Bond yields inched up to fresh 16-year highs after rising oil prices increased inflation angst.

What’s happening What’s driving markets Oil prices that have moved swiftly to 13-month highs are adding to the upward pressure on bond yields, as traders fret that revived inflationary pressures will cause the Federal Reserve to keep interest rates higher for longer.

Other U.S. economic updates for investors to consider on Thursday, include the weekly jobless claims report and the revision to second-quarter GDP, both due at 8:30 a.m., and pending home sales for August at 10 a.m.. However, expectations of likely Fed policy moves have not shifted too much during that time. Markets are pricing in a 78% probability that the Fed will leave interest rates unchanged at a range of 5.25% to 5.50% after its next meeting on November 1, according to the CME FedWatch tool.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Ten-year Treasury yields pull back from 16-year highsTreasury prices rose early Wednesday after yields at 16-year highs attracted buyers to bonds.

Ten-year Treasury yields pull back from 16-year highsTreasury prices rose early Wednesday after yields at 16-year highs attracted buyers to bonds.

Baca lebih lajut »

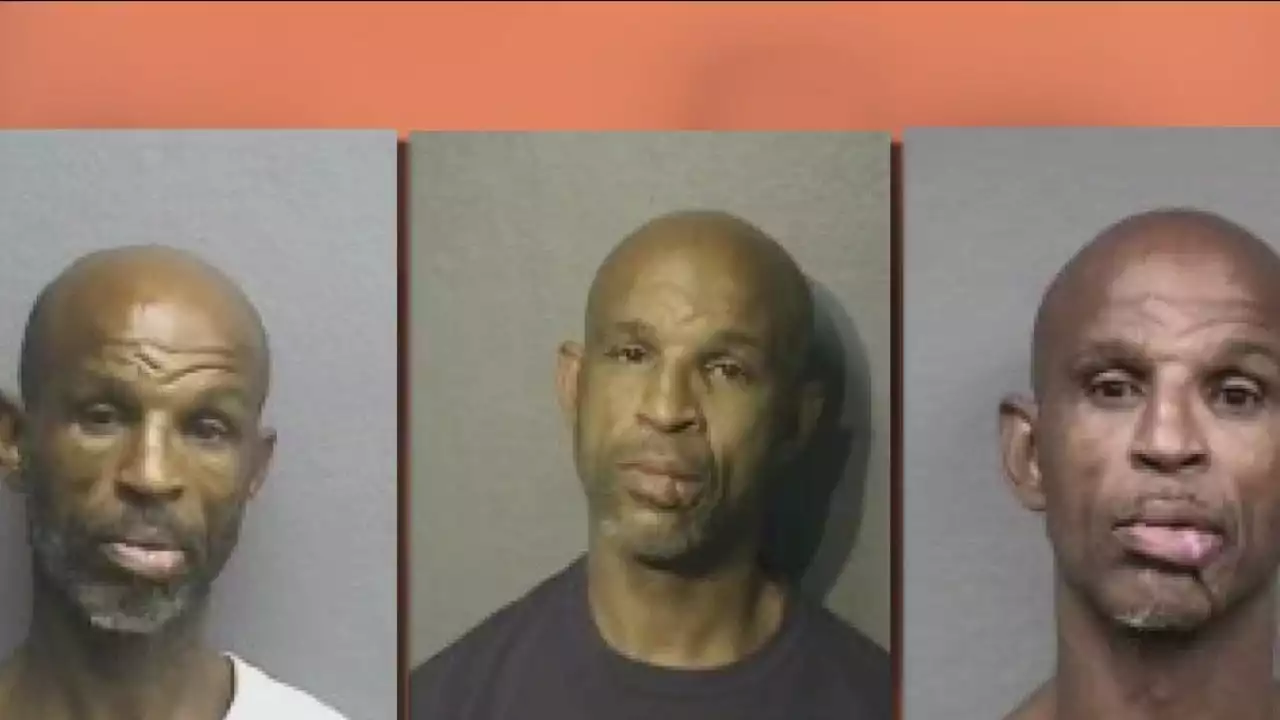

Breaking Bond: Career criminal free from jail on PR bond after allegedly stealing catalytic converterOne of Robert James Williams' bond conditions is highly unusual and specific. He's not allowed to have a chainsaw outside his home.

Breaking Bond: Career criminal free from jail on PR bond after allegedly stealing catalytic converterOne of Robert James Williams' bond conditions is highly unusual and specific. He's not allowed to have a chainsaw outside his home.

Baca lebih lajut »

10 James Bond Franchise Traditions & Tropes Bond 26 Must DropEvery 007 cliche that Bond 26 must retire.

10 James Bond Franchise Traditions & Tropes Bond 26 Must DropEvery 007 cliche that Bond 26 must retire.

Baca lebih lajut »

Treasury's 'weird' security approaches 5% yield, signaling 10-year rate may tooThe rate on the 20-year government bond heads for a high of almost 4.9%, becoming the first long-term Treasury yield to approach the 5% mark.

Treasury's 'weird' security approaches 5% yield, signaling 10-year rate may tooThe rate on the 20-year government bond heads for a high of almost 4.9%, becoming the first long-term Treasury yield to approach the 5% mark.

Baca lebih lajut »

10-year Treasury yield pulls back from more than 15-year highU.S. Treasury yields fell on Wednesday as investors assessed the state of the U.S. economy following the latest economic data.

10-year Treasury yield pulls back from more than 15-year highU.S. Treasury yields fell on Wednesday as investors assessed the state of the U.S. economy following the latest economic data.

Baca lebih lajut »