Americans may get a better sense of how much pain could be in store.

FILE - A for sale sign is posted in front of a home in Sacramento, Calif., Thursday, March 3, 2022. The Federal reserve is expected at its meeting this week to raise its key interest rate by a substantial three-quarters of a point for the third consecutive time. Another hike that large would lift its benchmark rate which affects many consumer and business loans to a range of 3% to 3.25%, the highest level in 14 years.

. The Fed intends those higher borrowing costs to slow growth by cooling off a still-robust job market to cap wage growth and other inflation pressures. Yet the risk is growing that the Fed may weaken the economy so much as to cause a downturn that would produce job losses. The inflation report also documented just how broadly inflation has spread through the economy, complicating the the Fed's anti-inflation efforts. Inflation now appearsand less by the supply shortages that had bedeviled the economy during the pandemic recession.

“He’s not going to say that," Bostjancic said. But, referring to the most recent Fed meeting in July, when Powell raised hopes for an eventual pullback on rate hikes, she added:"He also wants to make sure that the markets don’t come away and rally. That’s what happened last time.”

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Biggest Fed rate hike in 40 years? 5 things to know in Bitcoin this weekBitcoin tanks as BTC price action prepares for a 'sledgehammer' Fed rate hike.

Biggest Fed rate hike in 40 years? 5 things to know in Bitcoin this weekBitcoin tanks as BTC price action prepares for a 'sledgehammer' Fed rate hike.

Baca lebih lajut »

ECB’s Lange, Nagel signal higher rates, more pain ahead“The European Central Bank (ECB) could raise interest rates into next year, causing pain for consumers as it tries to depress demand that is now incre

ECB’s Lange, Nagel signal higher rates, more pain ahead“The European Central Bank (ECB) could raise interest rates into next year, causing pain for consumers as it tries to depress demand that is now incre

Baca lebih lajut »

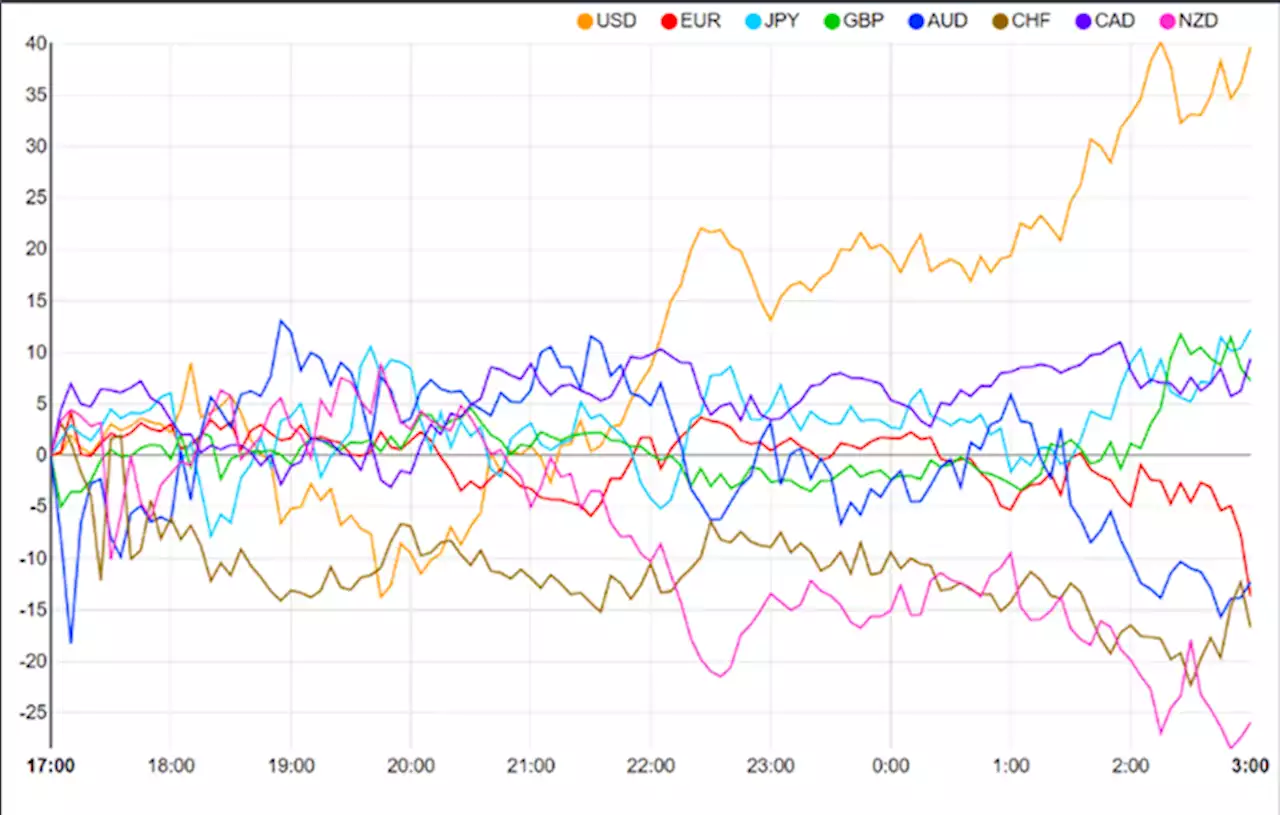

EUR/USD Dips Below Parity with Dollar Index Leading the WayEURUSD surrendered parity once more in early trade, failing to take out Fridays high. Get your market update from zvawda here:

EUR/USD Dips Below Parity with Dollar Index Leading the WayEURUSD surrendered parity once more in early trade, failing to take out Fridays high. Get your market update from zvawda here:

Baca lebih lajut »

Crypto market bloodbath leads to $432M in liquidationThe higher CPI data is expected to be followed by the biggest Fed rate hike in 40 years during the upcoming meeting scheduled for Sept. 21.

Crypto market bloodbath leads to $432M in liquidationThe higher CPI data is expected to be followed by the biggest Fed rate hike in 40 years during the upcoming meeting scheduled for Sept. 21.

Baca lebih lajut »

Federal Reserve expected to raise rates againThe Fed's rate hikes could ultimately lead to the economy cooling off more than the central bank would like, experts say.

Federal Reserve expected to raise rates againThe Fed's rate hikes could ultimately lead to the economy cooling off more than the central bank would like, experts say.

Baca lebih lajut »

Here is why a 0.75% Fed rate hike could be bullish for Bitcoin and altcoinsThe Federal Reserve is set to raise interest rates this week. Here’s why traders expect a 0.75% hike to trigger a crypto market rally.

Here is why a 0.75% Fed rate hike could be bullish for Bitcoin and altcoinsThe Federal Reserve is set to raise interest rates this week. Here’s why traders expect a 0.75% hike to trigger a crypto market rally.

Baca lebih lajut »