GBP/USD trims intraday gains, remaining higher around 1.2530 during the Asian hours on Monday.

GBP/USD remains in the positive territory after trimming daily gains on Monday. US ISM Manufacturing PMI is expected to improve to 48.4 in March, from 47.8 prior. GBP could face a struggle due tothe speculation of the BoE initiating three quarter-point rate cuts in 2024.

Year-over-year PCE increased by 2.5%, meeting expectations. On the other side, the anticipation of the Bank of England initiating three quarter-point rate reductions in 2024 is putting pressure on the Pound Sterling . This pressure is further compounded by recent weaker economic data, indicating that the UK economy slipped into recession in the latter half of 2023.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

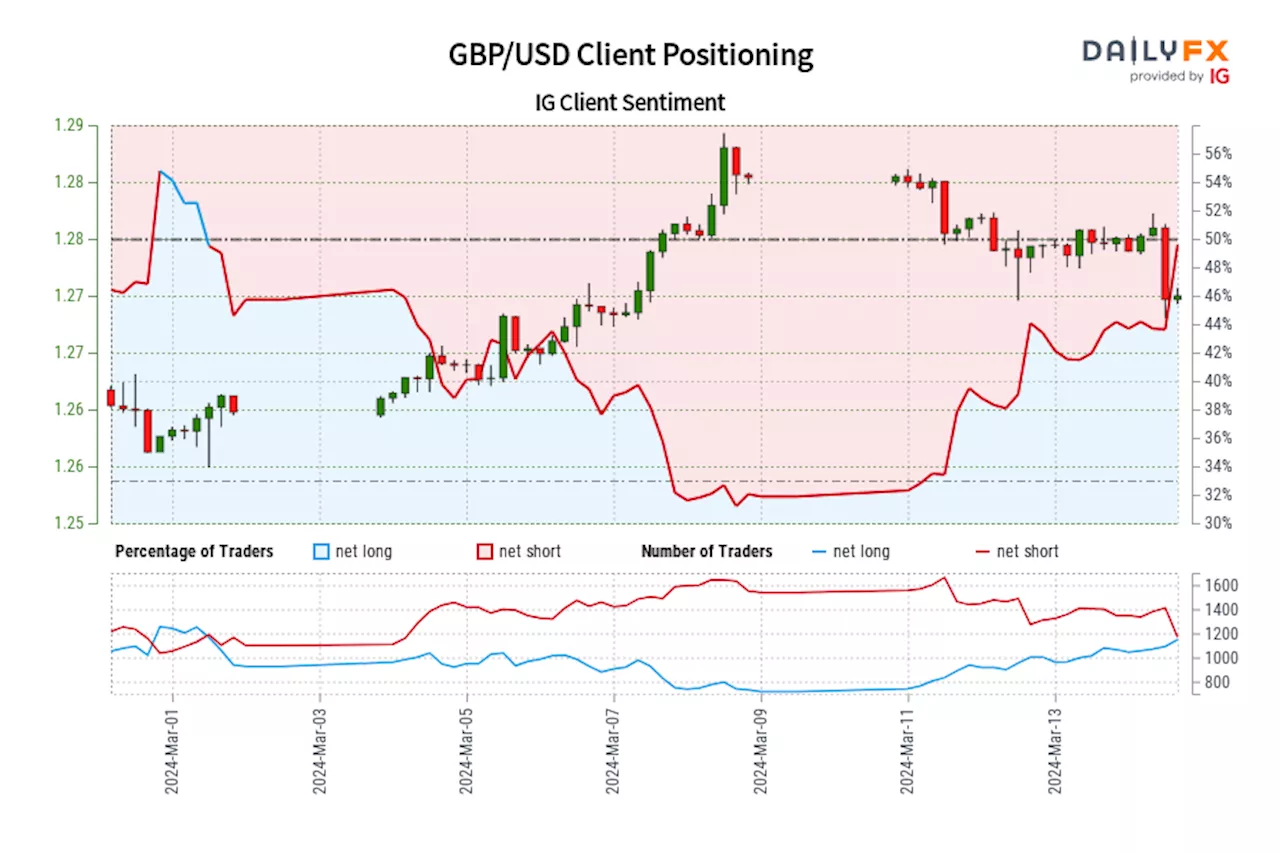

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Baca lebih lajut »

GBP/USD gains ground near the 1.2800 barrier, BoE rate decision eyedThe GBP/USD pair gains momentum during the early Asian trading hours on Thursday.

GBP/USD gains ground near the 1.2800 barrier, BoE rate decision eyedThe GBP/USD pair gains momentum during the early Asian trading hours on Thursday.

Baca lebih lajut »

GBP/USD Forecast: Pound Sterling weakens as US Dollar rebounds modestlyThe Pound Sterling (GBP) returned to red against the US Dollar (USD), reversing the previous week’s rebound.

GBP/USD Forecast: Pound Sterling weakens as US Dollar rebounds modestlyThe Pound Sterling (GBP) returned to red against the US Dollar (USD), reversing the previous week’s rebound.

Baca lebih lajut »

US Jobs Report to Guide US Dollar’s Outlook; EUR/USD, USD/JPY, GBP/USD SetupsThe February's U.S. jobs report is poised to inject a considerable amount of volatility into financial markets and may play a pivotal role in shaping the near-term trajectory of the U.S. dollar.

US Jobs Report to Guide US Dollar’s Outlook; EUR/USD, USD/JPY, GBP/USD SetupsThe February's U.S. jobs report is poised to inject a considerable amount of volatility into financial markets and may play a pivotal role in shaping the near-term trajectory of the U.S. dollar.

Baca lebih lajut »

GBP/USD Forecast: Pound Sterling rebounds firmly on weaker US DollarFollowing a down week, the Pound Sterling (GBP) regained its lost footing against US Dollar (USD), with GBP/USD clinching the highest level in seven months near the 1.2900 mark.

GBP/USD Forecast: Pound Sterling rebounds firmly on weaker US DollarFollowing a down week, the Pound Sterling (GBP) regained its lost footing against US Dollar (USD), with GBP/USD clinching the highest level in seven months near the 1.2900 mark.

Baca lebih lajut »

GBP/USD outlook: Cable surges to eight-month high after US labor dataCable accelerated to a multi-month high after US labor data added to Fed Powell’s dovish stance and strengthened expectations for the start of rate cuts, most likely in June.

GBP/USD outlook: Cable surges to eight-month high after US labor dataCable accelerated to a multi-month high after US labor data added to Fed Powell’s dovish stance and strengthened expectations for the start of rate cuts, most likely in June.

Baca lebih lajut »