The Federal Reserve raised interest rates by half a percentage point Wednesday, which was a smaller increase than the four previous hikes.

On average, Fed policymakers now expect their benchmark rate to reach 5.1% next year — up from 4.6% they were projecting in September.

Rents continue to climb, but Fed officials believe the worst of shelter inflation may be behind us. Increases in market rents have slowed since spring.The biggest concern now is the rising price of services, which is primarily driven by the cost of labor. With a tight job market, wages have been climbing rapidly. While that's good for workers, it tends to stoke the flames of inflation.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Interest rates are going up, again, as Federal Reserve tries to tame inflation.The Federal Reserve is meeting this week and is expected to continue raising interest rates in an effort to fight stubborn inflation.

Interest rates are going up, again, as Federal Reserve tries to tame inflation.The Federal Reserve is meeting this week and is expected to continue raising interest rates in an effort to fight stubborn inflation.

Baca lebih lajut »

Bitcoin slips below $18,000 as Federal Reserve raises interest rates by 50 basis pointsBitcoin falls as the Fed delivered the expected 50 basis point increase.

Bitcoin slips below $18,000 as Federal Reserve raises interest rates by 50 basis pointsBitcoin falls as the Fed delivered the expected 50 basis point increase.

Baca lebih lajut »

Bitcoin falls below $18,000 after Federal Reserve raises interest ratesBitcoin loses ground as the Fed delivers a rate hike and signals more to come.

Bitcoin falls below $18,000 after Federal Reserve raises interest ratesBitcoin loses ground as the Fed delivers a rate hike and signals more to come.

Baca lebih lajut »

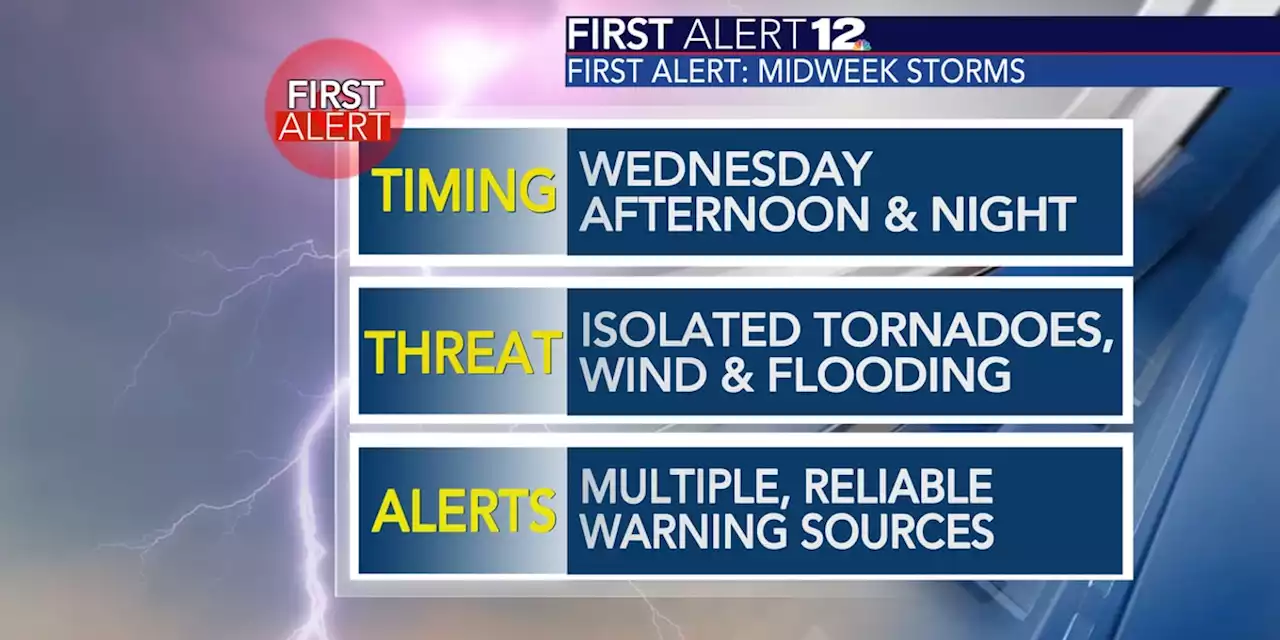

First Alert Weather Day declared for late Wednesday into Wednesday nightWednesday into Wednesday night is a First Alert Weather Day for the chance of isolated tornadoes and localized flooding.

First Alert Weather Day declared for late Wednesday into Wednesday nightWednesday into Wednesday night is a First Alert Weather Day for the chance of isolated tornadoes and localized flooding.

Baca lebih lajut »

EUR/USD floats above 1.0600 ahead of Federal Reserve monetary policy meetingEUR/USD portrays the typical pre-Fed consolidation as it makes rounds to 1.0630-20 ahead of the key Federal Open Market Committee (FOMC) monetary poli

EUR/USD floats above 1.0600 ahead of Federal Reserve monetary policy meetingEUR/USD portrays the typical pre-Fed consolidation as it makes rounds to 1.0630-20 ahead of the key Federal Open Market Committee (FOMC) monetary poli

Baca lebih lajut »

USD/CHF juggles below 0.9300 as investors await Federal Reserve/Swiss National Bank policyUSD/CHF is displaying back-and-forth moves in a narrow range below the critical resistance of 0.9300 in the early European session. The Swiss Franc ma

USD/CHF juggles below 0.9300 as investors await Federal Reserve/Swiss National Bank policyUSD/CHF is displaying back-and-forth moves in a narrow range below the critical resistance of 0.9300 in the early European session. The Swiss Franc ma

Baca lebih lajut »