The GBP/USD pair trades in negative territory for the fifth consecutive day during the early Asian session on Wednesday.

GBP/USD trades on a weaker note near 1.2719 on the stronger USD. The Fed is likely to keep its benchmark rate steady on Wednesday. UK CPI inflation report might offer some hints on whether the BoE will signal the timeline of its first interest rate cut. The UK February CPI inflation and Fed interest rate decisions will be the highlights on Wednesday. Investors await the UK February Consumer Price Index inflation data and the Federal Reserve interest rate decision on Wednesday.

On the other hand, the UK CPI inflation report due later in the day might offer some hints on whether the Bank of England will signal the timeline of its first interest rate cut or retain its higher rate for a longer stance. The headline UK CPI is expected to rise 3.6% MoM in February from a 4.0% rise in January, while the Core CPI figure is projected to fall to 4.6% YoY in February from a 5.1% rise in January.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

US Dollar Forecast: US CPI to Spark Next Big Move - EUR/USD, USD/JPY, GBP/USDFebruary's U.S. inflation data is poised to ignite heightened market volatility in the upcoming week, playing a pivotal in shaping the near-term outlook for the U.S. dollar.

US Dollar Forecast: US CPI to Spark Next Big Move - EUR/USD, USD/JPY, GBP/USDFebruary's U.S. inflation data is poised to ignite heightened market volatility in the upcoming week, playing a pivotal in shaping the near-term outlook for the U.S. dollar.

Baca lebih lajut »

Sterling Outlook: GBP/USD, EUR/GBP, GBP/JPY Setups Ahead of CPISterling remains one of the better performers against the dollar this year with the BoE less dovish than the Fed – something that could improve its interest rate differential

Sterling Outlook: GBP/USD, EUR/GBP, GBP/JPY Setups Ahead of CPISterling remains one of the better performers against the dollar this year with the BoE less dovish than the Fed – something that could improve its interest rate differential

Baca lebih lajut »

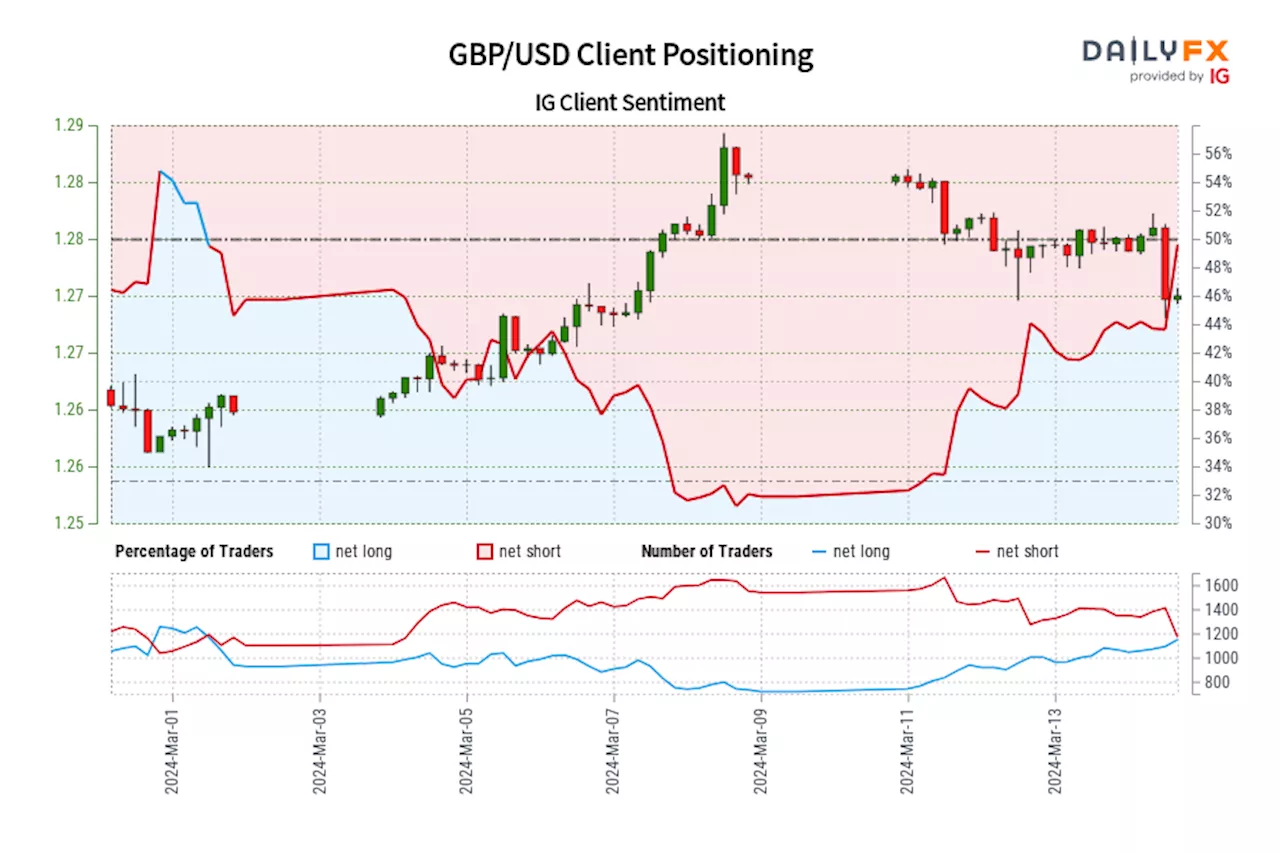

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Baca lebih lajut »

US Dollar Soars on Inflation Risks as Fed Looms; EUR/USD, GBP/USD, USD/JPY SetupsThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY and GBP/USD, exploring various technical and fundamental scenarios that could play out in the near term.

US Dollar Soars on Inflation Risks as Fed Looms; EUR/USD, GBP/USD, USD/JPY SetupsThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY and GBP/USD, exploring various technical and fundamental scenarios that could play out in the near term.

Baca lebih lajut »

GBP/USD consolidates around 1.2730 as markets adopt caution ahead of Fed decisionGBP/USD appears to reverse its decline initiated on Thursday, hovering around 1.2730 during the Asian session on Monday.

GBP/USD consolidates around 1.2730 as markets adopt caution ahead of Fed decisionGBP/USD appears to reverse its decline initiated on Thursday, hovering around 1.2730 during the Asian session on Monday.

Baca lebih lajut »

Forex Today: The Fed, the whole Fed and nothing but the FedThe Greenback managed to maintain its multi-session constructive bias well and sound and propel the USD Index (DXY) back above 104.00, albeit ephemerally.

Forex Today: The Fed, the whole Fed and nothing but the FedThe Greenback managed to maintain its multi-session constructive bias well and sound and propel the USD Index (DXY) back above 104.00, albeit ephemerally.

Baca lebih lajut »