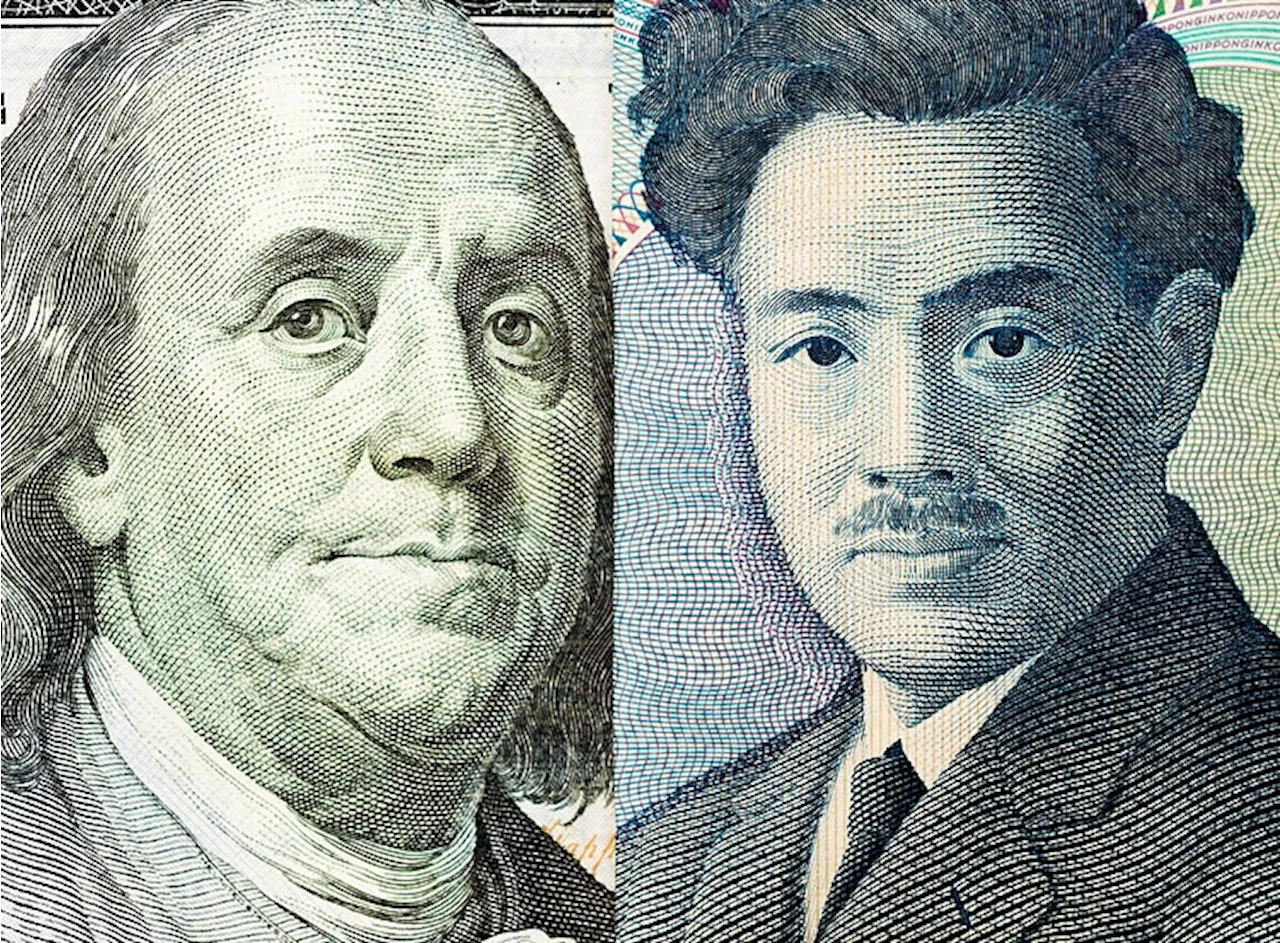

Dovish comments from Fed officials coupled with the violence in Israel and Gaza have put a lid on US Treasury yields, boosting JPY. What is the outlook and what are the key levels to watch in USD/JPY, AUD/JPY and GBP/JPY?

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies.Wall Street IG Client Sentiment: Our data shows traders are now net-short Wall Street for the first time since Sep 21, 2023 when Wall Street traded near 34,068.90.Commodities Update: As of 02:00, these are your best and worst performers based on the London trading schedule: Oil - US Crude: 0....

Dallas Fed president Lorie Logan and Fed Vice Chair Philip Jefferson on Monday suggested that the sharp rise in yields has tightened financial conditions, lessening the need for further interest rate hikes. Markets are now pricing in around a 10% chance of a 25 basis points hike by the Fed when it meets next month, down from around a 28% chance a week ago. Moreover, the yen appears to have attracted some safe-haven bids on account of a flare up in geopolitical tensions.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.a registered Introducing Broker with the Commodity Futures Trading Commission and is no longer a Member of the National Futures Association in the U.S. Any and all information provided by FXP is not intended for use by U.S. residents or individuals domiciled in the U.S.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

USD/JPY oscillates at around 148.60 amidst dovish Fed remarks, risk-on impulseUSD/JPY prints minimal gains on Tuesday after beginning the week on a lower note, weighed by the fall in US Treasury bond yields, which, continued but

USD/JPY oscillates at around 148.60 amidst dovish Fed remarks, risk-on impulseUSD/JPY prints minimal gains on Tuesday after beginning the week on a lower note, weighed by the fall in US Treasury bond yields, which, continued but

Baca lebih lajut »

USD/JPY: Impact of Israel-Hamas Conflict on the Currency PairForex Analysis by Fawad Razaqzada covering: USD/JPY, EUR/JPY, GBP/JPY, XAU/USD. Read Fawad Razaqzada's latest article on Investing.com

USD/JPY: Impact of Israel-Hamas Conflict on the Currency PairForex Analysis by Fawad Razaqzada covering: USD/JPY, EUR/JPY, GBP/JPY, XAU/USD. Read Fawad Razaqzada's latest article on Investing.com

Baca lebih lajut »

USD/JPY drops on risk-aversion spurred on Middle-East tensions, falling US bond yieldsThe Japanese yen (JPY) appeals to its status as a safe haven and appreciates against the Greenback (USD) in the mid-North American session as tensions

USD/JPY drops on risk-aversion spurred on Middle-East tensions, falling US bond yieldsThe Japanese yen (JPY) appeals to its status as a safe haven and appreciates against the Greenback (USD) in the mid-North American session as tensions

Baca lebih lajut »

GBP/JPY Price Analysis: Dives on safe-haven flows towards the YenThe GBP/JPY recovery stalls on Monday, following developments during the weekend, as the conflict between Hamas and Israel escalated. Hence, the Japan

GBP/JPY Price Analysis: Dives on safe-haven flows towards the YenThe GBP/JPY recovery stalls on Monday, following developments during the weekend, as the conflict between Hamas and Israel escalated. Hence, the Japan

Baca lebih lajut »

Dollar Index (DXY) Retreats Helping USD/JPY Tick Lower, 145.00 Incoming?USD/JPY Continues to edge lower as last week's bond buying spree from the BoJ appears to have run its course. Are we finally in for a retracement?

Baca lebih lajut »

AUD/JPY Price Analysis: Remains subdued amid rising geopolitical tensions, bearish harami loomsAUD/JPY resumed its uptrend on Monday but failed to crack last Friday’s high of 95.55 due to a risk-off impulse, given the resurgence of fights betwee

AUD/JPY Price Analysis: Remains subdued amid rising geopolitical tensions, bearish harami loomsAUD/JPY resumed its uptrend on Monday but failed to crack last Friday’s high of 95.55 due to a risk-off impulse, given the resurgence of fights betwee

Baca lebih lajut »