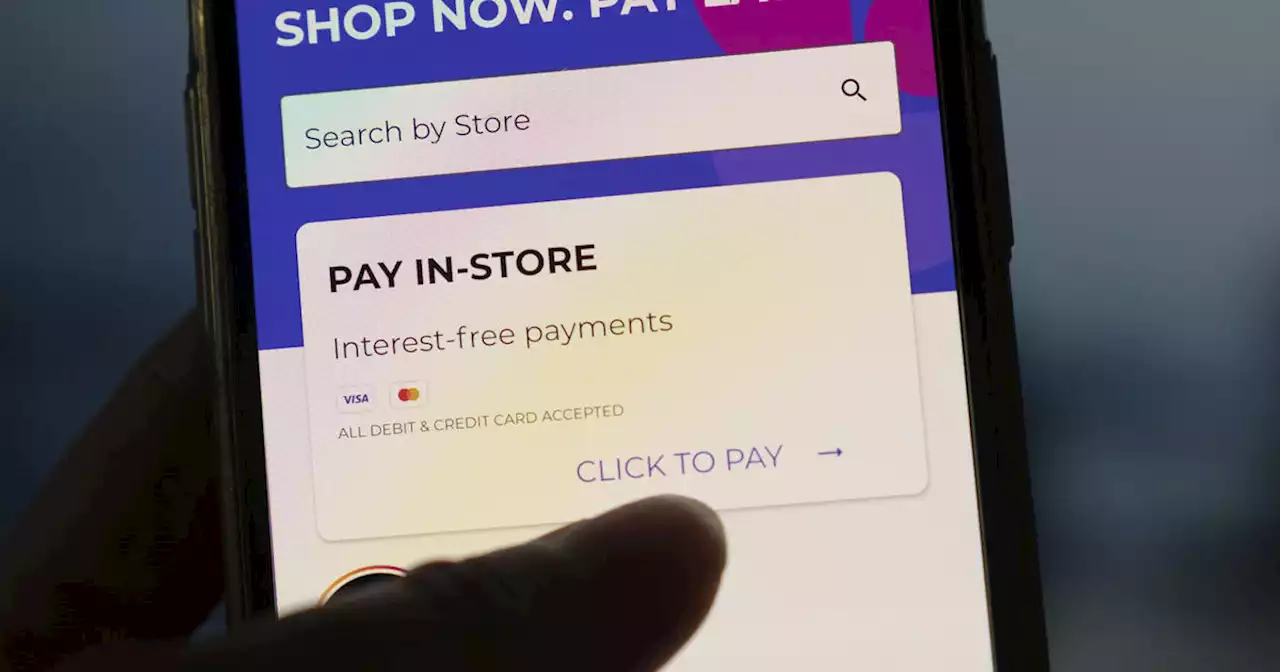

Millions have embraced the practice of buying small-ticket items and paying for them in installments, a popular model among retailers known as 'buy now, pay later' loans. But many consumers are struggling with the 'pay later' part of the equation.

loans. But many consumers are struggling with the"pay later" part of the equation.

"Buy now, pay later is a rapidly growing type of loan that serves as a close substitute for credit cards," CFPB Director Rohit Chopra said Thursday in a."We will be working to ensure that borrowers have similar protections, regardless of whether they use a credit card or a buy now, pay later loan." In 2021, buy now, pay later loans totaled $24 billion, up from $2 billion in 2019, according to a CFPB. The payment option has become ubiquitous in stores and online, forcing regulators to play catch up. At the same time, the agency has seen a steady rise in the percentage of borrowers who fall behind.

"[W]e find that buy now, pay later firms are building business models dependent on digital surveillance. In some ways, these firms aren't just lenders, they are also advertisers and virtual mall operators," Chopra said."Because they are deeply embedded as a payment mechanism for e-commerce, buy now, pay later lenders can gather extraordinarily detailed information about your purchase behavior, in a way traditional cards cannot.