Commodities Analysis by David I. Kranzler covering: Gold Spot US Dollar, Silver Spot US Dollar, Gold Futures, Silver Futures. Read David I. Kranzler's latest article on Investing.com

is up nearly 4% as I write this. Here’s the title from the September 19th issue: “The Mining Stocks Remain Historically Undervalued.” GDX is up 4% as I write this. Several of the micro-cap, project development stocks that I recommend are up over 20% since mid-September., have potential 10-20x returns ahead of them. I updated Cabral in yesterday’s issue with a couple of imminent catalysts that could trigger a 25% to 35% move in the stock before Christmas.

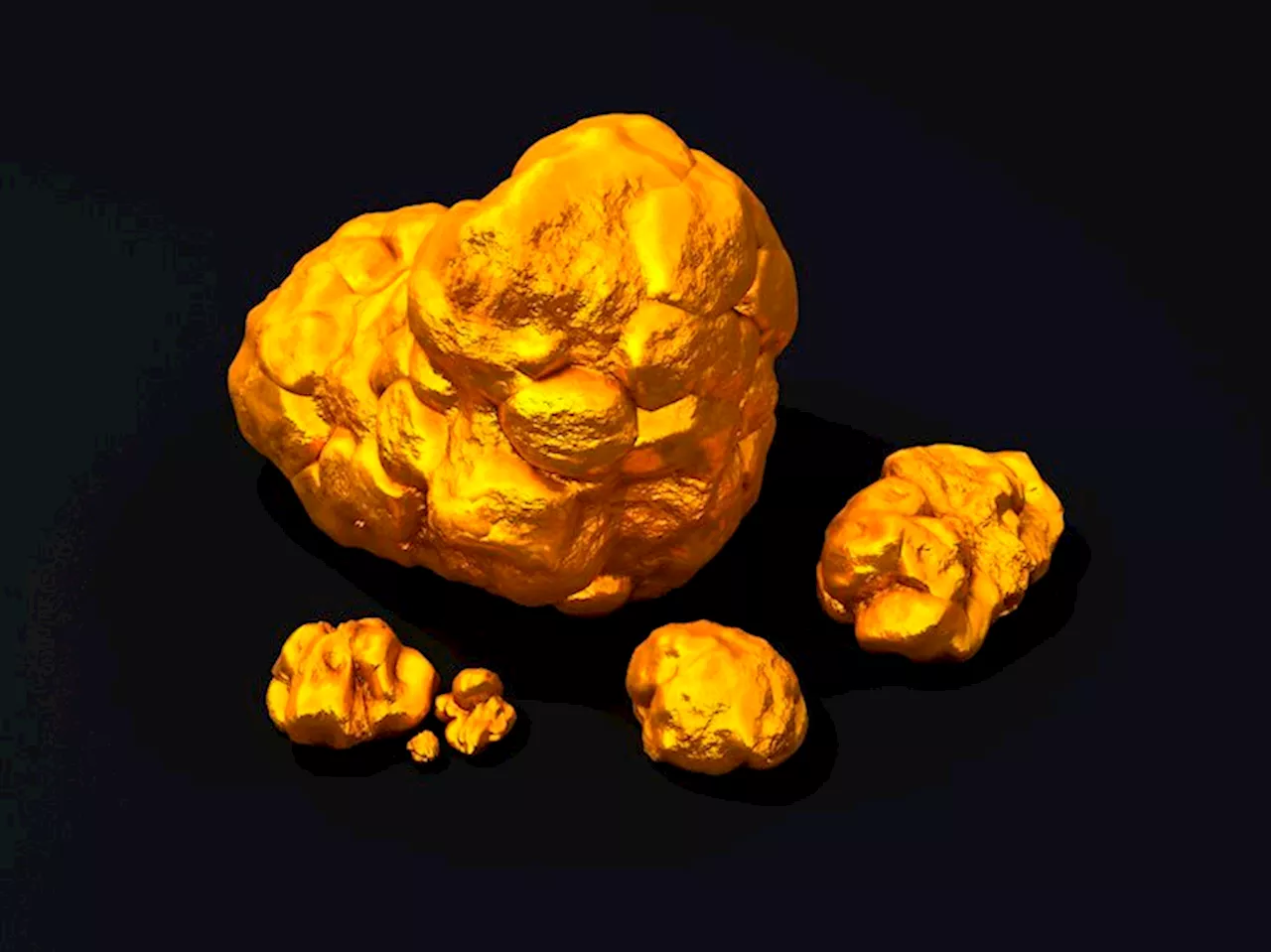

This view is supported by the fundamental set-up in the silver market. It’s been well circulated that the Silver Institute of America is forecasting a 215 million ounce silver supply/demand deficit for 2024. Several factors will likely increase the size of that deficit in 2025. First, Russia announced in its Draft Federal Budget release that it plans to significantly increase the holdings in precious metals in its State Fund .

Finally, at some point – as occurred in the late 1970’s and again leading up to the 2011 top in silver – the “poor man’s gold” attribute of silver will become a large factor in driving a massive amount of investor money into silver as a cheap substitute for gold. This demand would be coming from the greater public beyond the precious metals “bugs” who have been stacking silver for years.

Silver Spot US Dollar Gold Futures Silver Futures

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

The Economy May Be in Worse Shape Than It AppearsMarket Overview Analysis by David I. Kranzler covering: . Read David I. Kranzler's latest article on Investing.com

The Economy May Be in Worse Shape Than It AppearsMarket Overview Analysis by David I. Kranzler covering: . Read David I. Kranzler's latest article on Investing.com

Baca lebih lajut »

Consumer Credit Is a Ticking Time Bomb for the BanksMarket Overview Analysis by David I. Kranzler covering: Ally Financial Inc. Read David I. Kranzler's latest article on Investing.com

Consumer Credit Is a Ticking Time Bomb for the BanksMarket Overview Analysis by David I. Kranzler covering: Ally Financial Inc. Read David I. Kranzler's latest article on Investing.com

Baca lebih lajut »

Silver Price Prediction: Silver makes tentative break above trendlineSilver (XAG/USD) has broken tentatively above a key trendline in the $30s.

Silver Price Prediction: Silver makes tentative break above trendlineSilver (XAG/USD) has broken tentatively above a key trendline in the $30s.

Baca lebih lajut »

Gold, Silver: Strong Quarterly, Monthly Closes Indicate More Upside AheadCommodities Analysis by Jordan Roy-Byrne, CMT covering: Gold Spot US Dollar, Silver Spot US Dollar, Gold Futures, Silver Futures. Read Jordan Roy-Byrne, CMT's latest article on Investing.com

Gold, Silver: Strong Quarterly, Monthly Closes Indicate More Upside AheadCommodities Analysis by Jordan Roy-Byrne, CMT covering: Gold Spot US Dollar, Silver Spot US Dollar, Gold Futures, Silver Futures. Read Jordan Roy-Byrne, CMT's latest article on Investing.com

Baca lebih lajut »

Gold and Silver are max longCTAs are 'max long' Gold and Silver, but the margin of safety against algo liquidations in Gold still remains elevated, TDS commodity analyst Daniel Ghali notes.

Gold and Silver are max longCTAs are 'max long' Gold and Silver, but the margin of safety against algo liquidations in Gold still remains elevated, TDS commodity analyst Daniel Ghali notes.

Baca lebih lajut »

US Dollar Rallies Strong While Gold, Silver Hesitate as Pressure MountsMarket Overview Analysis by Sunshine Profits (Przemyslaw Radomski, CFA) covering: Gold Spot US Dollar, Silver Spot US Dollar, US Dollar Index Futures, Gold Futures. Read Sunshine Profits (Przemyslaw Radomski, CFA)'s latest article on Investing.com

US Dollar Rallies Strong While Gold, Silver Hesitate as Pressure MountsMarket Overview Analysis by Sunshine Profits (Przemyslaw Radomski, CFA) covering: Gold Spot US Dollar, Silver Spot US Dollar, US Dollar Index Futures, Gold Futures. Read Sunshine Profits (Przemyslaw Radomski, CFA)'s latest article on Investing.com

Baca lebih lajut »