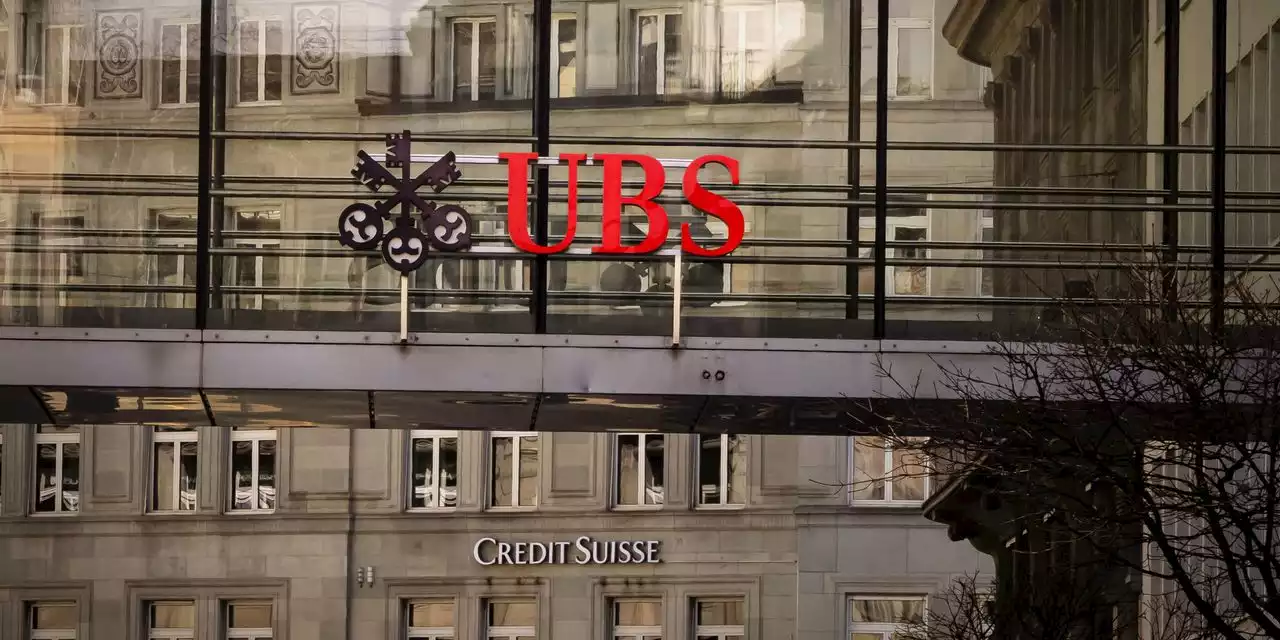

Credit Suisse and UBS could benefit from more than 260 billion Swiss francs ($280 billion) in state and central bank support, a third of the country's gross domestic product, as part of their merger to buffer Switzerland against global financial turmoil, documents outlining the deal show.

UBS said it will pay $3.2 billion for the 167-year-old flagship while the government said UBS would also take on the first $5.4 billion in losses from unwinding derivatives and other risky assets.

The total of 259 billion francs of support is equivalent to a third of Switzerland's entire economic output, which stood at 771 billion francs last year. In a memo seen by Reuters that was sent to staff on Sunday after the deal announcement, Credit Suisse reassured staff that their bonuses would be paid in full.Credit Suisse had already been drawing on the Swiss National Bank’s emergency liquidity assistance scheme.

The third tranche of support allows Credit Suisse to draw on a further 100 billion francs of funding via a public liquidity backstop, which is explicitly guaranteed by the Swiss government.Credit Suisse has been the biggest name ensnared in global market turmoil unleashed by the recent collapse of U.S. lenders Silicon Valley Bank and Signature Bank.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Switzerland puts up 260 billion francs for Credit Suisse rescue, documents showCredit Suisse and UBS could benefit from more than 260 billion Swiss francs ($280 billion) in state and central bank support, a third of the country's gross domestic product, as part of their merger to buffer Switzerland against global financial turmoil, documents outlining the terms of the deal show.

Switzerland puts up 260 billion francs for Credit Suisse rescue, documents showCredit Suisse and UBS could benefit from more than 260 billion Swiss francs ($280 billion) in state and central bank support, a third of the country's gross domestic product, as part of their merger to buffer Switzerland against global financial turmoil, documents outlining the terms of the deal show.

Baca lebih lajut »

Switzerland preparing emergency measures for UBS' takeover of Credit Suisse: ReportAccording to a March 18 Financial Times report citing three people familiar with the situation, Switzerland is preparing to use 'emergency measures' to accelerate UBS' takeover of Credit Suisse before 'markets open on Monday.'

Switzerland preparing emergency measures for UBS' takeover of Credit Suisse: ReportAccording to a March 18 Financial Times report citing three people familiar with the situation, Switzerland is preparing to use 'emergency measures' to accelerate UBS' takeover of Credit Suisse before 'markets open on Monday.'

Baca lebih lajut »

Analysis: UBS swallows Credit Suisse, casting shadow over SwitzerlandUBS Group emerged as Switzerland’s one and only global bank with a state-backed rescue of its smaller peer Credit Suisse, a risky bet that makes the Swiss economy more dependent on a single lender.

Analysis: UBS swallows Credit Suisse, casting shadow over SwitzerlandUBS Group emerged as Switzerland’s one and only global bank with a state-backed rescue of its smaller peer Credit Suisse, a risky bet that makes the Swiss economy more dependent on a single lender.

Baca lebih lajut »

Musk responds to $100B credit line in $2B UBS-Credit Suisse deal: 'Wow'Twitter CEO Elon Musk responded to the news that UBS would get a $100 billion credit line in the buyout of Credit Suisse for $2 billion, with one word: wow.

Musk responds to $100B credit line in $2B UBS-Credit Suisse deal: 'Wow'Twitter CEO Elon Musk responded to the news that UBS would get a $100 billion credit line in the buyout of Credit Suisse for $2 billion, with one word: wow.

Baca lebih lajut »

UBS in Talks to Take Over Credit SuisseUBS is in talks to take over parts or all of Credit Suisse, part of an urgent effort by Swiss and global authorities to restore trust in the banking system.

UBS in Talks to Take Over Credit SuisseUBS is in talks to take over parts or all of Credit Suisse, part of an urgent effort by Swiss and global authorities to restore trust in the banking system.

Baca lebih lajut »

The fate of Credit Suisse could be decided in the next 36 hours | CNN BusinessThe fate of Credit Suisse could be decided in the next 36 hours after a torrid week for Switzerland's second biggest bank.

The fate of Credit Suisse could be decided in the next 36 hours | CNN BusinessThe fate of Credit Suisse could be decided in the next 36 hours after a torrid week for Switzerland's second biggest bank.

Baca lebih lajut »