The Bank of Spain (BancoDeEspana) plans to start a wholesale CBDC project and opened on Monday a call for proposals from financial institutions and technology solution providers. andresengler reports

The Bank of Spain plans to start a wholesale central bank digital currency project and on Monday opened a call for proposals from financial institutions and technology solution providers.bank said in an official statement

, adding that it also seeks to experiment with the integration of a wholesale CBDC with the settlement of financial assets and to analyze the possible advantages and disadvantages of its introduction. Interested parties will have until January 31, 2023 to submit their respective applications, the bank said. It added that the program for a wholesale CBDC is not related to the research work the European Union is doing on a retail CBDC, also known as digital euro.projects to achieve the benefits of CBDCs used at a wholesale level by banks and financial markets.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Central bank plans to make CBDC 'only legal digital tender' in Indonesia, says govPerry Warjiyo, the governor of the Bank of Indonesia, spoke at the central bank’s annual meeting on Dec. 5 to provide updates on Project Garuda.

Central bank plans to make CBDC 'only legal digital tender' in Indonesia, says govPerry Warjiyo, the governor of the Bank of Indonesia, spoke at the central bank’s annual meeting on Dec. 5 to provide updates on Project Garuda.

Baca lebih lajut »

Nigeria bans ATM cash withdrawals over $225 a week to force use of CBDCWith the adoption of Nigeria’s eNaira Central Bank Digital Currency (CBDC) lagging, the country’s central bank imposed further cash withdrawal restrictions on its citizens and reissued new banknotes as it seeks to encourage digital financial transactions.

Nigeria bans ATM cash withdrawals over $225 a week to force use of CBDCWith the adoption of Nigeria’s eNaira Central Bank Digital Currency (CBDC) lagging, the country’s central bank imposed further cash withdrawal restrictions on its citizens and reissued new banknotes as it seeks to encourage digital financial transactions.

Baca lebih lajut »

Report outlines reasons why stakeholders are against CBDCThe report highlighted that stakeholders are concerned about privacy and anonymity, interoperability, scalability, tech structure and balance between policy and design.

Report outlines reasons why stakeholders are against CBDCThe report highlighted that stakeholders are concerned about privacy and anonymity, interoperability, scalability, tech structure and balance between policy and design.

Baca lebih lajut »

![]() World Bank, partners launch tracking system to clean up carbon marketsThe World Bank and partners including Singapore on Wednesday launched a global tracking system to clean up the opaque market for carbon credits and help developing countries raise much-needed climate finance quickly and more cheaply.

World Bank, partners launch tracking system to clean up carbon marketsThe World Bank and partners including Singapore on Wednesday launched a global tracking system to clean up the opaque market for carbon credits and help developing countries raise much-needed climate finance quickly and more cheaply.

Baca lebih lajut »

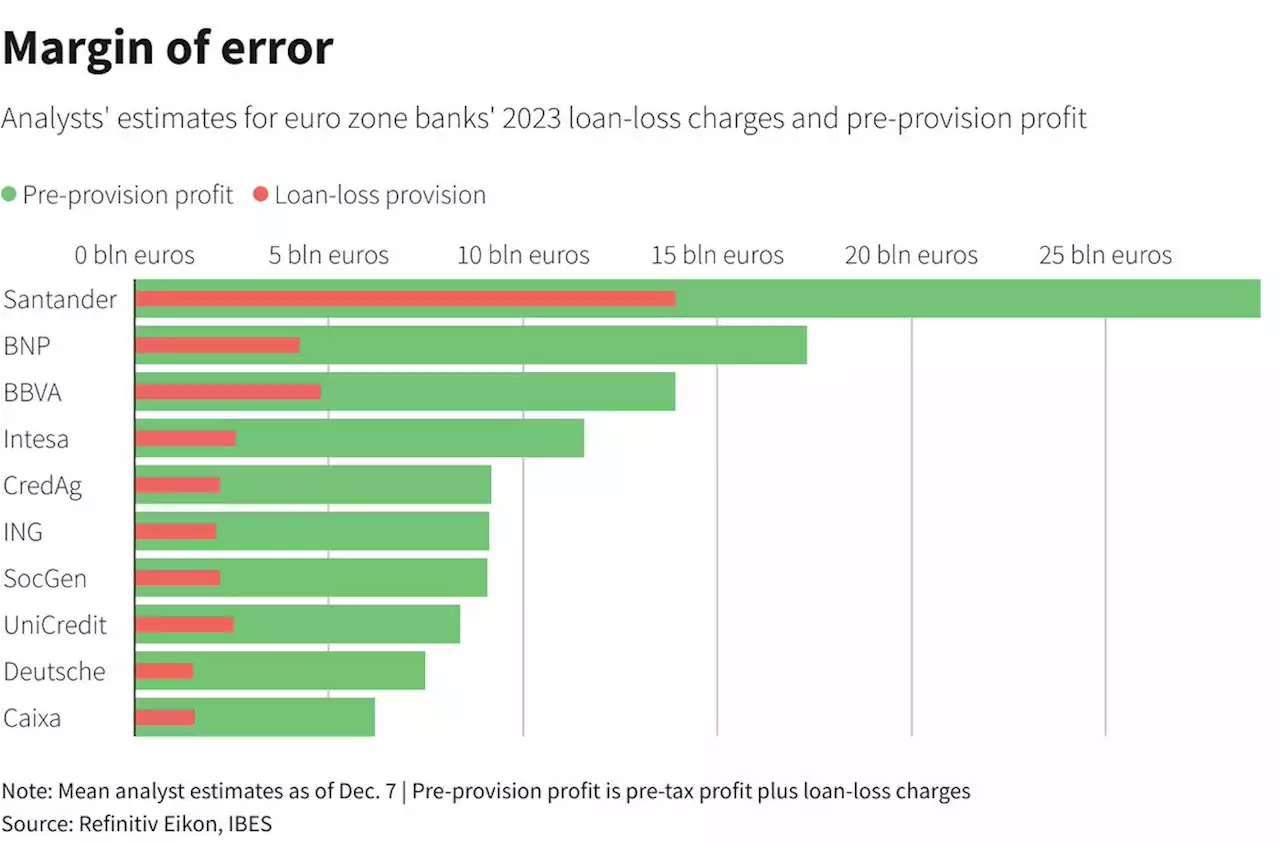

ECB’s bank loan-loss worries look overdoneChief supervisor Andrea Enria fears that BNP, ING and others are flying blind into a 2023 default storm. But rate hikes will give the 10 largest lenders a 120 bln euro profit buffer before their capital gets hit. The big banks can afford to keep going with dividends and buybacks.

ECB’s bank loan-loss worries look overdoneChief supervisor Andrea Enria fears that BNP, ING and others are flying blind into a 2023 default storm. But rate hikes will give the 10 largest lenders a 120 bln euro profit buffer before their capital gets hit. The big banks can afford to keep going with dividends and buybacks.

Baca lebih lajut »

Bank of Russia wants to ban miners from selling crypto to Russians“We adhere to the position on the inadmissibility of the circulation of digital currency on the territory of the Russian Federation,” the Bank of Russia said.

Bank of Russia wants to ban miners from selling crypto to Russians“We adhere to the position on the inadmissibility of the circulation of digital currency on the territory of the Russian Federation,” the Bank of Russia said.

Baca lebih lajut »