I explore how community college students achieve their goals — whether they’re fresh out of high school, or going back to school for the first time in years — and how colleges help them do so.

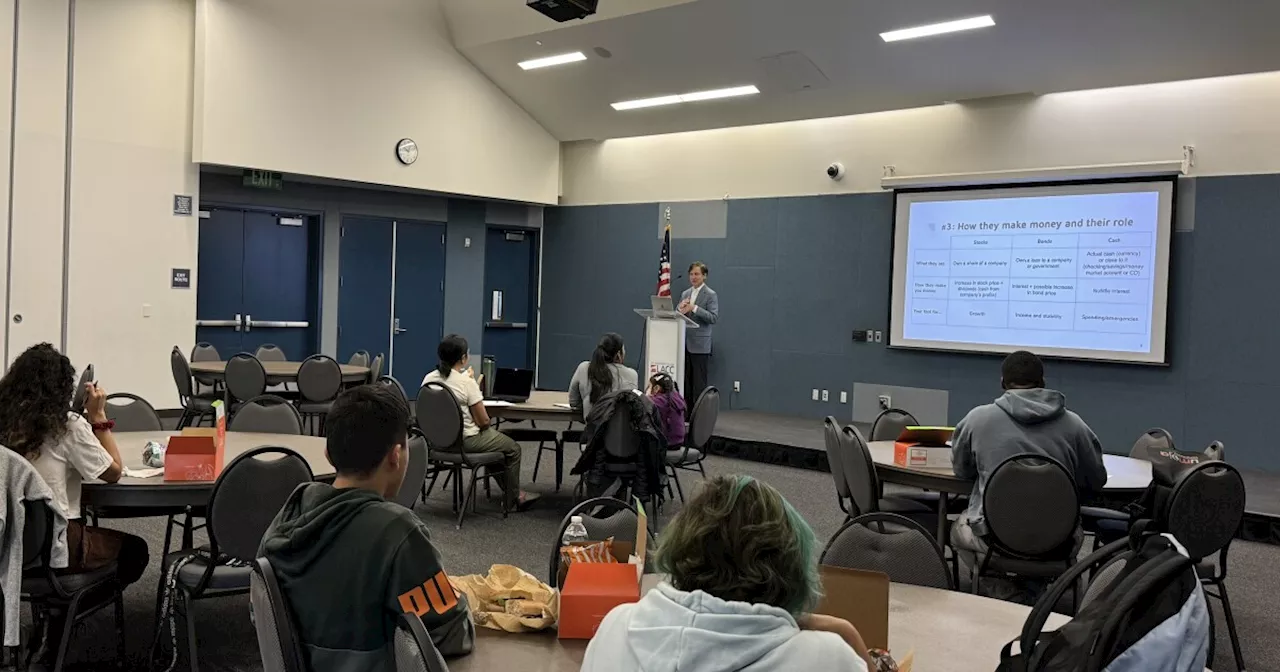

Los Angeles City College students attended the in-person “Understanding Money" workshop during lunchtime. An upcoming workshop will take place online.In these challenging times, the need for reliable local reporting has never been greater. Put a value on the impact of our year-round coverage. Help us continue to highlight LA stories, hold the powerful accountable, and amplify community voices. Your support keeps our reporting free for all to use. Stand with us today.

The lunchtime event was the second of two 90-minute sessions, which covered everything from personal spending to saving up for retirement.“My hope is that, at the end of two sessions, can say, ‘I can do this,’” said Bruce Miller, who taught the workshop. He is now retired after a career in marketing and advertising. Miller has hosted similar courses at community colleges and universities across the country, including Stanford and Dartmouth, his alma maters.

But, he told LAist, “I want them to be able to think: ‘Even on a very modest budget, I can get some breathing room by cutting back a little on things.” Part of his motivation for attending the workshop was to learn more about how to invest his profits. He also appreciated learning about, along with Miller’s emphasis on “giving back when you can.” To that end, Knox is planning to team up with a nonprofit to distribute smoothies to unhoused Angelenos in mid-April. “To be able to give is always a blessing,” he said.Patricia De Peralta is a finance student at Los Angeles City College.

“And so, the money stuff can wait,” Miller added. “I tell them: ‘Learn the tools now. Enjoy your time as a student, because it is a precious time in your life. And then, armed with the knowledge down the road, when you have the job and the time is right, you can apply the things that you learned here.”Community colleges can be a gateway for students, whether they’re continuing their education or looking for a fresh start.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Many Workers Living Paycheck-to-Paycheck, Debt Cited as Main ReasonMany workers are living paycheck-to-paycheck, with about one in three citing debt as one of the main reasons why, according to a PYMNTS study.

Many Workers Living Paycheck-to-Paycheck, Debt Cited as Main ReasonMany workers are living paycheck-to-paycheck, with about one in three citing debt as one of the main reasons why, according to a PYMNTS study.

Baca lebih lajut »

High debt is causing more consumers to live paycheck-to-paycheckBoth high-income and low-income consumers are facing higher levels of debts, causing more people to live paycheck-to-paycheck.

High debt is causing more consumers to live paycheck-to-paycheckBoth high-income and low-income consumers are facing higher levels of debts, causing more people to live paycheck-to-paycheck.

Baca lebih lajut »

Fort Lewis College’s president stepping down to lead Occidental College in Los AngelesTom Stritikus has served as Fort Lewis College’s president for six years, guiding the school through the pandemic and an effort to recognize the university’s past as an Indian boarding …

Fort Lewis College’s president stepping down to lead Occidental College in Los AngelesTom Stritikus has served as Fort Lewis College’s president for six years, guiding the school through the pandemic and an effort to recognize the university’s past as an Indian boarding …

Baca lebih lajut »

Private College Costs Exceed $90,000, Making College Education Expensive for Wealthy FamiliesA number of private colleges have exceeded the $90,000 threshold for the first time this year as they set their annual costs for tuition, board, meals, and other expenses. This means that a wealthy family with three children could expect to spend over $1 million by the time their youngest child completes a four-year degree. However, many colleges with large endowments have been focused on making college more affordable for lower-income students. Some lower-income families may only have to pay 10% of the advertised rate, making attending a selective private college cheaper than a state institution.

Private College Costs Exceed $90,000, Making College Education Expensive for Wealthy FamiliesA number of private colleges have exceeded the $90,000 threshold for the first time this year as they set their annual costs for tuition, board, meals, and other expenses. This means that a wealthy family with three children could expect to spend over $1 million by the time their youngest child completes a four-year degree. However, many colleges with large endowments have been focused on making college more affordable for lower-income students. Some lower-income families may only have to pay 10% of the advertised rate, making attending a selective private college cheaper than a state institution.

Baca lebih lajut »

Pro-Palestinian students at Smith College near weeklong building occupationSmith College SJP is occupying an administrative building, saying they will not leave until the school divests from weapons manufacturers.

Pro-Palestinian students at Smith College near weeklong building occupationSmith College SJP is occupying an administrative building, saying they will not leave until the school divests from weapons manufacturers.

Baca lebih lajut »

With college decisions looming, students ask: What’s the cost, really?FAFSA delays leave students seeking advice on paying for college without crucial information on financial aid.

With college decisions looming, students ask: What’s the cost, really?FAFSA delays leave students seeking advice on paying for college without crucial information on financial aid.

Baca lebih lajut »