The CARES Act was beneficial for most, yet it was targeted for scams by a few bad apples. The IRS is treating all small businesses as presumed guilty of deception.

This attitude reflects a terrible disdain by federal bureaucrats for the work being done to get small businesses whole and operational again. Small percentages of inappropriate payments in the program should not serve as a pretext to shut off the entirety of a program for small businesses in need that legitimately qualify for the ERC.

Pat Cleary, chief executive of the National Association of Professional Employer Organizations, was quoted in The Wall Street Journal on Sept. 5 as arguing that “it is an occupational hazard for the IRS to deal with fraud. They are using this as a shield against paying companies what they are entitled to.”

In other words, the IRS defies the will of Congress and the letter of the law when they try to create new qualifications, using unconstitutional means, regarding who can receive the tax credit.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

IRS Teams Up with Global Agencies to Train Ukrainian Officers to Combat Crypto-Enabled CrimeCipherTrace, BlockTrace as well Chainalysis have joined forces with international law enforcement agencies to educate Ukrainian officers on crypto-tracing

IRS Teams Up with Global Agencies to Train Ukrainian Officers to Combat Crypto-Enabled CrimeCipherTrace, BlockTrace as well Chainalysis have joined forces with international law enforcement agencies to educate Ukrainian officers on crypto-tracing

Baca lebih lajut »

ANALYSIS: IRS Targeting More Supposedly 'High-Income' Americans Than AdvertisedEarlier this month, the IRS announced a new focus on squeezing 'high-income earners' as part of a 'historic effort to restore fairness in tax compl...

ANALYSIS: IRS Targeting More Supposedly 'High-Income' Americans Than AdvertisedEarlier this month, the IRS announced a new focus on squeezing 'high-income earners' as part of a 'historic effort to restore fairness in tax compl...

Baca lebih lajut »

IRS to target ‘unscrupulous' tax preparers amid crackdown of small business tax creditThe IRS has unveiled plans to crack down on tax preparers with “questionable practices” as it elevates scrutiny of a small business tax credit.

IRS to target ‘unscrupulous' tax preparers amid crackdown of small business tax creditThe IRS has unveiled plans to crack down on tax preparers with “questionable practices” as it elevates scrutiny of a small business tax credit.

Baca lebih lajut »

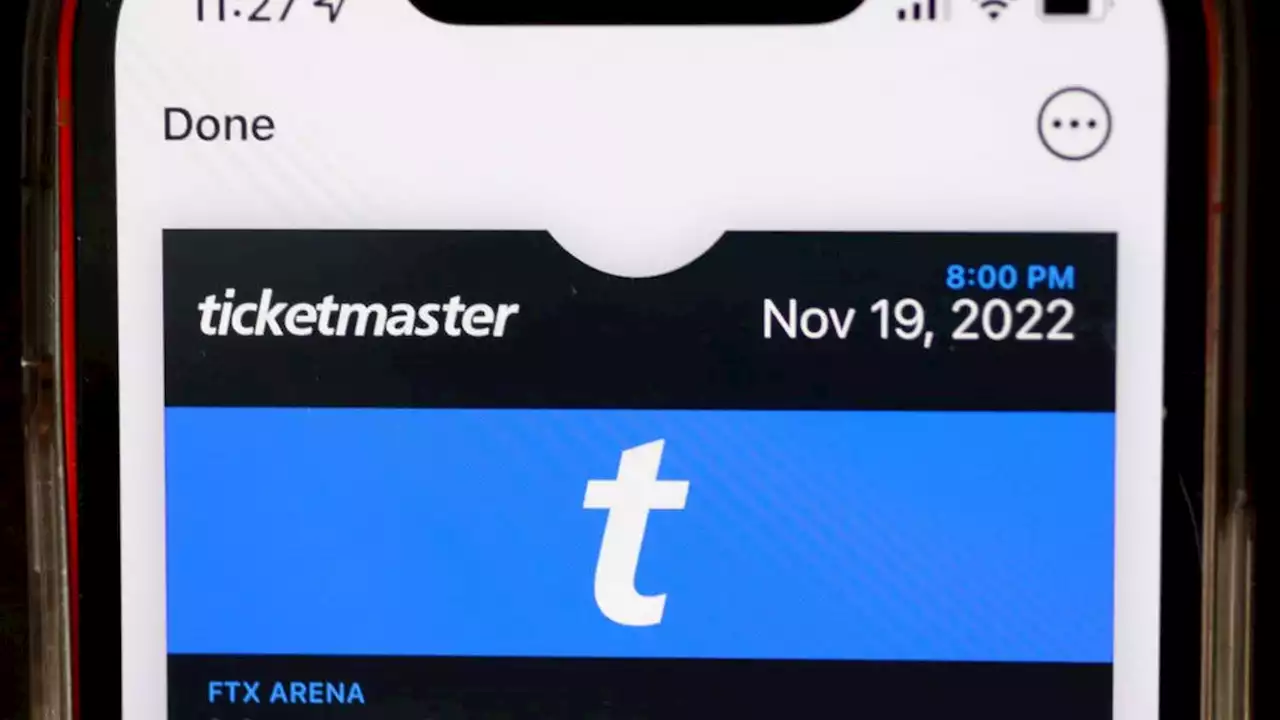

New IRS rule on reselling concert, sporting event tickets could impact large number of AmericansThe IRS is now tracking ticket resellers who made more than $600.

New IRS rule on reselling concert, sporting event tickets could impact large number of AmericansThe IRS is now tracking ticket resellers who made more than $600.

Baca lebih lajut »

IRS has important deadline reminder for some Alabama taxpayersThere’s an important tax deadline for people in parts of Alabama.

IRS has important deadline reminder for some Alabama taxpayersThere’s an important tax deadline for people in parts of Alabama.

Baca lebih lajut »

Ticketmaster, StubHub to report resales of over $600 to IRSIt doesn’t matter if the person reselling the tickets turned a profit, only that they sold more than $600, Fox Business reported. If they made a profit by selling it for more than they originally paid, the ticket seller would have to pay additional taxes.

Ticketmaster, StubHub to report resales of over $600 to IRSIt doesn’t matter if the person reselling the tickets turned a profit, only that they sold more than $600, Fox Business reported. If they made a profit by selling it for more than they originally paid, the ticket seller would have to pay additional taxes.

Baca lebih lajut »