A majority of investment fund managers now say they see “below-trend growth and above-trend inflation”— aka stagflation — happening this year.

stagnation and high inflation, characterized by soaring consumer prices as well as high unemployment. The phenomenon ravaged the U.S. economy in the 1970s and early 1980s, as spiking oil prices, rising unemployment and easy monetary policy pushed the consumer price index as high as 14.8% in 1980, forcing Fed policymakers to raise interest rates to nearly 20% that year. Although the investment managers believe that inflation in the U.S.

Consumer prices jumped 8.3% in April on an annual basis, close to a 40-year high, and are expected to remain elevated in coming months. As a result, the Fed is embarking on its most aggressive course to tighten policy in decades, raising rates by a half-point earlier this month and signaling that similarly sized hikes are on the table at coming meetings.

There are growing fears that the Fed will trigger a recession because hiking interest rates tends to create higher rates on consumer and business loans, which slows the economy by forcing employers to cut back on spending. Bank of America, as well as Fannie Mae and Deutsche Bank, are among theIn this Jan. 29, 2020 file photo, Federal Reserve Chair Jerome Powell pauses during a news conference in Washington.

Powell has acknowledged there could be some "pain associated" with reducing inflation and curbing demand but pushed back against the notion of an impending recession, identifying the labor market and strong consumer spending as bright spots in the economy. Still, he has warned that a soft landing — the sweet spot between cooling demand without crushing it and triggering a recession — is not assured.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Treasury Yields Rise as Inflation and Economic Growth Concerns LingerU.S. Treasury yields rose on Monday morning, as concerns about inflation and economic growth remained in focus for investors.

Treasury Yields Rise as Inflation and Economic Growth Concerns LingerU.S. Treasury yields rose on Monday morning, as concerns about inflation and economic growth remained in focus for investors.

Baca lebih lajut »

Conjunto legend Santiago Jimenez Jr. 'Still Kicking!' with new recordAt age 77, conjunto artist Santiago Jimenez Jr. will release a new 10-song album Friday night at the Lonesome Rose.

Conjunto legend Santiago Jimenez Jr. 'Still Kicking!' with new recordAt age 77, conjunto artist Santiago Jimenez Jr. will release a new 10-song album Friday night at the Lonesome Rose.

Baca lebih lajut »

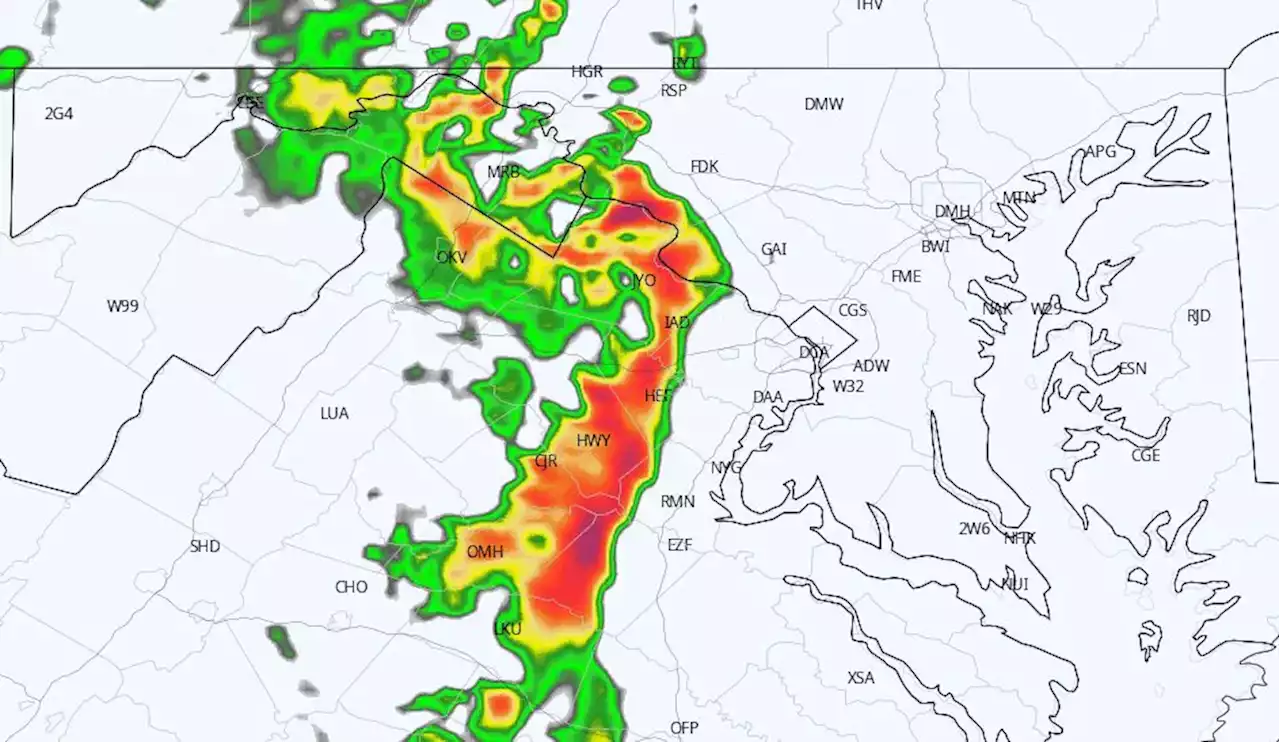

D.C.-area forecast: A steamy Sunday with hefty afternoon storms likelyMuch cooler Monday through Wednesday with some clouds and a few showers.

D.C.-area forecast: A steamy Sunday with hefty afternoon storms likelyMuch cooler Monday through Wednesday with some clouds and a few showers.

Baca lebih lajut »

Czech central bank chief: rates likely to rise in June if forecast confirmedThe Czech central bank will likely raise interest rate further in June if data from the economy are in line with the bank's latest macroeconomic forecast, Governor Jiri Rusnok said on Sunday.

Czech central bank chief: rates likely to rise in June if forecast confirmedThe Czech central bank will likely raise interest rate further in June if data from the economy are in line with the bank's latest macroeconomic forecast, Governor Jiri Rusnok said on Sunday.

Baca lebih lajut »

Johann Rupert Defiant on Richemont Strategy Despite Falling SharesA shrinking share price, fear of stagflation and uncertainty about China’s medium-term future haven’t undermined Johann Rupert’s underlying optimism about Compagnie Financière Richemont, or the future of hard luxury.

Johann Rupert Defiant on Richemont Strategy Despite Falling SharesA shrinking share price, fear of stagflation and uncertainty about China’s medium-term future haven’t undermined Johann Rupert’s underlying optimism about Compagnie Financière Richemont, or the future of hard luxury.

Baca lebih lajut »

Global leaders warn of economic dangers as crises multiplyAt the G-7 conference in Germany, financial leaders warned of the potential for a global economic slowdown, as the threats caused by Russia’s invasion of Ukraine continued to multiply.

Global leaders warn of economic dangers as crises multiplyAt the G-7 conference in Germany, financial leaders warned of the potential for a global economic slowdown, as the threats caused by Russia’s invasion of Ukraine continued to multiply.

Baca lebih lajut »