The GBP/USD pair remains on the defensive around 1.2630 on Thursday during the early European trading hours.

GBP/USD trades on a softer note below the mid-1.2600s on Thursday ahead of UK GDP growth numbers data. The pair keeps the bearish vibe below the key EMA; RSI indicator holds below the 50 midlines. The immediate resistance level will emerge at 1.2655; the initial support level is located at the 1.2600–1.2605 zone. The hawkish tone from Federal Reserve Governor Christopher Waller early Thursday has lifted the US Dollar broadly, which creates a headwind for the GBP/USD pair.

The first upside barrier for GBP/USD will emerge near the upper boundary of the Bollinger Band at 1.2655. A break above the latter will expose the 100-period EMA at 1.2685. Further north, the next hurdle is seen near a high of March 18 at 1.2746, followed by the psychological level of 1.2800. On the flip side, the initial support level of the major pair is located near the lower limit of the Bollinger Band at the 1.2600-1.2605 region.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

GBP/USD Price Analysis: Clings near 1.2720 followed by the barrier at 14-day EMAGBP/USD trims intraday losses and attempts to snap its losing streak on Wednesday.

GBP/USD Price Analysis: Clings near 1.2720 followed by the barrier at 14-day EMAGBP/USD trims intraday losses and attempts to snap its losing streak on Wednesday.

Baca lebih lajut »

GBP/USD Price Analysis: Subdued around 1.2700, with bears in charge pre-FOMC decisionThe Pound Sterling drops some 0.12% against the US Dollar in early trading during the North American session as traders brace for the Federal Reserve’s monetary policy.

GBP/USD Price Analysis: Subdued around 1.2700, with bears in charge pre-FOMC decisionThe Pound Sterling drops some 0.12% against the US Dollar in early trading during the North American session as traders brace for the Federal Reserve’s monetary policy.

Baca lebih lajut »

GBP/USD Price Analysis: Holds position below the major level of 1.2650GBP/USD attempts to continue gaining ground, advancing to near 1.2640 during the Asian trading hours on Tuesday.

GBP/USD Price Analysis: Holds position below the major level of 1.2650GBP/USD attempts to continue gaining ground, advancing to near 1.2640 during the Asian trading hours on Tuesday.

Baca lebih lajut »

US Dollar Technical Analysis: EUR/USD & GBP/USD Rebound, USD/JPY FlatThis article provides an in-depth analysis of the outlook for EUR/USD, GBP/USD and USD/JPY, exploring price action dynamics and several technical scenarios that could unfold in the days ahead.

US Dollar Technical Analysis: EUR/USD & GBP/USD Rebound, USD/JPY FlatThis article provides an in-depth analysis of the outlook for EUR/USD, GBP/USD and USD/JPY, exploring price action dynamics and several technical scenarios that could unfold in the days ahead.

Baca lebih lajut »

![Weekly forex analysis: EUR/USD, GBP/USD, AUD/USD and more [Video]](https://i.headtopics.com/images/2024/3/17/fxstreetnews/weekly-forex-analysis-eur-usd-gbp-usd-aud-usd-and--weekly-forex-analysis-eur-usd-gbp-usd-aud-usd-and--0614B19069DC80E30764839509690575.webp?w=640) Weekly forex analysis: EUR/USD, GBP/USD, AUD/USD and more [Video]Weekly forex forecast covers forecast on EUR/USD , GBP/USD , AUD/USD , NZD/USD , USD/CAD , USD/JPY , USD/CHF Forecast.Our weekly forex forecast covers technical analysis, price action on major forex pairs , assets using the high-timeframes and market environment.

Weekly forex analysis: EUR/USD, GBP/USD, AUD/USD and more [Video]Weekly forex forecast covers forecast on EUR/USD , GBP/USD , AUD/USD , NZD/USD , USD/CAD , USD/JPY , USD/CHF Forecast.Our weekly forex forecast covers technical analysis, price action on major forex pairs , assets using the high-timeframes and market environment.

Baca lebih lajut »

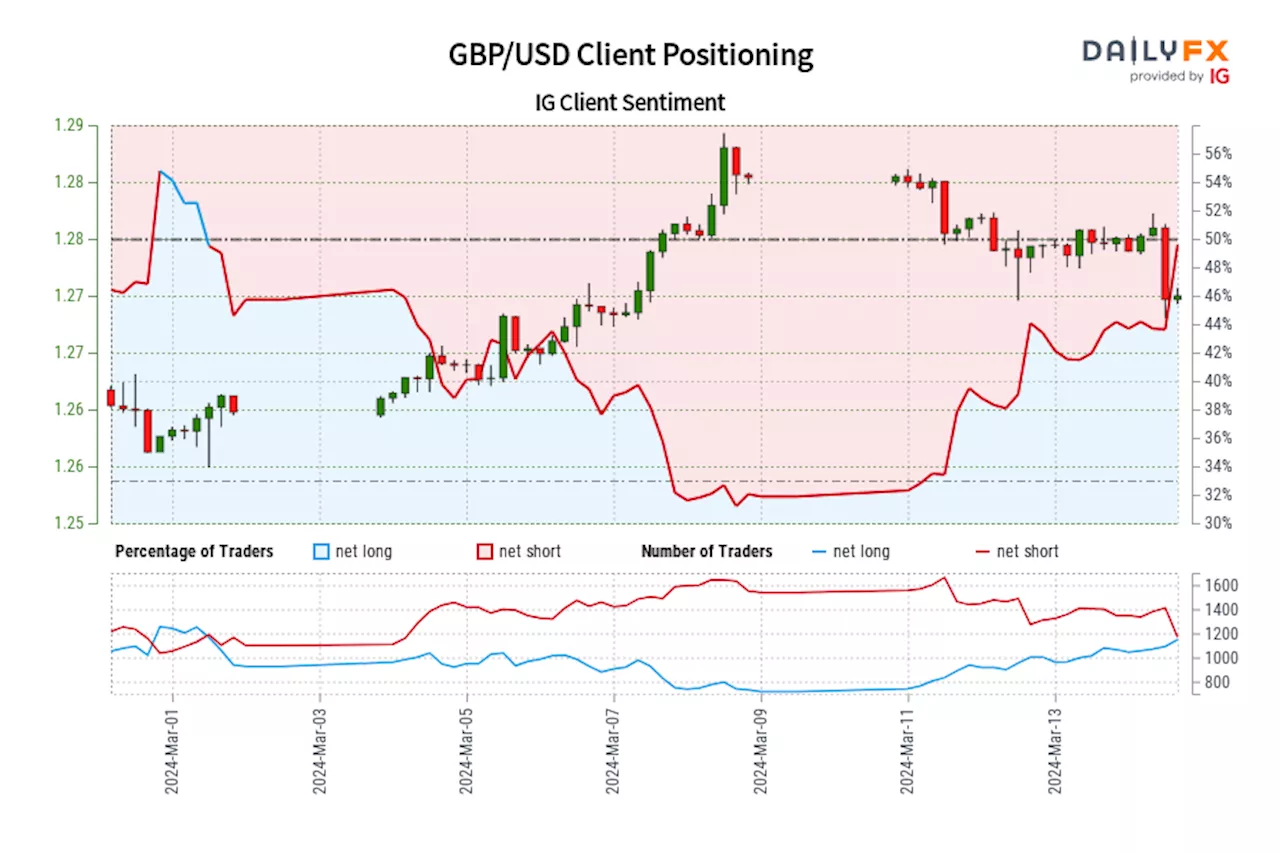

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Baca lebih lajut »