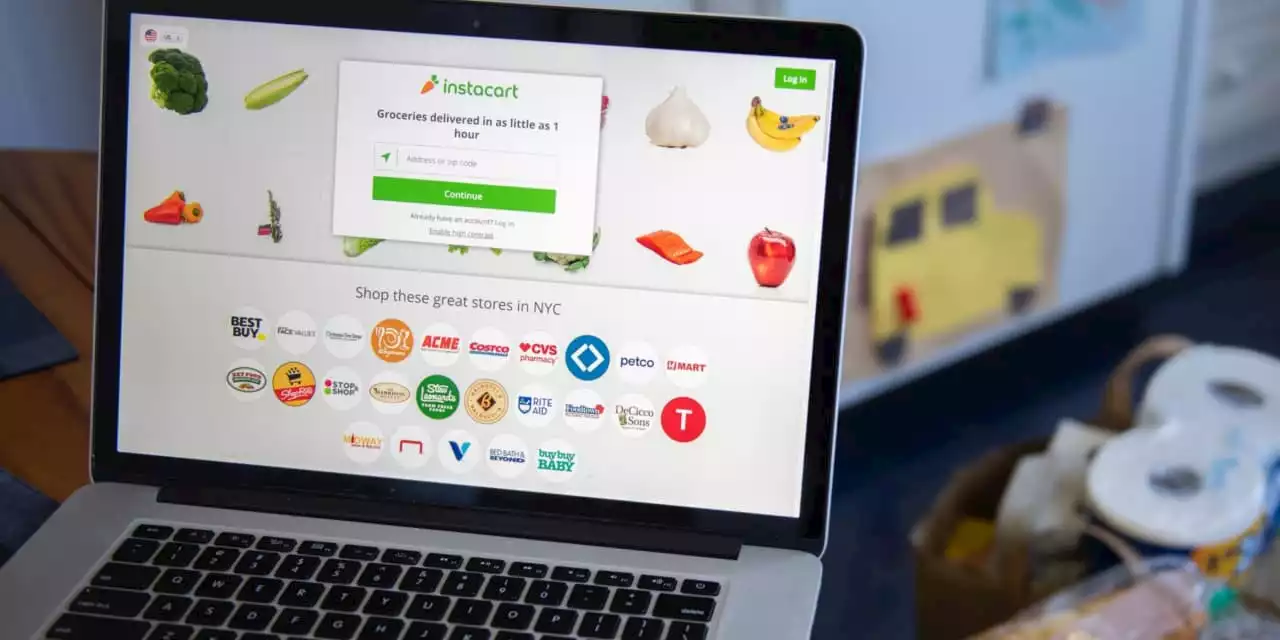

The grocery-delivery company is set to deliver significant paper losses to many of the private investors who piled on late.

Sept. 16, 2023 5:30 am ETInstacart in its coming IPO is targeting a valuation far lower than where it was when startup funding peaked two years ago.

When Instacart lists in the coming week, it will leave many of its later investors with significant paper losses—a sign of the pain venture capitalists are facing after years of fast-and-loose spending.Continue reading your article with

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

| Instacart Set to Raise IPO Price Target After Successful Arm DebutAt the high end of the new range, the grocery-delivery company would be valued at nearly $10 billion on a fully diluted basis.

| Instacart Set to Raise IPO Price Target After Successful Arm DebutAt the high end of the new range, the grocery-delivery company would be valued at nearly $10 billion on a fully diluted basis.

Baca lebih lajut »

Instacart set to raise IPO target price after Arm's successful debut- WSJ By ReutersInstacart set to raise IPO target price after Arm's successful debut- WSJ

Instacart set to raise IPO target price after Arm's successful debut- WSJ By ReutersInstacart set to raise IPO target price after Arm's successful debut- WSJ

Baca lebih lajut »

Instacart raises IPO price range to $28 to $30 a share from $26 to $28 previouslyGrocery-delivery app Instacart raised the proposed price range for its planned initial public offering on Friday to $28 to $30 from $26 to $28 previously....

Instacart raises IPO price range to $28 to $30 a share from $26 to $28 previouslyGrocery-delivery app Instacart raised the proposed price range for its planned initial public offering on Friday to $28 to $30 from $26 to $28 previously....

Baca lebih lajut »

Instacart raises proposed price range for IPO By ReutersInstacart raises proposed price range for IPO

Instacart raises proposed price range for IPO By ReutersInstacart raises proposed price range for IPO

Baca lebih lajut »

Instacart Raises IPO Price Target After Successful Arm DebutInstacart's valuation rises to a range of $9.3 billion to $9.9 billion.

Instacart Raises IPO Price Target After Successful Arm DebutInstacart's valuation rises to a range of $9.3 billion to $9.9 billion.

Baca lebih lajut »