Reserve Bank governor Philip Lowe: End of QE doesn't mean cash-rate rise imminent By ross_burland RBA AUDUSD CentralBanks

Reserve Bank of Australia governor Philip Lowe's speech on the economic outlook today to National Press Club is underway and can be followed and listened to live atLowe is speaking following yesterdays RBA interest rate decision and before the bank will release a full set of economic forecasts on Friday.Weathered economic storm better than expected. Optimistic about the country's prospects. Says achievement of our inflation, unemployment goals within sight.

"As the Board has stated previously, it will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range," RBA"While inflation has picked up, it is too early to conclude that it is sustainably within the target band." The dovish message sent the Aussie lower on the knee-jerk to 0.7033 though markets still think the RBA is behind the curve on inflation.AUD/USD Price Analysis: Bears are waiting to pounce from key higher time frame resistance structures

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Reserve Bank of Australia Makes Modestly Hawkish ShiftReserve Bank of Australia makes modestly hawkish shift Australia's economy appears to be on a sturdy upturn, with a rebound in activity and quickening of inflation in the final quarter of 2021.

Reserve Bank of Australia Makes Modestly Hawkish ShiftReserve Bank of Australia makes modestly hawkish shift Australia's economy appears to be on a sturdy upturn, with a rebound in activity and quickening of inflation in the final quarter of 2021.

Baca lebih lajut »

First National Bank celebrates a century in businessWATCH: First National Bank celebrated 100 years in business with fireworks and a celebration at Cuddy Park on Saturday night.

First National Bank celebrates a century in businessWATCH: First National Bank celebrated 100 years in business with fireworks and a celebration at Cuddy Park on Saturday night.

Baca lebih lajut »

Central Bank of Jordan Exploring the Possibility of Launching a CBDC – Fintech Bitcoin NewsThe governor hinted that the Central Bank of Jordan (CBJ) might eventually allow crypto trading once the appropriate regulatory framework is in place. cryptotrading regulation centralbank

Central Bank of Jordan Exploring the Possibility of Launching a CBDC – Fintech Bitcoin NewsThe governor hinted that the Central Bank of Jordan (CBJ) might eventually allow crypto trading once the appropriate regulatory framework is in place. cryptotrading regulation centralbank

Baca lebih lajut »

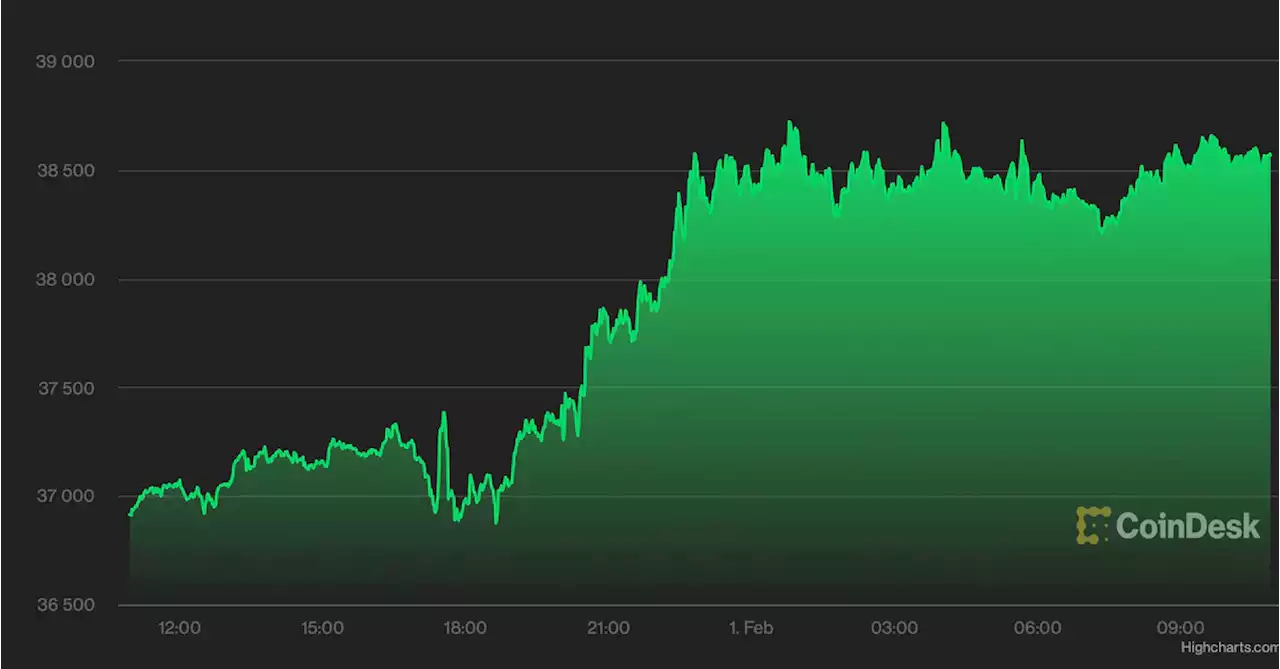

Bitcoin Steady Near $38.5K as Australian Central Bank Ends Easing ProgramBitcoin keeps overnight gains as Australia's central bank scraps liquidity-boosting bond purchases. reports godbole17

Bitcoin Steady Near $38.5K as Australian Central Bank Ends Easing ProgramBitcoin keeps overnight gains as Australia's central bank scraps liquidity-boosting bond purchases. reports godbole17

Baca lebih lajut »

Nigerian Crypto Firm Executive: Central Bank Prohibition Led to Growth in Crypto Awareness – Featured Bitcoin NewsRotimi Ogunwede insisted the growth in cryptocurrency knowledge levels shows that Nigerians are against the CBN’s tough policies. cryptocurrency centralbank adoption

Nigerian Crypto Firm Executive: Central Bank Prohibition Led to Growth in Crypto Awareness – Featured Bitcoin NewsRotimi Ogunwede insisted the growth in cryptocurrency knowledge levels shows that Nigerians are against the CBN’s tough policies. cryptocurrency centralbank adoption

Baca lebih lajut »

Bank of England Expected to Impose Back-To-Back Rate Hikes for the First Time Since 2004Economists expect the Bank of England to hike interest rates consecutively for the first time since 2004 as it looks to steer the U.K. economy through persistent high inflation.

Bank of England Expected to Impose Back-To-Back Rate Hikes for the First Time Since 2004Economists expect the Bank of England to hike interest rates consecutively for the first time since 2004 as it looks to steer the U.K. economy through persistent high inflation.

Baca lebih lajut »