Wall Street’s 'timid approach to earnings revisions sets up risks' for the U.S. stock market, which already is expensive, according to the CIO of Morgan...

Wall Street’s “timid approach to earnings revisions sets up risks” for the U.S. stock market, which already is expensive, according to the chief investment officer of Morgan Stanley’s wealth-management business.

“We estimate 2023 consensus earnings expectations are 10% to 20% too high,” she wrote. “Based on our forecast, stocks sell at a relatively risky 20 times earnings.” The S&P 500, which is a capitalization-weighted index of large-cap stocks in the U.S., is currently trading around “an already expensive 17 times forward earnings,” Shalett said. Based on Morgan’s Stanley’s below-consensus earnings forecast of $195 per share for the index, “the implied forward multiple rises to 20.”

But while equities appear “overpriced,” bond yields are “attractive,” she wrote. “History suggests that as Fed hiking cycles mature and yield curves reach maximum inversion — which may have occurred last week — investors should favor bonds over stocks.” Historically, the inversion of 10-year and 2-year yields in the U.S. Treasury market has preceded a recession.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Elon Musk restores Trump’s Twitter account after 51.8% vote in favor of reinstatementDonald Trump’s Twitter account was restored on Saturday, reversing a ban started when a mob attacked the U.S. Capitol on Jan. 6, 2021.

Elon Musk restores Trump’s Twitter account after 51.8% vote in favor of reinstatementDonald Trump’s Twitter account was restored on Saturday, reversing a ban started when a mob attacked the U.S. Capitol on Jan. 6, 2021.

Baca lebih lajut »

SF Advocates Push for Safer Streets During World Remembrance Day for Road Traffic VictimsSafety advocates and community members gathered in San Francisco Sunday to call for safer streets.

SF Advocates Push for Safer Streets During World Remembrance Day for Road Traffic VictimsSafety advocates and community members gathered in San Francisco Sunday to call for safer streets.

Baca lebih lajut »

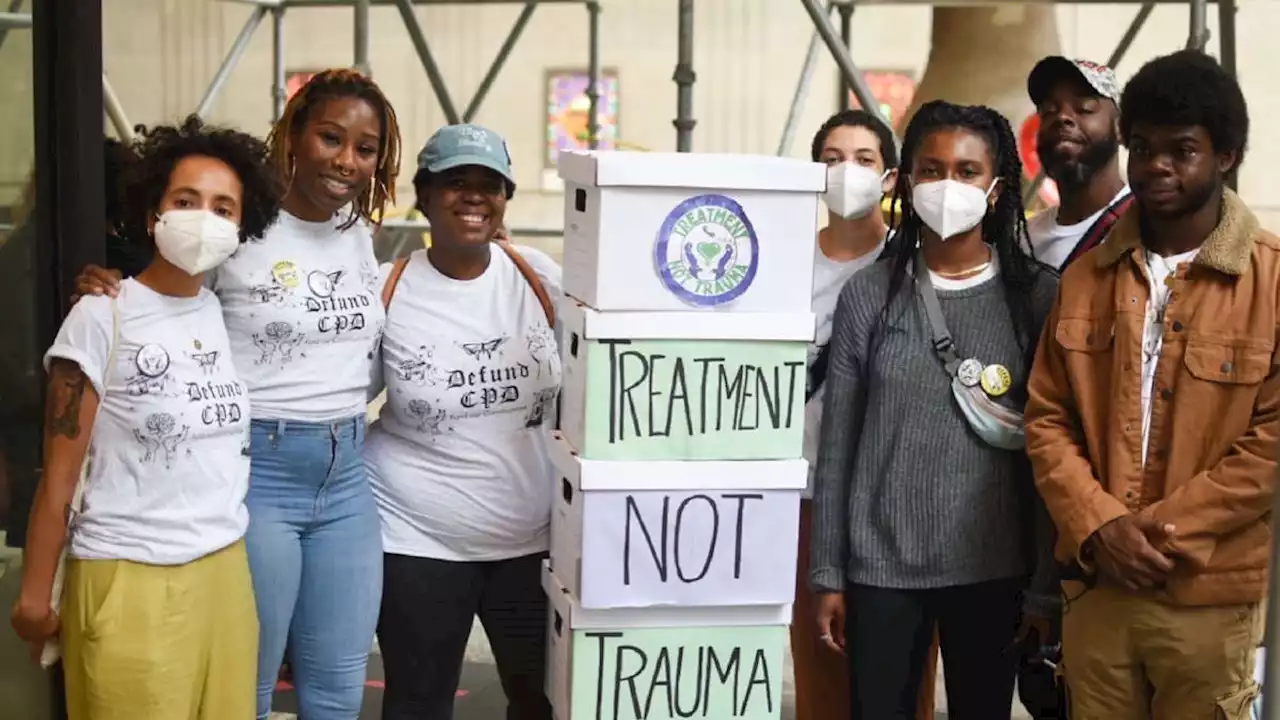

Chicago Votes in Favor of Removing Police From Mental Health Crisis ResponseThe response to the referendum was a victory for organizers who have fought to get police out of mental health.

Chicago Votes in Favor of Removing Police From Mental Health Crisis ResponseThe response to the referendum was a victory for organizers who have fought to get police out of mental health.

Baca lebih lajut »

Disney Stock Jumps as Wall Street Cheers Return of Bob Iger “Magic,” Predicts “Strategic Redirection”MoffettNathanson upgrades its rating on company shares to 'outperform' after 'concern that the former CEO Bob Chapek had become wedded to astreaming strategy that did not make sense given today’s reality.'

Disney Stock Jumps as Wall Street Cheers Return of Bob Iger “Magic,” Predicts “Strategic Redirection”MoffettNathanson upgrades its rating on company shares to 'outperform' after 'concern that the former CEO Bob Chapek had become wedded to astreaming strategy that did not make sense given today’s reality.'

Baca lebih lajut »