General Electric Co. investors should expect a 'particularly noisy' earnings report for the industrial conglomerate's fourth quarter, which will be the first...

General Electric Co. investors should expect a “particularly noisy” earnings report for the industrial conglomerate’s fourth quarter, which will be the first since the company said it was breaking up, and said it would start reporting results on a consolidated basis.

The company is expected to post year-over-year growth on the bottom line for the third-straight quarter, but a 13th-consecutive quarter of total revenue declines, according to FactSet data, as the company has continued to execute its turnaround plan by selling off assets. “Demand remains solid but many companies are building record backlog and are unable to handle the high volume of orders,” Dray wrote in a research note to clients. “The setup for fourth-quarter earnings is now likely more dour than consensus was expecting in early December.”

GE’s stock fell 2.0% Friday to $96.30. It has slumped 6.6% amid a four-day losing streak but has gained 1.9% year to date. Meanwhile, the SPDR Industrial Select Sector exchange-traded fund XLI, -0.92% has lost 4.4% this year and the S&P 500 index SPX, -1.89% has dropped 7.7%.Earnings: The average estimate of 18 analysts surveyed by FactSet is for adjusted earnings per share of 85 cents, up from 64 cents in the same period a year ago.

“This quarter is going to be a particularly noisy one as GE is transitioning its financials to single-column reporting going forward, where headline results will now be on a consolidated basis,” RBC’s Dray wrote.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Asia-Pacific markets set to track Wall Street declines; oil prices slip from highsAsia-Pacific markets were set to fall on Friday, tracking declines on Wall Street overnight.

Asia-Pacific markets set to track Wall Street declines; oil prices slip from highsAsia-Pacific markets were set to fall on Friday, tracking declines on Wall Street overnight.

Baca lebih lajut »

Japan's Nikkei Falls 2% as Asia-Pacific Stocks Track Wall Street Declines; Oil Slips From HighsAsia-Pacific Markets Set to Track Wall Street Declines; Oil Prices Slip From Highs

Japan's Nikkei Falls 2% as Asia-Pacific Stocks Track Wall Street Declines; Oil Slips From HighsAsia-Pacific Markets Set to Track Wall Street Declines; Oil Prices Slip From Highs

Baca lebih lajut »

Asian markets slide after more losses on Wall StreetShares were lower in Asia on Friday after a late afternoon sell-off wiped out gains for stocks on Wall Street.

Asian markets slide after more losses on Wall StreetShares were lower in Asia on Friday after a late afternoon sell-off wiped out gains for stocks on Wall Street.

Baca lebih lajut »

European stocks tumble, led by tech stocks, renewables after Wall Street routInvestors tracked losses across Asia and Wall Street, which suffered a late selloff, led by tech.

European stocks tumble, led by tech stocks, renewables after Wall Street routInvestors tracked losses across Asia and Wall Street, which suffered a late selloff, led by tech.

Baca lebih lajut »

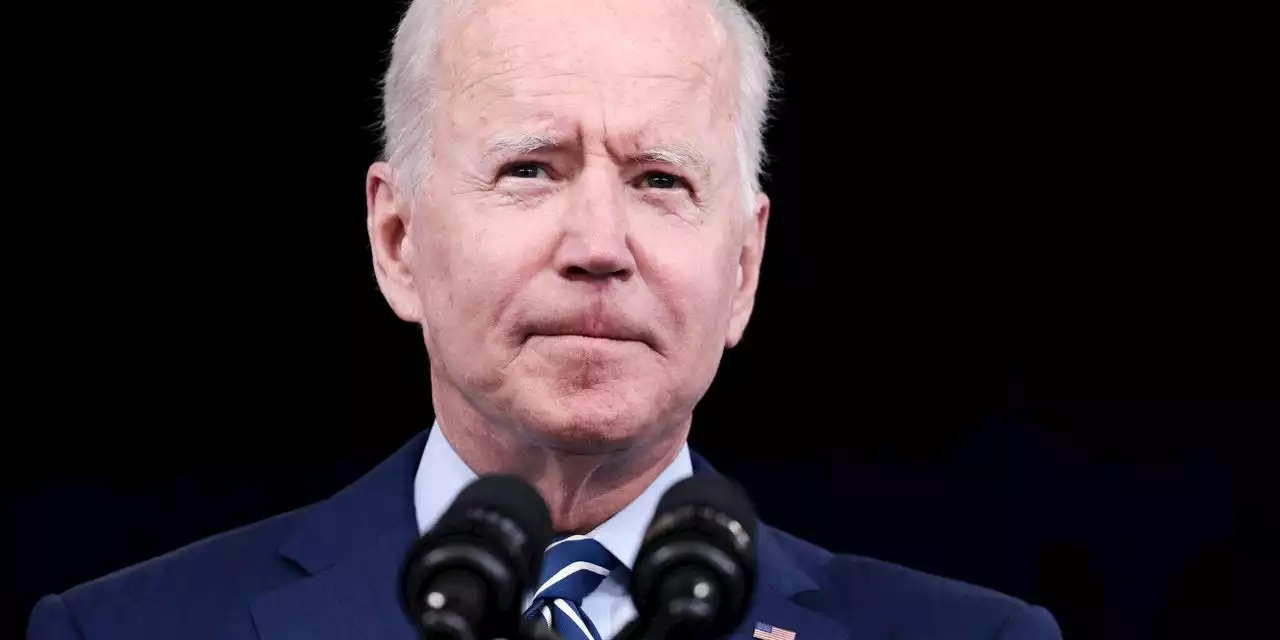

Why Wall Street is celebrating Joe Biden’s low approval ratingOPINION: A president’s approval rating is often inversely correlated with the stock market. Here’s why.

Why Wall Street is celebrating Joe Biden’s low approval ratingOPINION: A president’s approval rating is often inversely correlated with the stock market. Here’s why.

Baca lebih lajut »