.profgalloway explains that the middle class can only thrive when the government invests in it: “And the only way you support it is with taxes. And the only way you have an effective democracy is through a progressive tax system.” Listen to PivotPod:

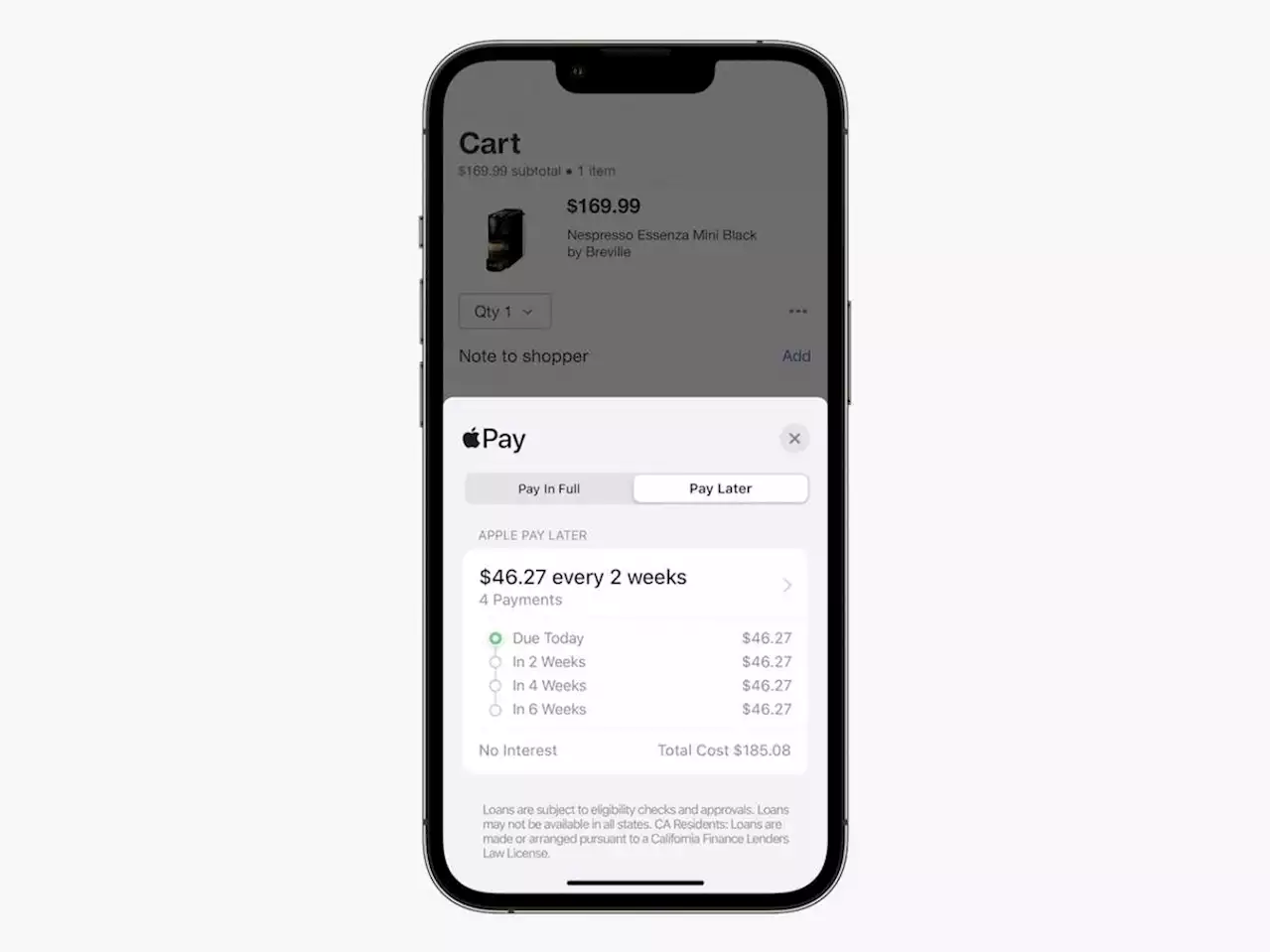

Kara and Scott discuss Apple getting into the Buy-Now-Pay-Later game, and Texas announcing an investigation into the number of bots on Twitter. Also, Buzzfeed shares took a major tumble. Then, a listener question on whether ethical billionaires exist.Learn more about your ad choices. Visit podcastchoices.

com/adchoicesKara and Scott discuss Apple getting into the Buy-Now-Pay-Later game, and Texas announcing an investigation into the number of bots on Twitter. Also, Buzzfeed shares took a major tumble. Then, a listener question on whether ethical billionaires exist.Learn more about your ad choices. Visit podcastchoices.com/adchoices

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Pucci names new CEO in pivot to see-now, buy-nowItalian fashion label Emilio Pucci has appointed a new CEO, Saar Debrouwere.

Pucci names new CEO in pivot to see-now, buy-nowItalian fashion label Emilio Pucci has appointed a new CEO, Saar Debrouwere.

Baca lebih lajut »

Apple’s kind of a bank nowApple Financing is handling the new Pay Later service.

Apple’s kind of a bank nowApple Financing is handling the new Pay Later service.

Baca lebih lajut »

‘Buy Now, Pay Later' Firms Were Already in Trouble. Apple Just Gave Them One More Thing to Worry AboutApple’s move into the crowded “buy now, pay later” space has raised the stakes for the fintech companies that pioneered the trend.

‘Buy Now, Pay Later' Firms Were Already in Trouble. Apple Just Gave Them One More Thing to Worry AboutApple’s move into the crowded “buy now, pay later” space has raised the stakes for the fintech companies that pioneered the trend.

Baca lebih lajut »

Apple created a subsidiary to handle Pay Later loans | EngadgetWhen its Pay Later service launches alongside iOS 16 later this year, Apple plans to handle lending decisions on its own..

Apple created a subsidiary to handle Pay Later loans | EngadgetWhen its Pay Later service launches alongside iOS 16 later this year, Apple plans to handle lending decisions on its own..

Baca lebih lajut »

The ugly economics behind Apple’s new Pay Later systemApple’s BNPL service is at odds with the brand’s image.

The ugly economics behind Apple’s new Pay Later systemApple’s BNPL service is at odds with the brand’s image.

Baca lebih lajut »

Breakingviews - Apple pay-later foray blurs tech-finance boundaryTim Cook has crossed the banking divide. Big U.S. tech firms have so far largely kept out of the lending business. But on Monday Apple’s chief executive unveiled plans to use the $2.4 trillion company’s balance sheet to offer “buy now, pay later” loans to iPhone users. The push into financial services will keep traditional banks on their toes.

Breakingviews - Apple pay-later foray blurs tech-finance boundaryTim Cook has crossed the banking divide. Big U.S. tech firms have so far largely kept out of the lending business. But on Monday Apple’s chief executive unveiled plans to use the $2.4 trillion company’s balance sheet to offer “buy now, pay later” loans to iPhone users. The push into financial services will keep traditional banks on their toes.

Baca lebih lajut »