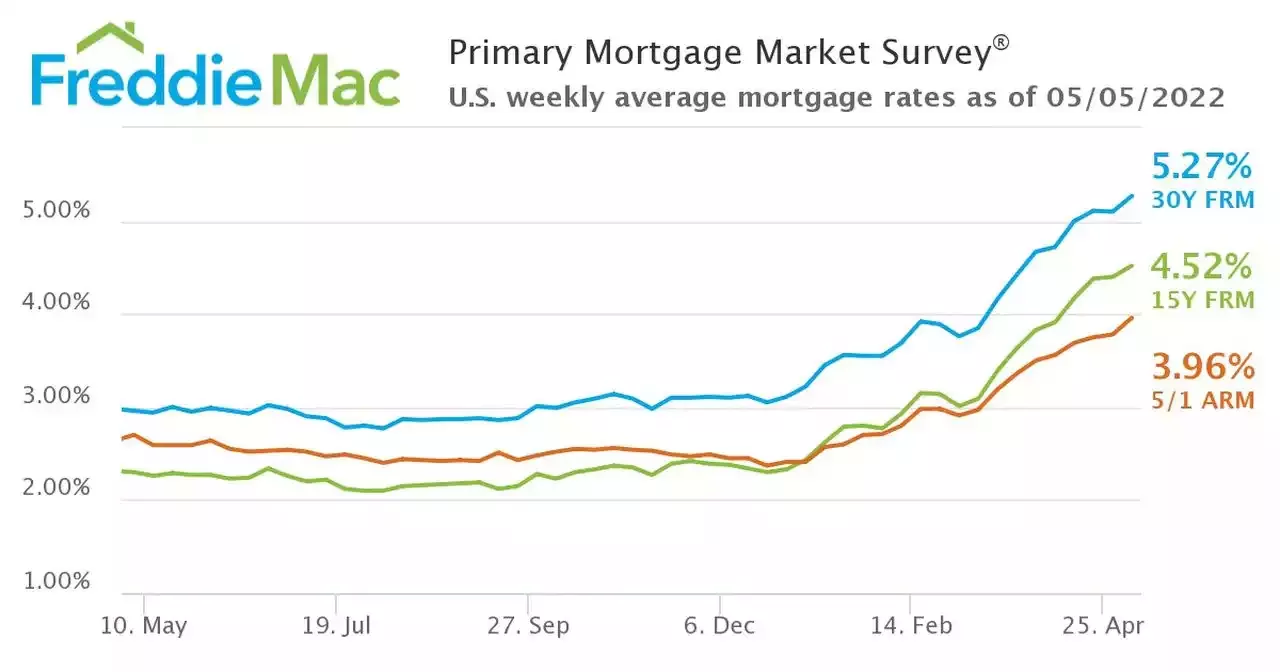

Mortgage rates are rising further and banks are adjusting after the Federal Reserve’s most aggressive rate hike since 2000.

CLEVELAND, Ohio — The side effect could be less buying power for people seeking homes.was 5.27% Thursday, up from 5.10% last week and up from 2.96% a year ago, according to Freddie Mac, a government-sponsored home-loan agency.“Mortgage rates resumed their climb this week as the 30-year fixed reached its highest point since 2009,” said Sam Khater, Freddie Mac’s Chief Economist.

At the 2.96% rate seen a year ago, the same payment would have been $629. These numbers don’t include property taxes, home insurance or other home buying costs factored into monthly payments. The Federal Reserve sets the rate that institutions charge each other for short-term loans. That cost trickles across the economy and affects mortgages, CD rates, personal loans and other types of lending.

The Federal Reserve increased rates in March, and are expected to raise rates multiple times to combat inflation. In a news release, PNC chief economist Gus Faucher said rates will likely increase through 2022 and into 2023.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

The Federal Reserve is raising interest rates into a ‘slowing economy,' says expertOxbow Advisors managing partner Ted Oakley discusses the Federal Reserve’s half-point rate hike.

The Federal Reserve is raising interest rates into a ‘slowing economy,' says expertOxbow Advisors managing partner Ted Oakley discusses the Federal Reserve’s half-point rate hike.

Baca lebih lajut »

'The pandemic boom in home sales is over’: Mortgage rates soar to highest level since 2009 as the Fed pressures the housing market‘The pandemic boom in home sales is over’: Mortgage rates soar to highest level since 2009 as the Fed pressures the housing market

'The pandemic boom in home sales is over’: Mortgage rates soar to highest level since 2009 as the Fed pressures the housing market‘The pandemic boom in home sales is over’: Mortgage rates soar to highest level since 2009 as the Fed pressures the housing market

Baca lebih lajut »

Fed raises key rate by a half-point in bid to tame inflationBREAKING: The Federal Reserve intensified its drive to curb the worst inflation in 40 years by raising its benchmark short-term interest rate by a sizable half-percentage point — its largest in 22 years.

Fed raises key rate by a half-point in bid to tame inflationBREAKING: The Federal Reserve intensified its drive to curb the worst inflation in 40 years by raising its benchmark short-term interest rate by a sizable half-percentage point — its largest in 22 years.

Baca lebih lajut »

Fed Raises Rates by Half a Percentage Point — the Biggest Hike in Two Decades — to Fight InflationWednesday’s rate hike will push the federal funds rate to a range of 0.75%-1%.

Fed Raises Rates by Half a Percentage Point — the Biggest Hike in Two Decades — to Fight InflationWednesday’s rate hike will push the federal funds rate to a range of 0.75%-1%.

Baca lebih lajut »

EUR/USD eyes 1.0650 on fresh blood infusion as Fed fades 75 bps oddsThe EUR/USD pair has witnessed a juggernaut upside move after the Federal Reserve (Fed) feature a rate hike by 50 basis points in the New York session

EUR/USD eyes 1.0650 on fresh blood infusion as Fed fades 75 bps oddsThe EUR/USD pair has witnessed a juggernaut upside move after the Federal Reserve (Fed) feature a rate hike by 50 basis points in the New York session

Baca lebih lajut »