Tax authorities like IRSnews could soon see details of your foreign bitcoin holdings - and maybe your NFTs too. jackschickler reports.

New global tax reporting rules could soon extend into crypto, non-fungible tokens and decentralized finance , but some worry the Organisation for Economic Cooperation and Development’s inflexible framework threatens to constrain a sector that’s still moving fast.require details of crypto holdings to be shared with foreign tax authorities.

, intended to curb dirty money by getting crypto users to prove their identity, to unhosted crypto wallets., some industry advocates may plead for a rethink of plans they say could strangle growth, while others are merely hoping the rules can be streamlined to avoid too much administrative heartache.The OECD proposal to extend the existing information-swapping system to virtual assets was expected and, in some cases, welcomed.

Worse still is if the rules are made to apply to fast-developing, and hence less well-defined, sectors such as decentralized finance. In jurisdictions like the European Union, lawmakers have already tied themselves in knots trying to figure out how to apply anti-money laundering rules to wallets where custody isn’t offered by any regulated crypto-asset service provider.It’s just as unclear what is supposed to be done with tax – for instance, in cases where a person uses an unhosted wallet to make a small payment in a store.

Though the OECD comprises major developed countries, it persuaded jurisdictions such as the Cayman Islands and Liechtenstein – small, but significant for tax dodging – to join in, too.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Tax Software Company Column Tax Raises A $21.7 Million Series ATax software company Column Tax, which provides an API that enables mobile banking and fintech companies to offer tax products to their users, announced today that it has raised a $21.7 million series A. The round was led by Bain Capital Ventures with participation from Felicis and Not Boring.

Tax Software Company Column Tax Raises A $21.7 Million Series ATax software company Column Tax, which provides an API that enables mobile banking and fintech companies to offer tax products to their users, announced today that it has raised a $21.7 million series A. The round was led by Bain Capital Ventures with participation from Felicis and Not Boring.

Baca lebih lajut »

California bill would expand state's child tax credit for low-income familiesLow-income families across California could be getting a little more financial help from the state.

California bill would expand state's child tax credit for low-income familiesLow-income families across California could be getting a little more financial help from the state.

Baca lebih lajut »

How to Sidestep a Tax Bomb When Selling Your HomeWith soaring prices and record home equity, you may expect a profit when selling your property. Here’s how to lessen the tax bite.

How to Sidestep a Tax Bomb When Selling Your HomeWith soaring prices and record home equity, you may expect a profit when selling your property. Here’s how to lessen the tax bite.

Baca lebih lajut »

Granholm 'bullish' on Congress passing clean energy tax creditsEnergy Secretary Jennifer Granholm said she is “bullish” that Congress will ultimately pass some form of clean energy tax credits — particularly as Sen. Joe Manchin holds bipartisan meetings with senators on an energy bill.

Granholm 'bullish' on Congress passing clean energy tax creditsEnergy Secretary Jennifer Granholm said she is “bullish” that Congress will ultimately pass some form of clean energy tax credits — particularly as Sen. Joe Manchin holds bipartisan meetings with senators on an energy bill.

Baca lebih lajut »

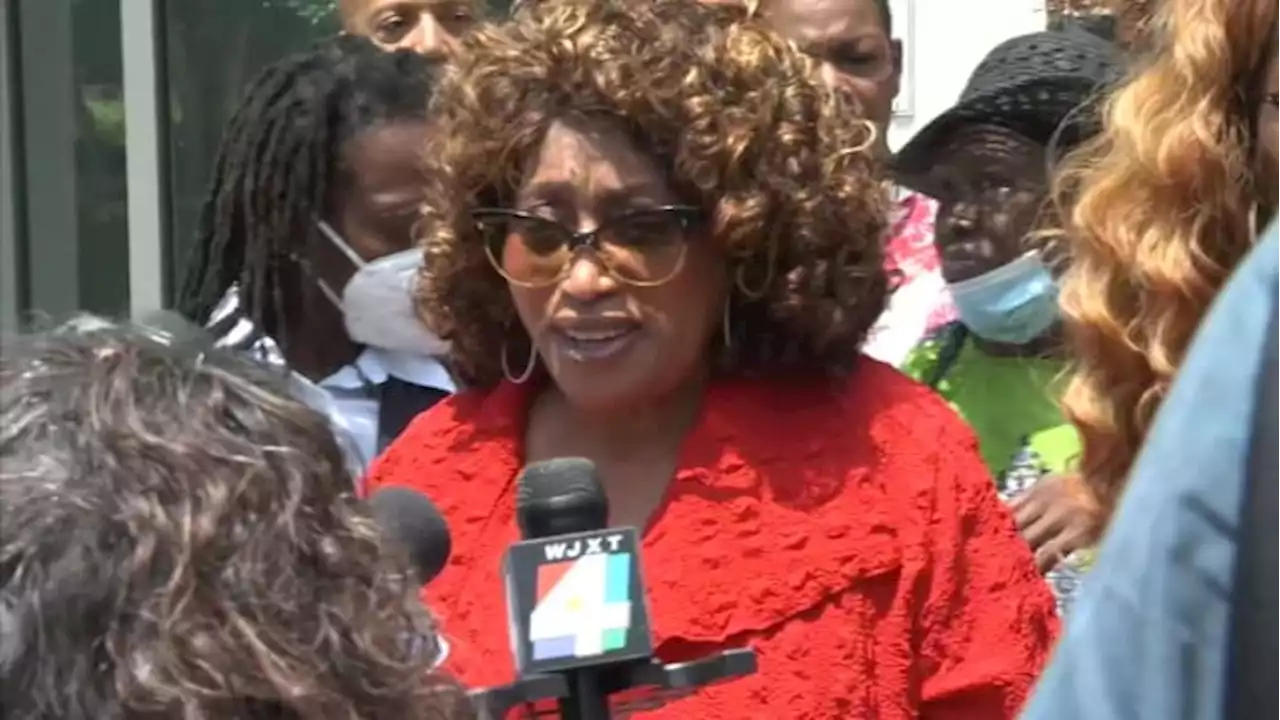

Former congresswoman Corrine Brown pleads guilty to tax fraudFormer congresswoman Corrine Brown returned to federal court Wednesday where she pleaded guilty to one count of tax evasion in her fraud case.

Former congresswoman Corrine Brown pleads guilty to tax fraudFormer congresswoman Corrine Brown returned to federal court Wednesday where she pleaded guilty to one count of tax evasion in her fraud case.

Baca lebih lajut »