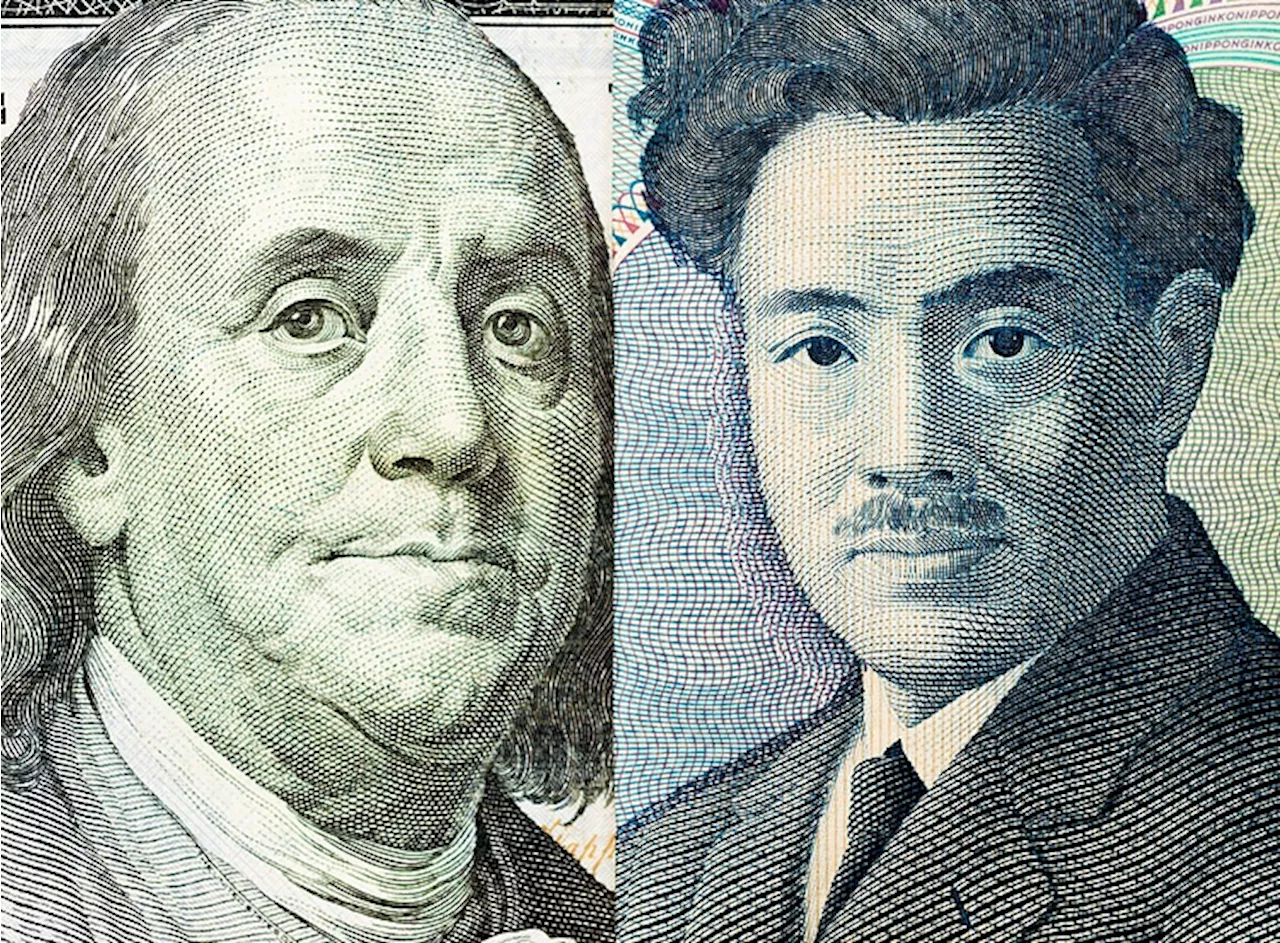

The Japanese Yen (JPY) gives ground against the US Dollar (USD) on Monday, with the USD/JPY pair coiling up below the key 150 level and threatening to

Japanese Yen continues giving ground against the US Dollar, with USD/JPY coiling up below 150 and threatening to break higher. Dovish comments from BoJ’s governor Ueda propelled the last push higher for USD/JPY. Intervention from Japanese authorities possible as key price and yield levels now approaching or touched. breakout higher as the dominant uptrend extends. Comments from Bank of Japan governor Katsuo Ueda fueled the recent rise in the pair.

The Fed’s preferred measure of inflation will carry the most significance when it is published on Thursday, October 27, along with Michigan Consumer Confidence. US Durable Goods Orders and GDP, out on Friday, October 28, may also impact the USD. USD/JPY is in an overall uptrend, rising on long-term, intermediate, and short-term bases. It is expected to continue this trend higher, with the next major target at the 152.00 highs achieved in October 2022.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

![Weekly forex analysis: EUR/USD, GBP/USD, AUD/USD and more [Video]](https://i.headtopics.com/images/2023/10/22/fxstreetnews/weekly-forex-analysis-eur-usd-gbp-usd-aud-usd-and--weekly-forex-analysis-eur-usd-gbp-usd-aud-usd-and--972D47259DE21523694E1CE3B91D095C.webp?w=640) Weekly forex analysis: EUR/USD, GBP/USD, AUD/USD and more [Video]Weekly forex forecast covers forecast on EUR/USD , GBP/USD , AUD/USD , NZD/USD , USD/CAD , USD/JPY / Gold (XAU/USD) , Bitcoin (BTC/USD) , S&P500 , Cru

Weekly forex analysis: EUR/USD, GBP/USD, AUD/USD and more [Video]Weekly forex forecast covers forecast on EUR/USD , GBP/USD , AUD/USD , NZD/USD , USD/CAD , USD/JPY / Gold (XAU/USD) , Bitcoin (BTC/USD) , S&P500 , Cru

Baca lebih lajut »

Japanese Yen Eyes New Lows as Markets Speculate on BoJ Action. Intervention Ahead?The Japanese Yen is facing scrutiny to start the week with USD/JPY edging toward prior peaks on growing unease around potential BoJ intervention. If USD/JPY pops, will the bank be selling?

Baca lebih lajut »

FX weekly — DXY and 14 currency pair levels and targetsEUR/USD this week is the most vital currency Vs USD as EUR/USD's direction determines the trade line up for the next month. EUR/USD remains oversold a

FX weekly — DXY and 14 currency pair levels and targetsEUR/USD this week is the most vital currency Vs USD as EUR/USD's direction determines the trade line up for the next month. EUR/USD remains oversold a

Baca lebih lajut »

Yen loiters around 150 as Middle East anxiety heightensYen loiters around 150 as Middle East anxiety heightens

Yen loiters around 150 as Middle East anxiety heightensYen loiters around 150 as Middle East anxiety heightens

Baca lebih lajut »

EUR/USD could retrace to 1.05 if bond differentials take the upper hand againThe resilience of EUR/USD was one of the main stories in G10 FX last week. Economists at Société Générale analyze the pair’s outlook. It is too soon t

EUR/USD could retrace to 1.05 if bond differentials take the upper hand againThe resilience of EUR/USD was one of the main stories in G10 FX last week. Economists at Société Générale analyze the pair’s outlook. It is too soon t

Baca lebih lajut »

USD/CAD hovers above 1.3700 major level after trimming intraday lossesUSD/CAD retraces intraday losses, trading around 1.3710 during the European session on Monday. The pair gains ground as the US Dollar treads waters to

USD/CAD hovers above 1.3700 major level after trimming intraday lossesUSD/CAD retraces intraday losses, trading around 1.3710 during the European session on Monday. The pair gains ground as the US Dollar treads waters to

Baca lebih lajut »