RBC Capital Markets analyst Nik Modi initiated coverage of Utz stock with an Outperform rating and $17 price target.

Utz Brands stock has taken a hit this year, but one analyst says now is the time to buy shares of the snack maker.

One reason for Wall Street concern is the recent popularity of weight-loss drugs and what that could mean for the snack food industry. Novo Nordisk’s Ozempic and Eli Lilly’s Mounjaro are two diabetes drugs being used by some for weight management. “We are not in this camp,” Modi said. “We must not forget that these drugs are expensive and out of reach for many Americans seeking to use them for weight loss as a result.”

Newsletter Sign-up Modi also recognized that there are other concerns within the snack space as consumers continue to feel the pinch of high grocery prices as inflation runs hot. With prices historically high, shoppers may choose to trade down to store brands or avoid buying snacks altogether.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Stock Market Decline May Not Be Over as Credit Spreads Begin to WidenMarket Overview Analysis by Michael Kramer covering: EUR/USD - Euro Dollaro Americano, GBP/USD, USD/JPY, Nasdaq 100. Read Michael Kramer's latest article on Investing.com

Stock Market Decline May Not Be Over as Credit Spreads Begin to WidenMarket Overview Analysis by Michael Kramer covering: EUR/USD - Euro Dollaro Americano, GBP/USD, USD/JPY, Nasdaq 100. Read Michael Kramer's latest article on Investing.com

Baca lebih lajut »

RBC Capital sees a 'compelling buy case for' Utz Brands By Investing.comRBC Capital sees a 'compelling buy case for' Utz Brands

RBC Capital sees a 'compelling buy case for' Utz Brands By Investing.comRBC Capital sees a 'compelling buy case for' Utz Brands

Baca lebih lajut »

The Best Hotel Poolside Snack Is the Last One You'd ExpectThe Intercontinental Da Nang is a property that is beaming with hidden gems just waiting to be found. Including its utterly delicious poolside menu.

The Best Hotel Poolside Snack Is the Last One You'd ExpectThe Intercontinental Da Nang is a property that is beaming with hidden gems just waiting to be found. Including its utterly delicious poolside menu.

Baca lebih lajut »

Amazon’s stock rallies toward its first gain in 8 sessionsShares of Amazon.com Inc. rose 1.9% in afternoon trading Monday, to put them on track for their first gain in eight sessions. The bounce comes after the...

Amazon’s stock rallies toward its first gain in 8 sessionsShares of Amazon.com Inc. rose 1.9% in afternoon trading Monday, to put them on track for their first gain in eight sessions. The bounce comes after the...

Baca lebih lajut »

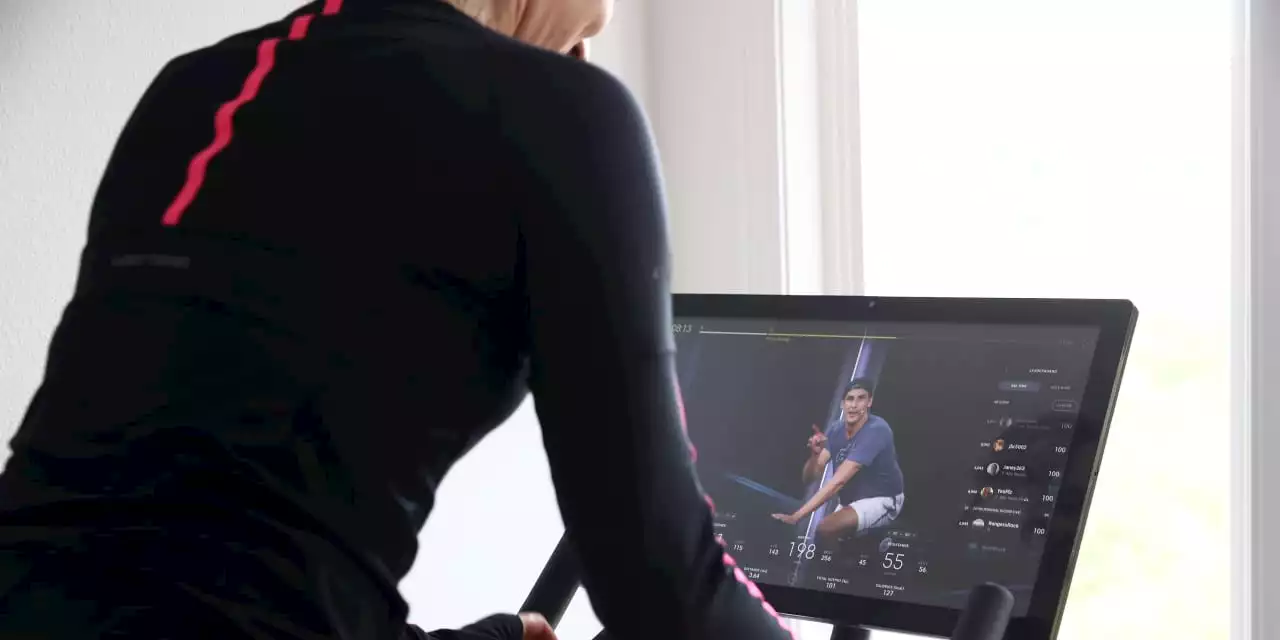

Peloton Stock Faces ‘Increased Uncertainty,’ Says UBSUBS analyst Arpine Kocharyan cut her price target on Peloton stock to $4 from $8, and kept a Sell rating. She also cut sales and Ebitda estimates.

Peloton Stock Faces ‘Increased Uncertainty,’ Says UBSUBS analyst Arpine Kocharyan cut her price target on Peloton stock to $4 from $8, and kept a Sell rating. She also cut sales and Ebitda estimates.

Baca lebih lajut »