Europe to bear greatest costs while inflation fight in U.S. gets tougher.

China, the world’s largest oil importer, will probably strain to reach this year’s economic growth target while developing countries in North Africa and the Middle East confront the danger of social unrest over rising energy and food costs, economists said.

Still, Capital Economics says it would take oil prices of $200-plus to trigger a U.S. recession. One reason is that U.S. households together have an ample $2.5 trillion savings cushion, dwarfing the estimated $150 billion to $200 billion cost to consumers of higher pump prices, said Ian Shepherdson, chief economist of Pantheon Macroeconomics.Though Russia accounts for just 2 percent of the world economy, it is a major player in global energy markets.

Predicting the future of Russian oil sales — and global prices — is especially hazardous. If U.S. allies in Europe overcome their economic worries and agree to a complete embargo on Russian energy, oil prices could hit $160 a barrel, according to Capital Economics. Bjornar Tonhaugen, an analyst with Oslo-based Rystad Energy, told clients this week that oil could hit $240 this summer in a worst-case scenario, according to a Bloomberg report.

Some private assessments are gloomier. Goldman Sachs said Thursday that euro-zone output will shrink in the second quarter. Eric Winograd, a senior economist at AllianceBernstein, puts recession chances at better than 50 percent. Others see higher energy costs pushing Europe perilously close to the brink.“Maybe growth is not negative, but it kind of kills the bounce back from covid,” said Sergi Lanau, deputy chief economist of the Institute of International Finance.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

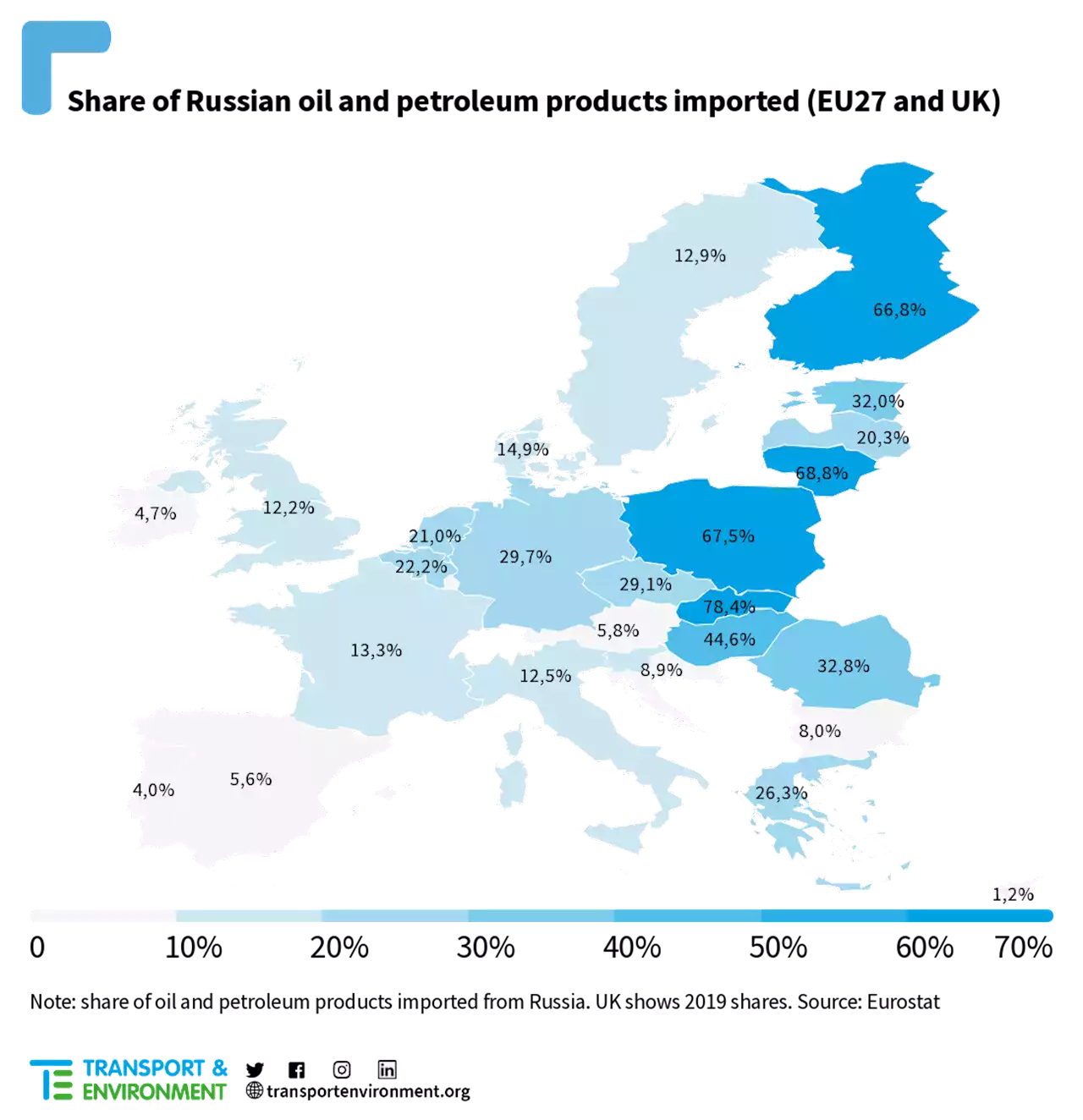

Where Russian Oil Goes In EuropeT&E's analysis of imports, dependency, trade value, ports and pipelines. Transport is the largest consumer of oil in the EU, and the EU is dependent on imports for 97% of its oil products. One out

Where Russian Oil Goes In EuropeT&E's analysis of imports, dependency, trade value, ports and pipelines. Transport is the largest consumer of oil in the EU, and the EU is dependent on imports for 97% of its oil products. One out

Baca lebih lajut »

The Russian oil ban should be a pivot point - away from oil | EditorialWe can't drill our way out of conflicts with petrostate goons. Make them irrelevant.

The Russian oil ban should be a pivot point - away from oil | EditorialWe can't drill our way out of conflicts with petrostate goons. Make them irrelevant.

Baca lebih lajut »

High Oil Prices Will Reduce Oil DemandWith oil prices threatening to hit new records, it is hoped that lower demand will help bring the market back into balance

High Oil Prices Will Reduce Oil DemandWith oil prices threatening to hit new records, it is hoped that lower demand will help bring the market back into balance

Baca lebih lajut »

First sign of oil price relief: UAE says it wants OPEC to increase productionThe oil market has been stretched incredibly thin, with few producers willing — or able — to replace Russian barrels banned by the United States and shunned by others. Enter the United Arab Emirates, which suggested it may be coming to the rescue.

First sign of oil price relief: UAE says it wants OPEC to increase productionThe oil market has been stretched incredibly thin, with few producers willing — or able — to replace Russian barrels banned by the United States and shunned by others. Enter the United Arab Emirates, which suggested it may be coming to the rescue.

Baca lebih lajut »

Progressives Denounce Big Oil for 'Shamelessly' Price-Gouging Amid Ukraine War\u0022Now more than ever, we can see why it is so essential to double down on our transition to renewable energy,\u0022 said Reps. Pramila Jayapal and Barbara Lee.

Progressives Denounce Big Oil for 'Shamelessly' Price-Gouging Amid Ukraine War\u0022Now more than ever, we can see why it is so essential to double down on our transition to renewable energy,\u0022 said Reps. Pramila Jayapal and Barbara Lee.

Baca lebih lajut »