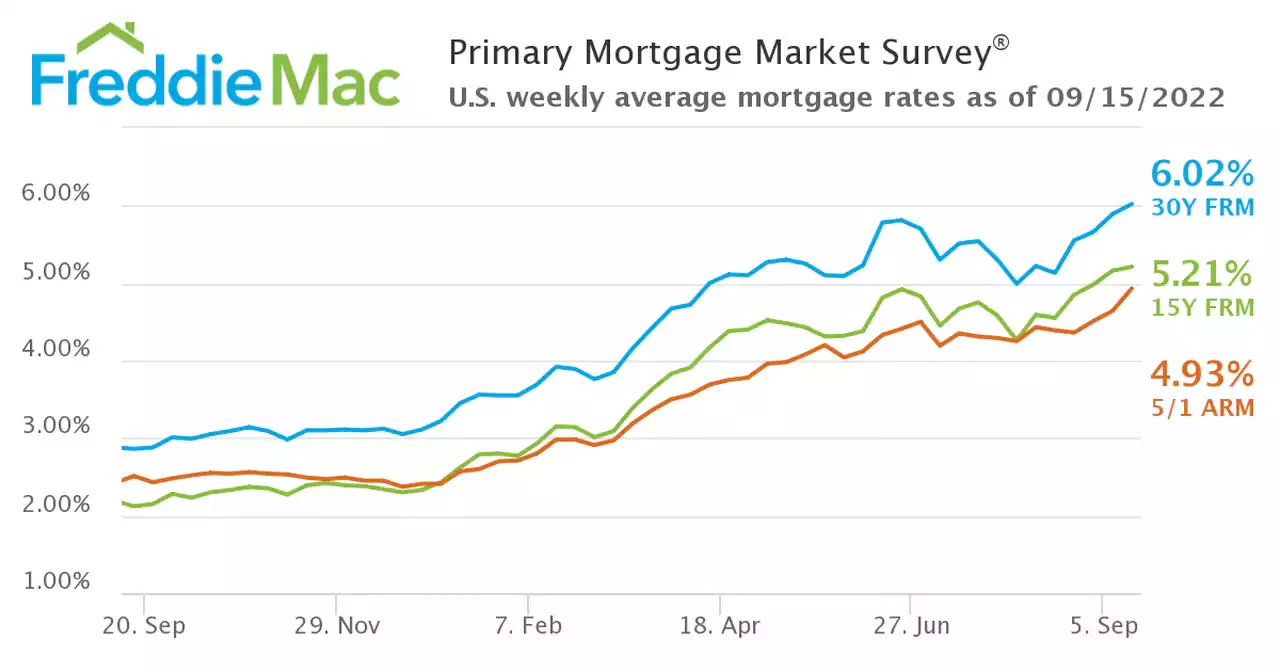

The jump in mortgage rates means if someone purchased a million dollar home now compared to January 1, they would be paying $1,400 more a month in interest.

Meanwhile, there is still a lack of inventory, especially in the Bay Area.

San Jose's housing crisis is the worst of any major United States city due to its low inventory, according to the latest survey from the internet services company ANGI. The San Jose metro area has 20% fewer homes on the market compared to last year. San Francisco comes in third on the list. "Buyers are often expecting that the prices are going to drop whenever the interest rates go up, but historically if you look at the last seven times interest rates went up, prices still went up," Jamison said."We're actually into a period where consumers are able to buy properties with contingencies," said Brett Caviness, Silicon Valley Association of Realtors president."Early this spring it was common to see 15 to 20 offers per property.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Mortgage rates climb above 6%, first time since 2008The average interest rate for a 30-year fixed mortgage is now about 6% for the first time since the financial crisis, more than double what it was a year ago.

Mortgage rates climb above 6%, first time since 2008The average interest rate for a 30-year fixed mortgage is now about 6% for the first time since the financial crisis, more than double what it was a year ago.

Baca lebih lajut »

30-year mortgage rates top 6% for first time since 2008Less than a year removed from historically low interest, the average rate on a 30-year fixed rate mortgage nationally is now higher than its been since 2008.

30-year mortgage rates top 6% for first time since 2008Less than a year removed from historically low interest, the average rate on a 30-year fixed rate mortgage nationally is now higher than its been since 2008.

Baca lebih lajut »

Mortgage rates rise above 6% for the first time since 2008The average 30-year mortgage rate has climbed to 6.02% — the first time the figure has surpassed 6% since 2008, according to new data from mortgage giant Freddie Mac.

Mortgage rates rise above 6% for the first time since 2008The average 30-year mortgage rate has climbed to 6.02% — the first time the figure has surpassed 6% since 2008, according to new data from mortgage giant Freddie Mac.

Baca lebih lajut »

Mortgage rates top 6% for the first time since 2008 | CNN BusinessMortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Mortgage rates top 6% for the first time since 2008 | CNN BusinessMortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Baca lebih lajut »

Mortgage rates top 6% for the first time since 2008Mortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Mortgage rates top 6% for the first time since 2008Mortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Baca lebih lajut »