The S&P 500 and the Nasdaq slipped on Monday, adding to the market's recent string of losses.

lost over 2% each last week after Fed Chair Jerome Powell signaled more policy tightening, and the central bank projected that interest rates would top the 5% mark in 2023, a level not seen since 2007.

"There's residual negativity from the Fed's more hawkish comments, concerns about where interest rates are going to end up next year and what that is going to do to valuations," Michael James, senior vice president of institutional equity trading at Wedbush Securities. "When people adjust their expectations after the Fed meeting, higher rates typically imply more compressed multiples for growth stocks."including New York Fed President John Williams last week underscored the U.S. central bank's determination to do what it takes to ease price pressures.

Still, money market participants are pricing in 65% chance of a 25 basis points rate hike in February to 4.5%-4.75%, with a terminal rate of 4.84% in May 2023. Economic data this week including housing starts, consumer confidence, weekly jobless claims and core personal consumption spending growth for November will set the investor mood, providing more clues on future rate hikes by the central bank.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Ford Spreads Gearhead Cheer with 500-HP Mustang Dark HorsePlus power upgrades for the regular GT and EcoBoost variants.

Ford Spreads Gearhead Cheer with 500-HP Mustang Dark HorsePlus power upgrades for the regular GT and EcoBoost variants.

Baca lebih lajut »

60,000 toys, 500 bikes given away as Children’s Christmas Party of Jacksonville returns after hiatusIt was the first time the event went on as planned since 2019 because of the COVID-19 pandemic. It has been 24 years of Jacksonville’s biggest one-day toy giveaway.

60,000 toys, 500 bikes given away as Children’s Christmas Party of Jacksonville returns after hiatusIt was the first time the event went on as planned since 2019 because of the COVID-19 pandemic. It has been 24 years of Jacksonville’s biggest one-day toy giveaway.

Baca lebih lajut »

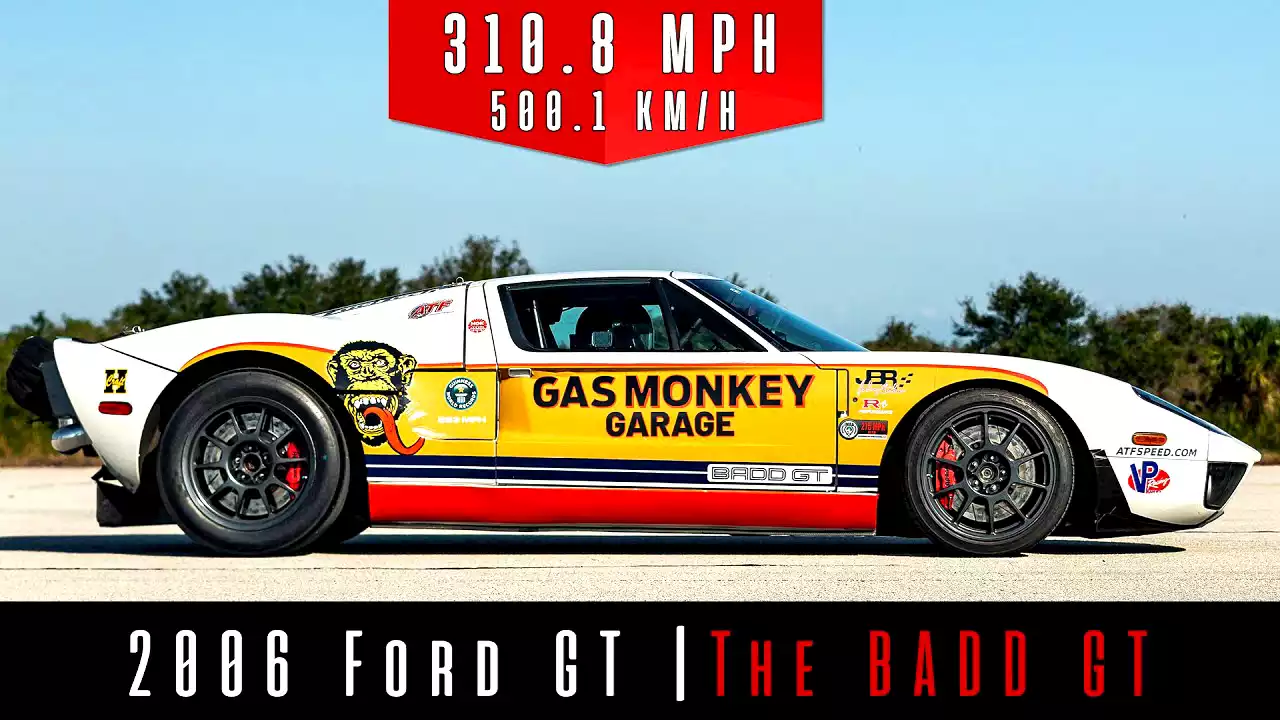

You Won't Believe How Easily This Ford GT Hits 310 MPH Or 500 km/h | CarscoopsYou Won't Believe How Easily This Ford GT Hits 310 MPH Or 500 km/h | Carscoops carscoops

You Won't Believe How Easily This Ford GT Hits 310 MPH Or 500 km/h | CarscoopsYou Won't Believe How Easily This Ford GT Hits 310 MPH Or 500 km/h | Carscoops carscoops

Baca lebih lajut »

Perspective | Why the Dow demolished the S&P 500 this yearJust half a dozen stocks have made most of the difference.

Perspective | Why the Dow demolished the S&P 500 this yearJust half a dozen stocks have made most of the difference.

Baca lebih lajut »

With the Fed out of the way, this is what could move the markets into year-endWith the Fed out of the way, this is what could move the markets into year-end. Here's the latest from BobPisani:

With the Fed out of the way, this is what could move the markets into year-endWith the Fed out of the way, this is what could move the markets into year-end. Here's the latest from BobPisani:

Baca lebih lajut »