Pound Sterling back above 1.2500 in run up to Fed Interest Rate Decision GBPUSD Technical Analysis Fundamental Analysis

From a technical perspective, GBP/USD continues to trade in a range within a broader bullish trend which began ever since the printing of the September lows. Longs are, therefore, favored over shorts. Market expectations have crystallized for a 25 bps interest rate hike by the Federal Reserve at its FOMC meeting on Wednesday. data, the probabilities for a quarter percent hike now stand at 87% – slightly down from Tuesday’s 97% but still relatively high.

The US Dollar may see fluctuations depending on the tone of the Fed’s accompanying policy statement, especially if it suggests May’s hike is a ‘one and done’. This suggests the Bank of England is far from done with hiking interest rates in the UK, and may have to hike more than once to get inflation back under control. If so, this is a medium-term bullish factor for Pound Sterling.

The pattern was followed by a bearish day on Tuesday, May 2 and dependent on other factors such as the outcome of the FOMC meeting, could signal further downside. Two-bar reversals, however, are only very short-term bearish signals.Given the dominant trend remains bullish-to-sideways, however, pressure to the upside is likely to re-emerge eventually, and could see the price recover and rally before breaking to fresh highs.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.Information on these pages contains forward-looking statements that involve risks and uncertainties.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Pound Sterling pulls back after US bank rescue seals Fed rate hikeThe Pound Sterling (GBP) continues bleeding against the US Dollar (USD) during the European session on Tuesday, as USD gains support from the news of

Pound Sterling pulls back after US bank rescue seals Fed rate hikeThe Pound Sterling (GBP) continues bleeding against the US Dollar (USD) during the European session on Tuesday, as USD gains support from the news of

Baca lebih lajut »

Scientists Study the Secrets of 2,500-Year-Old Mummified AnimalsProviding insight into the practice of animal mummification in Egypt, the research also reveals the potential of a new technique for assessing ancient artifacts.

Scientists Study the Secrets of 2,500-Year-Old Mummified AnimalsProviding insight into the practice of animal mummification in Egypt, the research also reveals the potential of a new technique for assessing ancient artifacts.

Baca lebih lajut »

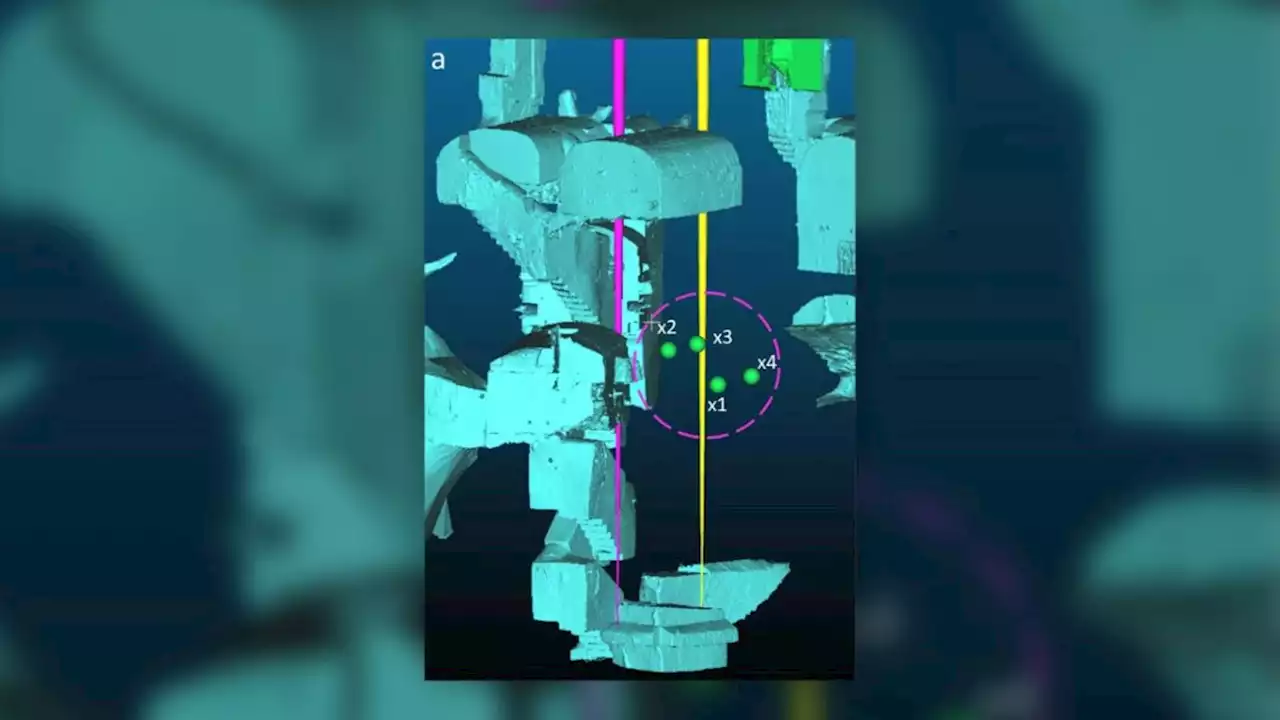

Cosmic rays reveal 2,500-year-old subterranean burial in ancient Greek necropolisCosmic rays have revealed an underground Greek tomb in Naples, Italy.

Cosmic rays reveal 2,500-year-old subterranean burial in ancient Greek necropolisCosmic rays have revealed an underground Greek tomb in Naples, Italy.

Baca lebih lajut »

NZD/USD refreshes day’s high above 0.6220 on upbeat Employment data, Fed policy eyedThe NZD/USD pair has scaled above the critical resistance of 0.6220 as Statz NZ has reported better-than-projected Employment data (Q1). The Employmen

NZD/USD refreshes day’s high above 0.6220 on upbeat Employment data, Fed policy eyedThe NZD/USD pair has scaled above the critical resistance of 0.6220 as Statz NZ has reported better-than-projected Employment data (Q1). The Employmen

Baca lebih lajut »

USD/CAD Price Analysis: Confidently established above 1.3600 as oil prices nosedive, Fed policy in focusUSD/CAD Price Analysis: Confidently established above 1.3600 as oil prices nosedive, Fed policy in focus USDCAD Fed Oil SupportResistance DollarIndex

USD/CAD Price Analysis: Confidently established above 1.3600 as oil prices nosedive, Fed policy in focusUSD/CAD Price Analysis: Confidently established above 1.3600 as oil prices nosedive, Fed policy in focus USDCAD Fed Oil SupportResistance DollarIndex

Baca lebih lajut »

AUD/USD Price Analysis: Bullish above 0.6650 amid firmer Aussie Retail Sales, pre-Fed USD fallAUD/USD Price Analysis: Bullish above 0.6650 amid firmer Aussie Retail Sales, pre-Fed USD fall AUDUSD Technical Analysis Fed RetailSales ChartPatterns

AUD/USD Price Analysis: Bullish above 0.6650 amid firmer Aussie Retail Sales, pre-Fed USD fallAUD/USD Price Analysis: Bullish above 0.6650 amid firmer Aussie Retail Sales, pre-Fed USD fall AUDUSD Technical Analysis Fed RetailSales ChartPatterns

Baca lebih lajut »