.IChotiner speaks with the director of Columbia University’s Center on Poverty and Social Policy about what made the child tax credit so effective—and the impact of its disappearance on Black and Latino children.

In February, the Center on Poverty and Social Policy, at Columbia University,a staggering new report on child poverty in the United States. The study found that the child-poverty rate had increased dramatically in the space of just a month, with seventeen per cent of children living in poverty in January, 2022, compared with around twelve per cent at the end of 2021.

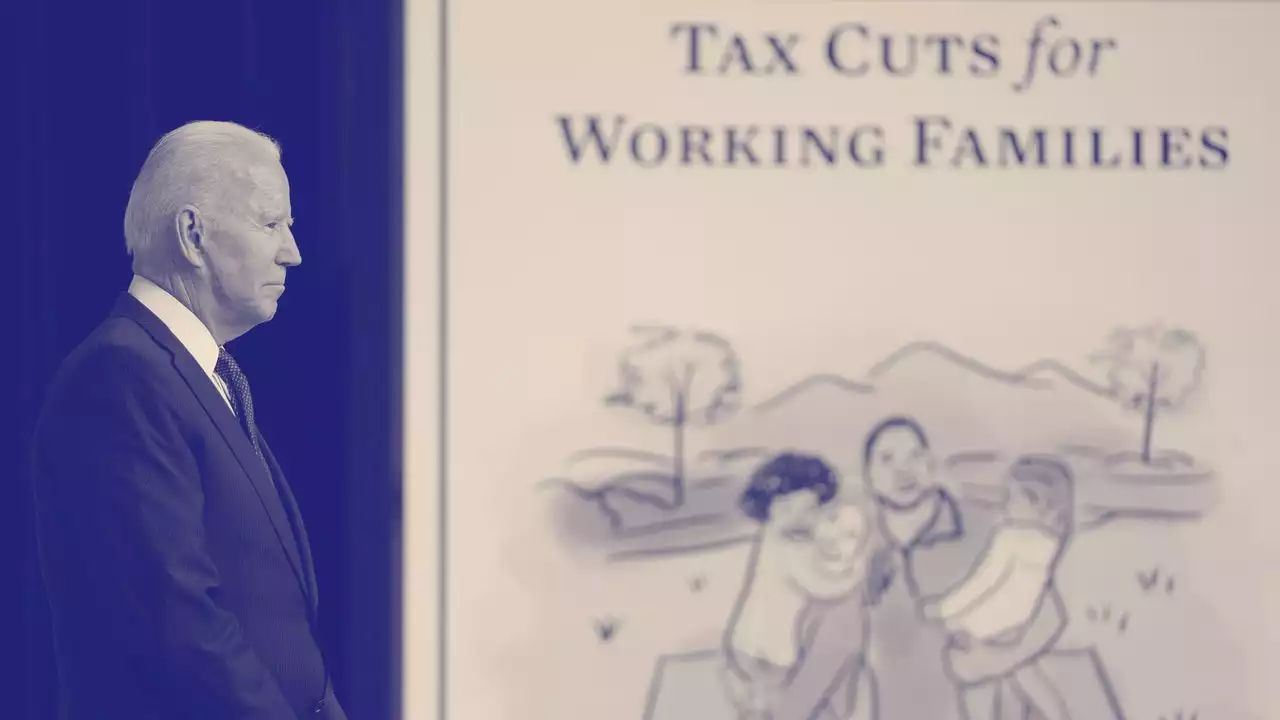

Intuitively, it seems very likely that the end of the credit is responsible for the spike we saw from December to January. But are there ways to control for the increase so that we know it was due to the child-tax-credit expiration? What did you find about poverty rates for Black and Latino children specifically in this December-to-January change?

Child poverty in 2020 was actually lower than you might have expected. And that actually had to do with the stimulus payments and the unemployment-insurance benefits that many families received. Counter to what many people probably think, 2020 actually had one of the lowest poverty rates on record as a direct result of the policies in place in that year.