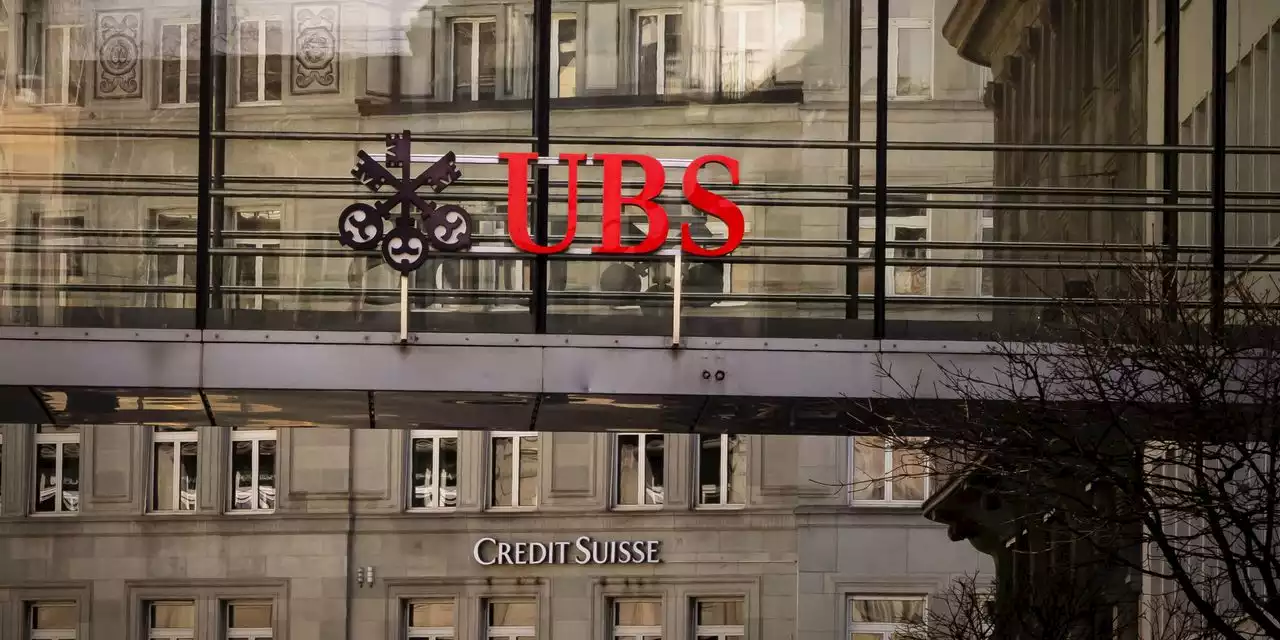

Credit Suisse’s additional tier one bonds are set to be wiped out following the struggling bank’s takeover by UBS.

Rudman says it may impact investor's views of the bonds and how much they are willing to pay for them.

"It has become harder to assess the attractiveness of the current historically large spread pick-up provided by AT1 bonds vs. their HY [high-yield corporate counterparts]," Goldman explained, concluding that this will likely lead to a reduced appetite for AT1 bonds.Meanwhile, banking regulators in the European Union, which Switzerland is not a part of, indicated on Monday that they would follow a different approach if similar situations arose within their remit.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Credit Suisse writes down $17 billion of bonds, angering holdersCredit Suisse has written down its Additional Tier 1 bonds to zero as part of its takeover by UBS, angering some bondholders who thought they would be better protected in a rescue deal announced on Sunday.

Credit Suisse writes down $17 billion of bonds, angering holdersCredit Suisse has written down its Additional Tier 1 bonds to zero as part of its takeover by UBS, angering some bondholders who thought they would be better protected in a rescue deal announced on Sunday.

Baca lebih lajut »

Credit Suisse says $17 billion debt worthless, angering bondholdersCredit Suisse said 16 billion Swiss francs ($17.24 billion) of its Additional Tier 1 debt will be written down to zero on the orders of the Swiss regulator as part of its rescue merger with UBS , angering bondholders on Sunday.

Credit Suisse says $17 billion debt worthless, angering bondholdersCredit Suisse said 16 billion Swiss francs ($17.24 billion) of its Additional Tier 1 debt will be written down to zero on the orders of the Swiss regulator as part of its rescue merger with UBS , angering bondholders on Sunday.

Baca lebih lajut »

Law firm in talks with Credit Suisse bondholders about potential lawsuit after $17 billion wipeoutA white-shoe law firm is working with Credit Suisse bondholders to pursue "possible legal actions" after the value of convertible bonds issued by...

Law firm in talks with Credit Suisse bondholders about potential lawsuit after $17 billion wipeoutA white-shoe law firm is working with Credit Suisse bondholders to pursue "possible legal actions" after the value of convertible bonds issued by...

Baca lebih lajut »

Musk responds to $100B credit line in $2B UBS-Credit Suisse deal: 'Wow'Twitter CEO Elon Musk responded to the news that UBS would get a $100 billion credit line in the buyout of Credit Suisse for $2 billion, with one word: wow.

Musk responds to $100B credit line in $2B UBS-Credit Suisse deal: 'Wow'Twitter CEO Elon Musk responded to the news that UBS would get a $100 billion credit line in the buyout of Credit Suisse for $2 billion, with one word: wow.

Baca lebih lajut »

Credit Suisse Bond-Wipeout Threatens $250 Billion MarketCredit Suisse’s merger with UBS will wipe out the bank’s riskiest bonds known as AT1s. What they are and why their write down matters for other European banks.

Credit Suisse Bond-Wipeout Threatens $250 Billion MarketCredit Suisse’s merger with UBS will wipe out the bank’s riskiest bonds known as AT1s. What they are and why their write down matters for other European banks.

Baca lebih lajut »

UBS Nears Deal to Take Over Credit SuisseUBS Group AG is nearing a deal to take over Credit Suisse Group AG, part of an urgent effort engineered by Swiss and global authorities to restore trust in the banking system.

UBS Nears Deal to Take Over Credit SuisseUBS Group AG is nearing a deal to take over Credit Suisse Group AG, part of an urgent effort engineered by Swiss and global authorities to restore trust in the banking system.

Baca lebih lajut »