The turbulence marks the latest fallout from CEO David Solomon's decision to exit most of Goldman's consumer efforts.

KKR, Apollo Global Management, Sixth Street Partners, Warburg Pincus and Synchrony Bank were among the asset managers and lenders involved in the first round of bids, which began early June, according to the people, who declined to be identified speaking about the sale. The companies declined to comment.

"Everybody's been coming in low, and the Goldman team keeps pushing back, pounding the table about the value of it," said one of the bidders. The bank is continuing negotiations with a smaller group of bidders this week with the hope of ratcheting up the ultimate price, according to the sources.Goldman has been pursuing offers for GreenSky's loan origination business and its book of existing loans separately as well as offers for a single deal, according to the people familiar.

One bidder said the origination platform is worth roughly $300 million, while another said it was worth closer to $500 million. If a deal closed at anywhere near that valuation, it would represent a steep discount to what Goldman paid for it, forcing the company to disclose a writedown hitting its bottom line in an upcoming quarter.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

The War Inside Goldman Sachs - The Journal. - WSJ PodcastsCracks are forming in a prestigious Wall Street institution: Goldman Sachs. Most bank CEOs make big decisions with a cadre of executives. But Goldman maintains a partnership with about 420 members, many of whom like to have a say in how the firm is run. WSJ’s AnnaMaria Andriotis explains why CEO David Solomon has come under fire from partners who complain about bonuses, strategy and that DJ side gig. Further Reading: - Goldman Sachs Is at War With Itself - Goldman Sachs’s 80 New Partners Are the Happiest People on Wall Street Today - Goldman Sachs Doesn’t Want to Be Everyone’s Bank, but It Has to Be Someone’s Further Listening: - Goldman Sachs and the 1MDB Scandal

The War Inside Goldman Sachs - The Journal. - WSJ PodcastsCracks are forming in a prestigious Wall Street institution: Goldman Sachs. Most bank CEOs make big decisions with a cadre of executives. But Goldman maintains a partnership with about 420 members, many of whom like to have a say in how the firm is run. WSJ’s AnnaMaria Andriotis explains why CEO David Solomon has come under fire from partners who complain about bonuses, strategy and that DJ side gig. Further Reading: - Goldman Sachs Is at War With Itself - Goldman Sachs’s 80 New Partners Are the Happiest People on Wall Street Today - Goldman Sachs Doesn’t Want to Be Everyone’s Bank, but It Has to Be Someone’s Further Listening: - Goldman Sachs and the 1MDB Scandal

Baca lebih lajut »

Disasters are coming more frequently, crossing Team Rubicon - CEO SpotlightArt delaCruz, CEO, Team Rubicon joins KRLD's David Johnson for this episode of CEO Spotlight.

Disasters are coming more frequently, crossing Team Rubicon - CEO SpotlightArt delaCruz, CEO, Team Rubicon joins KRLD's David Johnson for this episode of CEO Spotlight.

Baca lebih lajut »

Goldman Sachs: 50 stocks getting more profitableGoldman Sachs: Despite slowing macroeconomic conditions, these 50 stocks are poised to increase their profitability faster than the rest of the market

Baca lebih lajut »

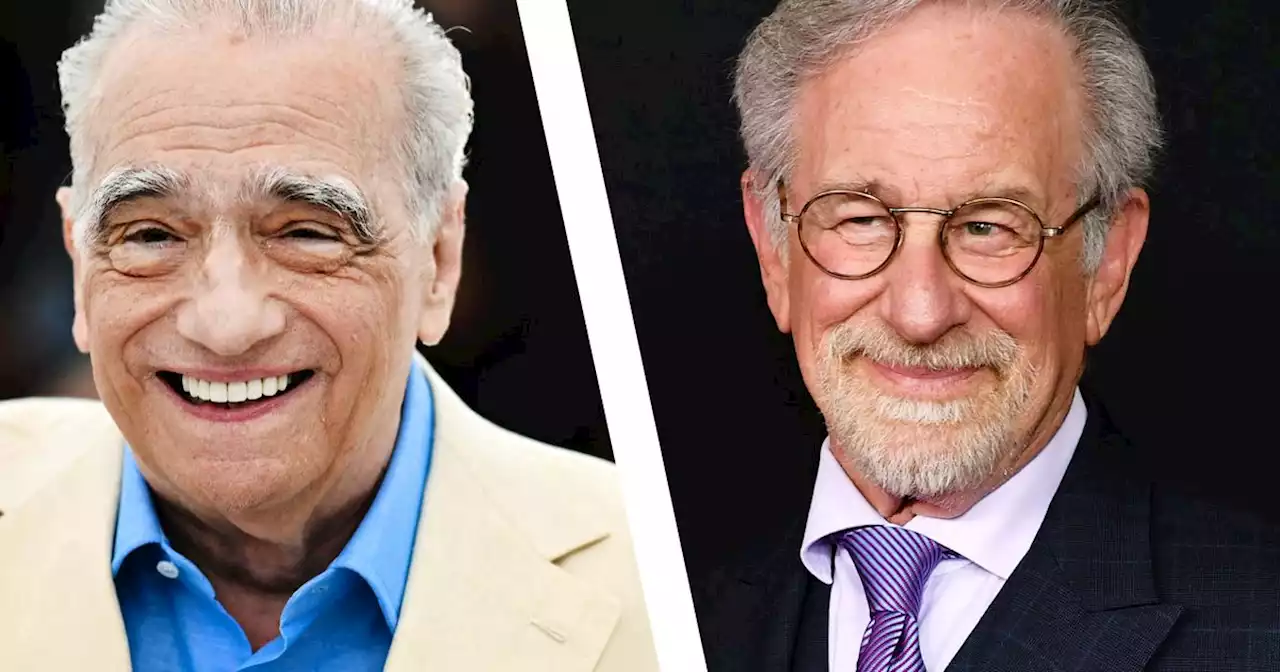

Scorsese, Spielberg, and P.T. Anderson Fight to Save Turner Classic MoviesAfter Warner Bros. CEO David Zaslav set layoffs at the network.

Scorsese, Spielberg, and P.T. Anderson Fight to Save Turner Classic MoviesAfter Warner Bros. CEO David Zaslav set layoffs at the network.

Baca lebih lajut »

Ex-Goldman banker convicted of insider tradingA former Goldman Sachs banker was convicted of insider trading by a New York jury on Wednesday, after prosecutors said he passed tips about potential mergers to a friend.

Ex-Goldman banker convicted of insider tradingA former Goldman Sachs banker was convicted of insider trading by a New York jury on Wednesday, after prosecutors said he passed tips about potential mergers to a friend.

Baca lebih lajut »