Taxpayers need to prepare to report transactions exceeding $600 that are received through Venmo, PayPal and other cash apps to the IRS starting in 2023.

Sen. Mike Braun, R-Ind., explains the details regarding the IRS starting to send out 1099-K forms for some payments on ‘Fox Business Tonight.’

Third-party payment processors will now be required to report a user's business transactions to the IRS if they exceed $600 for the year. The payment apps were previously required to send users Form 1099-K if their gross income exceeded $20,000 or they had 200 separate transactions within a calendar year."I think it will come as a shock out of nowhere that people are getting these," Nancy Dollar, a tax lawyer at Hanson Bridgett, told FOX Business.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

'Tripledemic' of flu, COVID and RSV lead to new face mask recommendations in New York CityHealth officials are recommending New Yorkers wear face masks amid a 'tripledemic' of flu, COVID and RSV cases. Christinafantv reports.

'Tripledemic' of flu, COVID and RSV lead to new face mask recommendations in New York CityHealth officials are recommending New Yorkers wear face masks amid a 'tripledemic' of flu, COVID and RSV cases. Christinafantv reports.

Baca lebih lajut »

Trigun Creator Releases New Art That Features Old And New VashTrigun Stampede will arrive on January 7th of next year, presenting a different version of Vash [...]

Trigun Creator Releases New Art That Features Old And New VashTrigun Stampede will arrive on January 7th of next year, presenting a different version of Vash [...]

Baca lebih lajut »

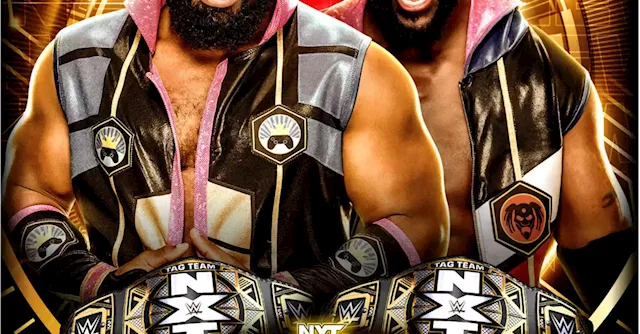

The New Day Defeats Pretty Deadly: New NXT Tag Team ChampionsTheNewDay (XavierWoods and KofiKingston) defeated PrettyDeadly (EltonPrince and KitWilson) at WWE's NXTDeadline to become the new NXT Tag Team Champions.

The New Day Defeats Pretty Deadly: New NXT Tag Team ChampionsTheNewDay (XavierWoods and KofiKingston) defeated PrettyDeadly (EltonPrince and KitWilson) at WWE's NXTDeadline to become the new NXT Tag Team Champions.

Baca lebih lajut »

NY law will allow buyers to redeem low-balance gift cards for cash, prevent cards from expiringA new law will help New York shoppers spend those leftover funds on gift cards.

NY law will allow buyers to redeem low-balance gift cards for cash, prevent cards from expiringA new law will help New York shoppers spend those leftover funds on gift cards.

Baca lebih lajut »

Lee Lorenz, New Yorker cartoonist who cultivated new talent, dies at 90As an editor for nearly 25 years, Mr. Lorenz brought more than 50 new cartoonists onto the New Yorker pages including Roz Chast and Bob Mankoff.

Lee Lorenz, New Yorker cartoonist who cultivated new talent, dies at 90As an editor for nearly 25 years, Mr. Lorenz brought more than 50 new cartoonists onto the New Yorker pages including Roz Chast and Bob Mankoff.

Baca lebih lajut »

The IRS Versus The Clumsy TaxpayerThe penalty for fairly innocent goofs can run into the millions of dollars. Just ask 82-year-old Monica Toth, who the IRS sent a bill to for $2.2 million. Read more:

The IRS Versus The Clumsy TaxpayerThe penalty for fairly innocent goofs can run into the millions of dollars. Just ask 82-year-old Monica Toth, who the IRS sent a bill to for $2.2 million. Read more:

Baca lebih lajut »