Banks in the Asia-Pacific region, including ones in the Philippines, are resilient to risks that characterized the failure of two large financial institutions in the United States, mainly as authorities are expected to support Asian banks if needed. /PDI

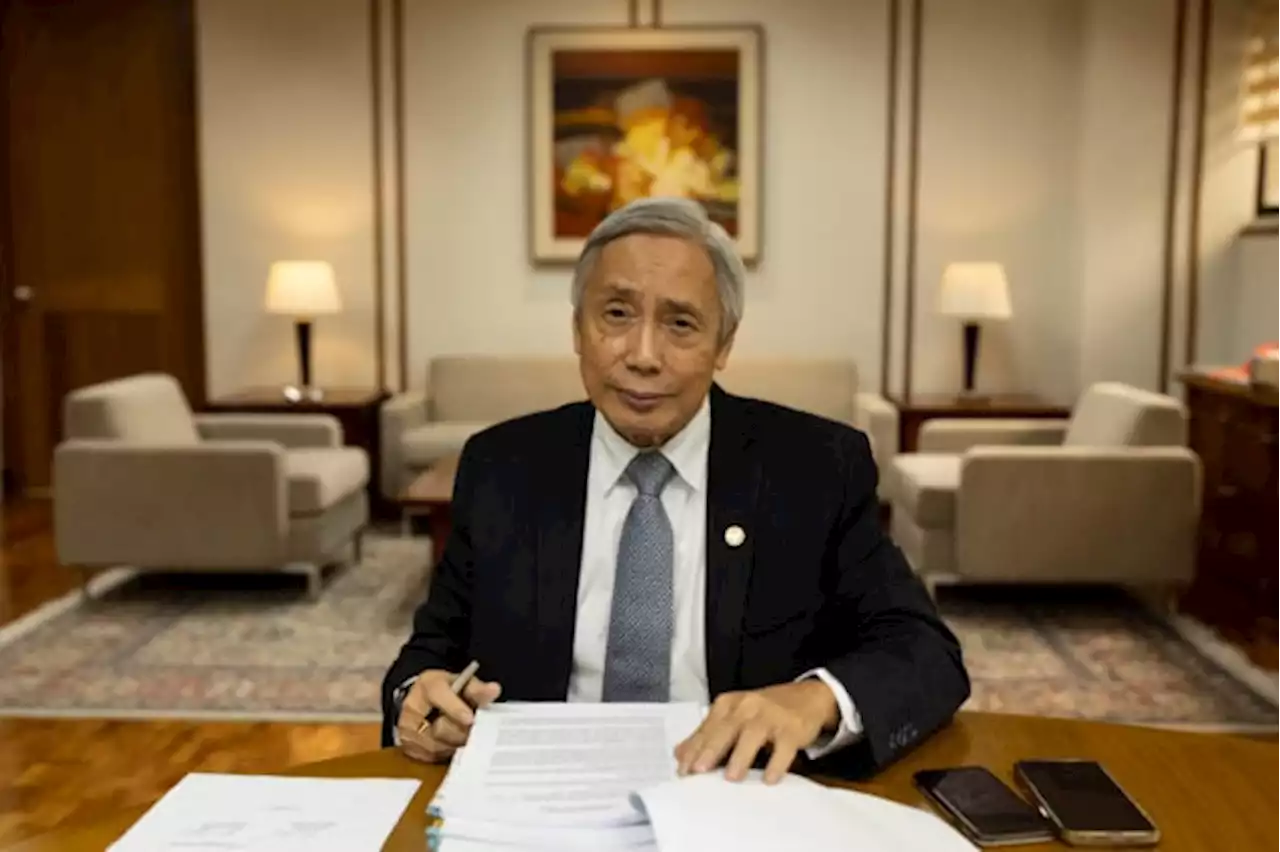

Medalla said the BSP recognizes the actions taken by banking supervisory authorities to address the potential contagion risk from the closure of banks.

“Nonetheless, we will respond accordingly as market conditions evolve,” he added. “We reiterate our earlier statement that our banks do not have any material exposure to the failed institutions.” The BSP chief said the central bank’s longstanding efforts, in consultation with the industry, in setting prudent standards and executing risk practices “remain the key pillar in safeguarding the interests of the Filipino people.”

A statement from Fitch Ratings bolsters the BSP’s assurance as the credit watchdog said that among Asia-Pacific banks that it is rating, direct exposures to Silicon Valley Bank and Signature Bank appear limited.For banks that do have direct exposures to SVB and Signature, Fitch Ratings said these were not material to credit profiles.

“Weaknesses that contributed to the failure of the two banks are among the factors already considered in our rating assessments for [Asia-Pacific] banks, but these are often offset by structural factors, such as regulation and our expectations that authorities would provide liquidity support if needed,” the group said.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

CAAP inks partnership with PUP to improve training programs, support for personnelMANILA, Philippines — The Civil Aviation Authority of the Philippines (CAAP) has signed a partnership with the Polytechnic University of the Philippines (PUP) to improve training programs

CAAP inks partnership with PUP to improve training programs, support for personnelMANILA, Philippines — The Civil Aviation Authority of the Philippines (CAAP) has signed a partnership with the Polytechnic University of the Philippines (PUP) to improve training programs

Baca lebih lajut »

Large U.S. banks view Credit Suisse exposure as manageable, say sourcesLarge U.S. banks have managed their exposure to Credit Suisse in recent months and view risks from the lender as contained so far, according to three industry sources who declined to be identified because of the sensitivity of the situation. | Reuters

Large U.S. banks view Credit Suisse exposure as manageable, say sourcesLarge U.S. banks have managed their exposure to Credit Suisse in recent months and view risks from the lender as contained so far, according to three industry sources who declined to be identified because of the sensitivity of the situation. | Reuters

Baca lebih lajut »

DOF: ‘US banks’ failure won’t hurt local economy | Jasper Y. ArcalasFINANCE Secretary Benjamin E. Diokno assured the public on Wednesday that the concerns and challenges faced by the US banking system following the collapse of the Silicon Valley Bank (SVB) would not harm the Philippine economy. In a message to reporters, Diokno said the Philippine banking system remains “sound” and…

DOF: ‘US banks’ failure won’t hurt local economy | Jasper Y. ArcalasFINANCE Secretary Benjamin E. Diokno assured the public on Wednesday that the concerns and challenges faced by the US banking system following the collapse of the Silicon Valley Bank (SVB) would not harm the Philippine economy. In a message to reporters, Diokno said the Philippine banking system remains “sound” and…

Baca lebih lajut »

S&P says SVB fallout won’t lead to rating actions on APAC banksChinese search engine giant Baidu unveiled its much-anticipated artificial intelligence-powered chatbot known as Ernie Bot, giving the world a glimpse of what could be China’s strongest rival to U.S. research lab OpenAI’s ChatGPT. | Reuters

S&P says SVB fallout won’t lead to rating actions on APAC banksChinese search engine giant Baidu unveiled its much-anticipated artificial intelligence-powered chatbot known as Ernie Bot, giving the world a glimpse of what could be China’s strongest rival to U.S. research lab OpenAI’s ChatGPT. | Reuters

Baca lebih lajut »

Major US banks inject $30 billion to rescue First Republic BankSome of the biggest US banking names including JPMorgan, Citigroup, Bank of America, Wells Fargo, Goldman Sachs, and Morgan Stanley prop up support for First Republic Bank after the regional lender's stock plunge.

Major US banks inject $30 billion to rescue First Republic BankSome of the biggest US banking names including JPMorgan, Citigroup, Bank of America, Wells Fargo, Goldman Sachs, and Morgan Stanley prop up support for First Republic Bank after the regional lender's stock plunge.

Baca lebih lajut »

Philippine banks safe and sound, BSP reiteratesThe Philippine banking system remains safe and sound despite a debacle in the United States that sent waves of concern whether this will spread to other markets, the Bangko Sentral ng Pilipinas reiterated. | RonWDomingoINQ /PDI

Philippine banks safe and sound, BSP reiteratesThe Philippine banking system remains safe and sound despite a debacle in the United States that sent waves of concern whether this will spread to other markets, the Bangko Sentral ng Pilipinas reiterated. | RonWDomingoINQ /PDI

Baca lebih lajut »