A supply storm is merging with brewing demand problems.

Lithium stocks are taking it on the chin Monday. A U.S. semiconductor maker, a Japanese battery maker, and a Chinese miner are why. Bottom line:

The problems start with ON Semiconductor , a U.S. supplier of chips for car makers. An EV contains about 14 times more ON-type chip content compared with a traditional vehicle, according to the company. Monday, ON said fourth-quarter sales would amount to about $2 billion. Wall Street was looking for $2.2 billion. Shares were down 18.% in midday trading.

The sales forecast in the company’s energy division, which includes batteries and other products, was cut by about 15% to about $5.9 billion. Panasonic blamed weakening demand for “high-end EVs” and weak consumer and industrial demand. High-end EVs typically have more expensive batteries. Auto makers, including Tesla, have been shifting to lower-priced batteries to save costs which is compounding Panasonic’s problem.

It all adds up to weakening EV demand, which is bad for a host of stocks, including lithium miners. Tesla stock is down 4.6% at $197.75 in midday trading. Rivian Automotive shares are down 2% at $15.68 apiece.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Hong Kong stocks climb for second day as Japanese stocks dropSupported by world-class markets data from Dow Jones and FactSet, and partnering with Automated Insights, MarketWatch Automation brings you the latest, most pertinent content at record speed and with unparalleled accuracy.

Hong Kong stocks climb for second day as Japanese stocks dropSupported by world-class markets data from Dow Jones and FactSet, and partnering with Automated Insights, MarketWatch Automation brings you the latest, most pertinent content at record speed and with unparalleled accuracy.

Baca lebih lajut »

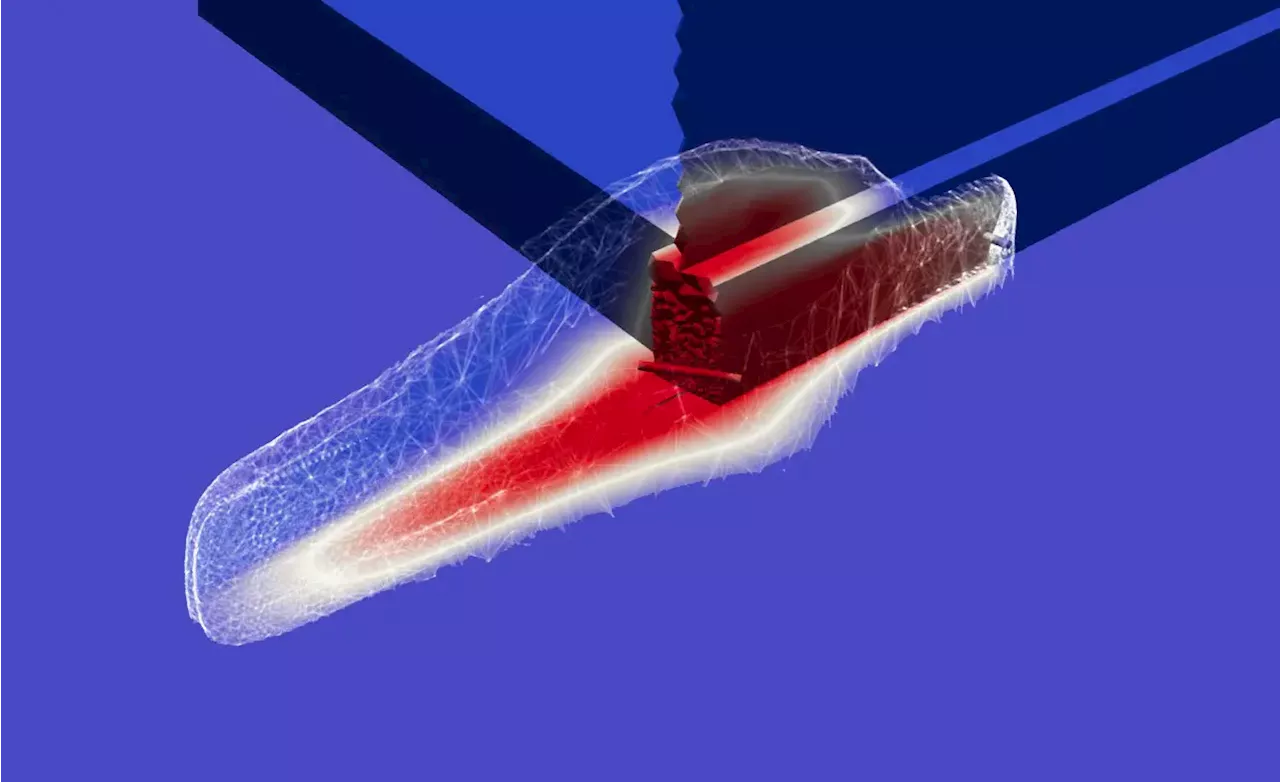

Lithium Goldmine: Sustainable Geothermal Extraction for Many DecadesScience, Space and Technology News 2023

Lithium Goldmine: Sustainable Geothermal Extraction for Many DecadesScience, Space and Technology News 2023

Baca lebih lajut »

Exxon sees 'promising' future for lithium in Arkansas, CEO saysExxon Mobil has never talked specifically about its lithium plans, because they’re still in very early stages. But CEO Darren Woods is now sharing a few early details, after analysts raised the question during a conference call Friday to discuss the company’s third-quarter results.

Exxon sees 'promising' future for lithium in Arkansas, CEO saysExxon Mobil has never talked specifically about its lithium plans, because they’re still in very early stages. But CEO Darren Woods is now sharing a few early details, after analysts raised the question during a conference call Friday to discuss the company’s third-quarter results.

Baca lebih lajut »

Lithium dividends help drive IGO free cash flowDespite a weaker performance from the nickel operations in Western Australia, IGO acting CEO Matt Dusci said the mining company had kicked off the 2024 financial year with a strong start, helped by dividends from its lithium business.

Lithium dividends help drive IGO free cash flowDespite a weaker performance from the nickel operations in Western Australia, IGO acting CEO Matt Dusci said the mining company had kicked off the 2024 financial year with a strong start, helped by dividends from its lithium business.

Baca lebih lajut »

Ora Banda inks $45m lithium JV with WesfarmersGold producer Ora Banda Mining on Monday announced a farm-in agreement with a subsidiary of Wesfarmers to sell a large portion of its mineral rights, other than gold, on the Davyhurst tenement package in a A$45-million deal. The announcement sent Ora Banda’s stock surging 19% to close at A$0.16 a share, just shy of its 52-week high of A$0.

Ora Banda inks $45m lithium JV with WesfarmersGold producer Ora Banda Mining on Monday announced a farm-in agreement with a subsidiary of Wesfarmers to sell a large portion of its mineral rights, other than gold, on the Davyhurst tenement package in a A$45-million deal. The announcement sent Ora Banda’s stock surging 19% to close at A$0.16 a share, just shy of its 52-week high of A$0.

Baca lebih lajut »