankSilicon Valley Bank used financial sweeteners to attract clients, powering growth for decades—leaving the sector vulnerable when the bank collapsed

Easy Loans, Great Service: Why Silicon Valley Loved Silicon Valley BankSilicon Valley Bank used financial sweeteners to attract clients, powering growth for decades—leaving the sector vulnerable when the bank collapsed

Baca lebih lajut »

![]() Silicon Valley Bank, Signature Bank executives gave thousands to Democrats and RepublicansBefore going down in history as two of the largest bank failures in the U.S., executives for Silicon Valley Bank of California and Signature Bank of New York were political donors who steered their money toward people who influence financial services laws.

Silicon Valley Bank, Signature Bank executives gave thousands to Democrats and RepublicansBefore going down in history as two of the largest bank failures in the U.S., executives for Silicon Valley Bank of California and Signature Bank of New York were political donors who steered their money toward people who influence financial services laws.

Baca lebih lajut »

![]() FDIC’s Silicon Valley Bank will likely be sold to another bank: ReportThe U.S. government will likely sell Silicon Valley Bank to another regulated bank, not a private equity firm, according to a report Wednesday by...

FDIC’s Silicon Valley Bank will likely be sold to another bank: ReportThe U.S. government will likely sell Silicon Valley Bank to another regulated bank, not a private equity firm, according to a report Wednesday by...

Baca lebih lajut »

![]() FDIC taps investment bank to lead Silicon Valley Bank saleThe FDIC has brought in the investment bank Piper Sandler to auction off Silicon Valley Bank, kicking off a high stakes sales process, according to two market sources who were granted anonymity to discuss the sale.

FDIC taps investment bank to lead Silicon Valley Bank saleThe FDIC has brought in the investment bank Piper Sandler to auction off Silicon Valley Bank, kicking off a high stakes sales process, according to two market sources who were granted anonymity to discuss the sale.

Baca lebih lajut »

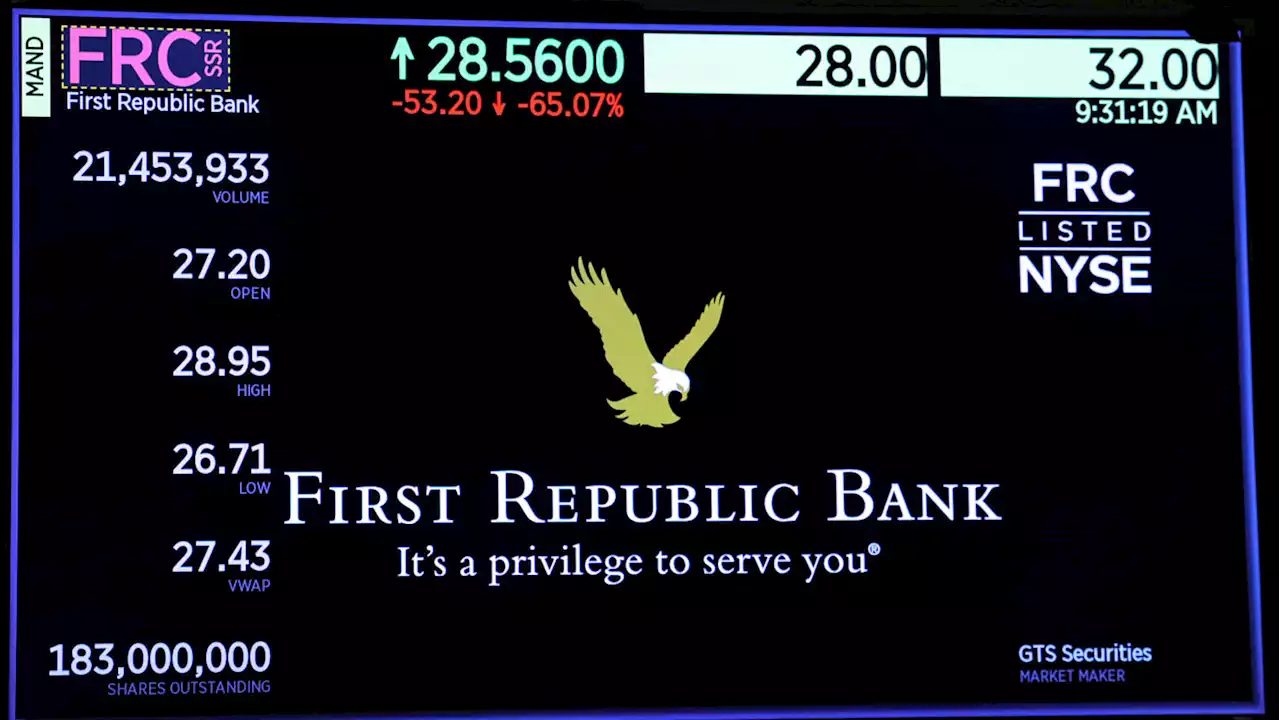

First Republic Bank Exploring Sale Amid Banking Sector ChaosThe troubled bank has been in turmoil since the collapse of Silicon Valley Bank.

First Republic Bank Exploring Sale Amid Banking Sector ChaosThe troubled bank has been in turmoil since the collapse of Silicon Valley Bank.

Baca lebih lajut »

Yellen tells Congress that U.S. banking system still ‘sound’ after collapse of Silicon Valley BankTreasury Secretary Janet Yellen told lawmakers Thursday that the nation’s banking system “remains sound” and that Americans shouldn’t worry about their deposits, a week after the second-largest bank collapse in U.S. history.

Yellen tells Congress that U.S. banking system still ‘sound’ after collapse of Silicon Valley BankTreasury Secretary Janet Yellen told lawmakers Thursday that the nation’s banking system “remains sound” and that Americans shouldn’t worry about their deposits, a week after the second-largest bank collapse in U.S. history.

Baca lebih lajut »