S&P500 Futures dribble after confirming bull market, Treasury yields grind higher as Fed hawks retreat – by anilpanchal7 SP500 Futures YieldCurve RiskAversion Recession

While portraying the mood, the S&P500 Futures print mild losses around the highest levels since August 2022, marked the previous day. That said, the benchmark Wall Street index confirmed bull markets on Thursday, by rising around 20.0% from the lows marked in October.

It’s worth noting that the market’s fears of recession take clues from the latest easing in China inflation and softer economics from Australia, Europe and the US. Also underpinning the pessimism are the hawkish central banks which remain ready to fuel the benchmark. It should be observed, however, that the receding hawkish bets on the US Federal Reserve seemed to have favored the equities and bond buyers the previous day.

Earlier in the day, China’s headline inflation gauges for May, namely the Consumer Price Index and Producer, flashed mixed signals as the CPI drops on MoM but improves on YoY whereas the PPI marks a slump during the stated month.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

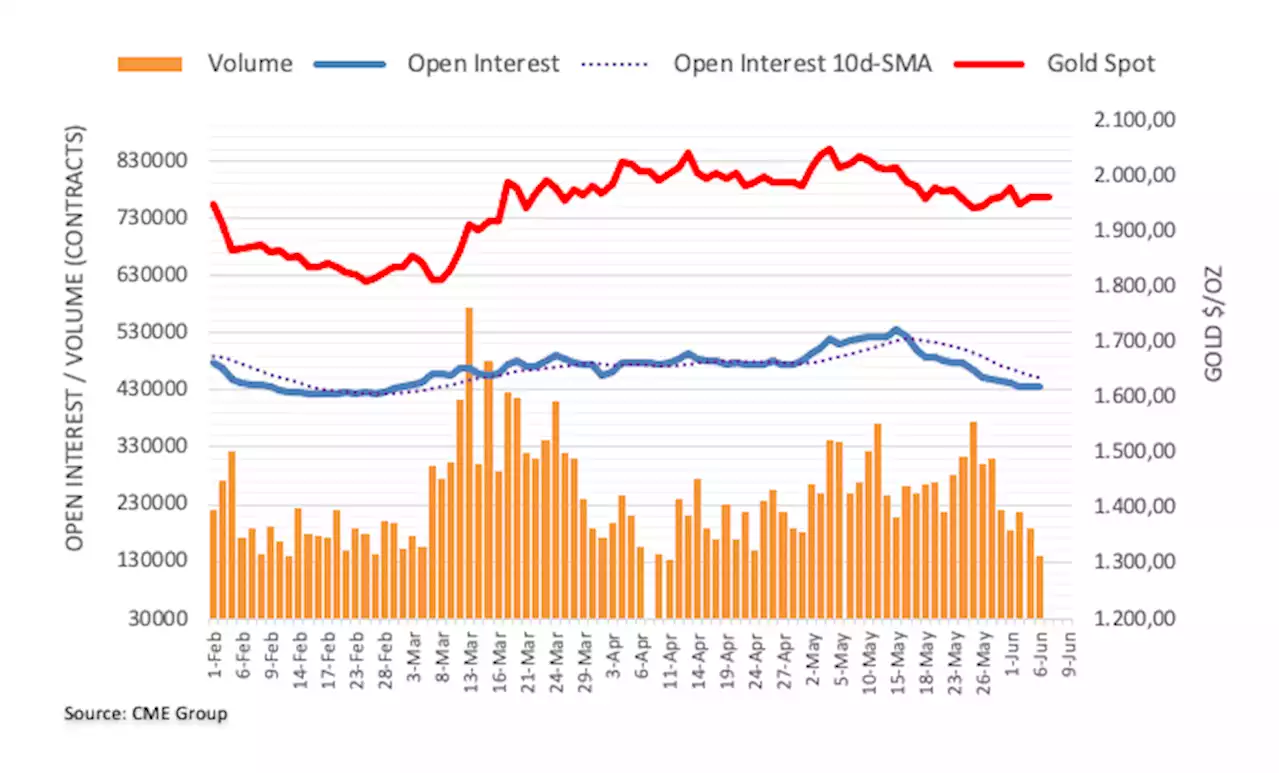

Gold Futures: Near-term consolidation on the cardsOpen interest in gold futures markets rose by more than 2K contracts on Tuesday, reversing at the same time a downtrend in place since May 16, accordi

Gold Futures: Near-term consolidation on the cardsOpen interest in gold futures markets rose by more than 2K contracts on Tuesday, reversing at the same time a downtrend in place since May 16, accordi

Baca lebih lajut »

Treasury may issue $1.6 trillion in T-bills this year after debt dealThe Treasury Department may issue $1.6 trillion in T-bills this year as it rebuilds its coffers after the debt ceiling deal

Baca lebih lajut »

Treasury’s $1 Trillion Debt Deluge Threatens Market CalmThe U.S. government could face borrowing at rates near 6%, up from 0.1% less than two years ago.

Treasury’s $1 Trillion Debt Deluge Threatens Market CalmThe U.S. government could face borrowing at rates near 6%, up from 0.1% less than two years ago.

Baca lebih lajut »

Crude Oil Futures: Further retracement not ruled outCME Group’s flash data for crude oil futures markets noted traders added nearly 15K contracts to their open interest positions on Tuesday, extending t

Crude Oil Futures: Further retracement not ruled outCME Group’s flash data for crude oil futures markets noted traders added nearly 15K contracts to their open interest positions on Tuesday, extending t

Baca lebih lajut »

U.S. Lawmakers Urge IRS, Treasury to Hurry Crypto Tax RulesCongressmen Brad Sherman and Stephen Lynch called the industry 'a major source of tax evasion' in a letter asking for the prompt release of proposed regulations on reporting requirements.

U.S. Lawmakers Urge IRS, Treasury to Hurry Crypto Tax RulesCongressmen Brad Sherman and Stephen Lynch called the industry 'a major source of tax evasion' in a letter asking for the prompt release of proposed regulations on reporting requirements.

Baca lebih lajut »

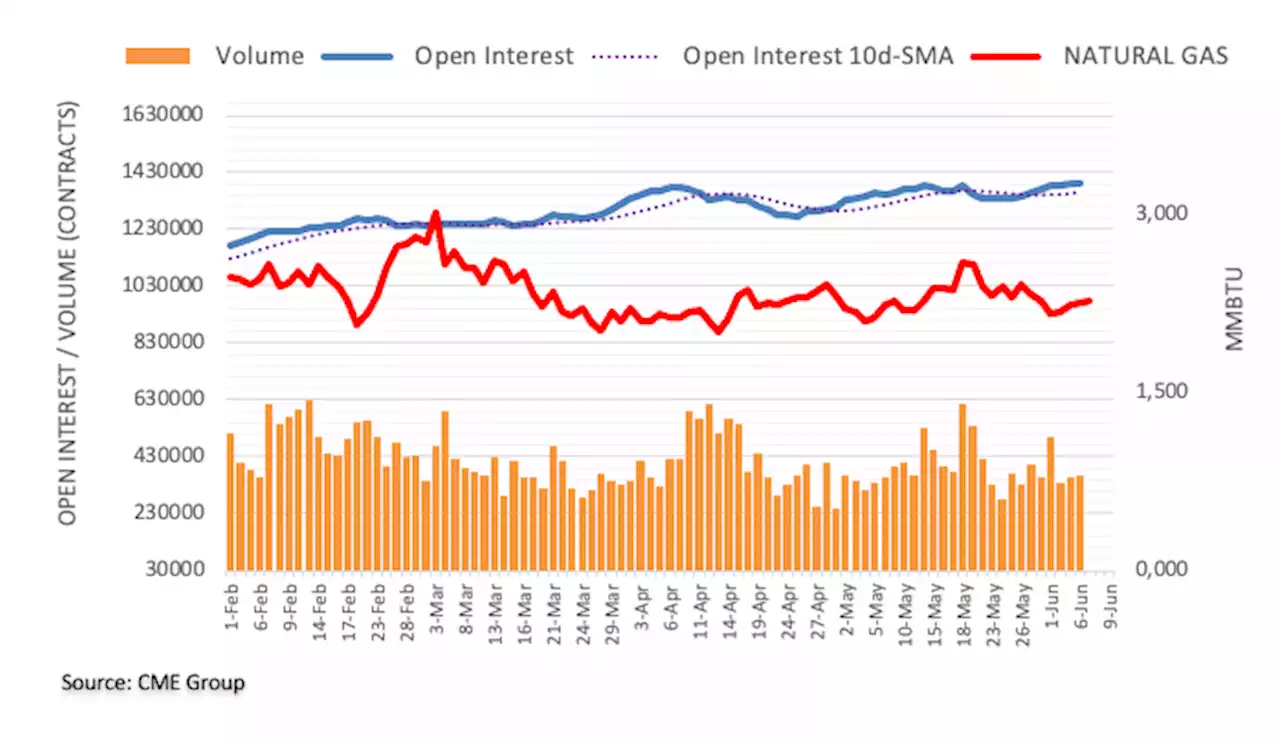

Natural Gas Futures: Scope for extra gainsConsidering advanced prints from CME Group for natural gas futures markets, open interest increased for the second session in a row on Tuesday, now by

Natural Gas Futures: Scope for extra gainsConsidering advanced prints from CME Group for natural gas futures markets, open interest increased for the second session in a row on Tuesday, now by

Baca lebih lajut »