The stock rally will end soon, recession will hit, and the Fed won't hike interest rates again, markets guru Jeremy Siegel predicts

The stock-market rally will run out of steam, the US economy will sink into a mild recession, and the Federal Reserve won't hike interest rates any higher, Jeremy Siegel has predicted.bull market

"This recent bull market move is no guarantee we are out of the woods from the downturn," the retired Wharton finance professor said in his"I remain cautious and I do not think we have the start of a major up move here," Siegel continued, adding that stocks are also unlikely to slump below their October lows.

While the Fed is widely expected to lift rates next month, Siegel suggested it might refrain fom tightening its monetary policy anymore.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Jeremy Siegel: The Fed will give up rate hikes if labor market faltersThe Fed will cease hiking interest rates if the labor market falters, Wharton professor Jeremy Siegel says

Baca lebih lajut »

FACTBOX Wall Street banks expect 'hawkish pause' from Fed in JuneMost big Wall Street banks expect the Federal Reserve to keep interest rates unchanged on Wednesday, while sticking to its hawkish tone due to a strong job market and elevated inflation.

FACTBOX Wall Street banks expect 'hawkish pause' from Fed in JuneMost big Wall Street banks expect the Federal Reserve to keep interest rates unchanged on Wednesday, while sticking to its hawkish tone due to a strong job market and elevated inflation.

Baca lebih lajut »

FOMC Preview: Banks expect the Fed to take a break, but signal higher rates aheadThe US Federal Reserve will announce its monetary policy decision on Wednesday, June 14 at 18:00 GMT and as we get closer to the release time, here ar

FOMC Preview: Banks expect the Fed to take a break, but signal higher rates aheadThe US Federal Reserve will announce its monetary policy decision on Wednesday, June 14 at 18:00 GMT and as we get closer to the release time, here ar

Baca lebih lajut »

Investors increasingly expect U.S. stock-market rally to continue as bears finally surrenderA roundup of recent surveys of individual and professional investors point to new optimism about the stock market.

Investors increasingly expect U.S. stock-market rally to continue as bears finally surrenderA roundup of recent surveys of individual and professional investors point to new optimism about the stock market.

Baca lebih lajut »

U.S. stocks extend rally; investors bet Fed will pause rate hikesU.S. stocks rallied on Monday, putting the S&P 500 within striking distance of its highest close since April 2022, and Oracle hit a record high ahead of quarterly results as investors awaited inflation data and the Federal Reserve's interest rate decision this week.

U.S. stocks extend rally; investors bet Fed will pause rate hikesU.S. stocks rallied on Monday, putting the S&P 500 within striking distance of its highest close since April 2022, and Oracle hit a record high ahead of quarterly results as investors awaited inflation data and the Federal Reserve's interest rate decision this week.

Baca lebih lajut »

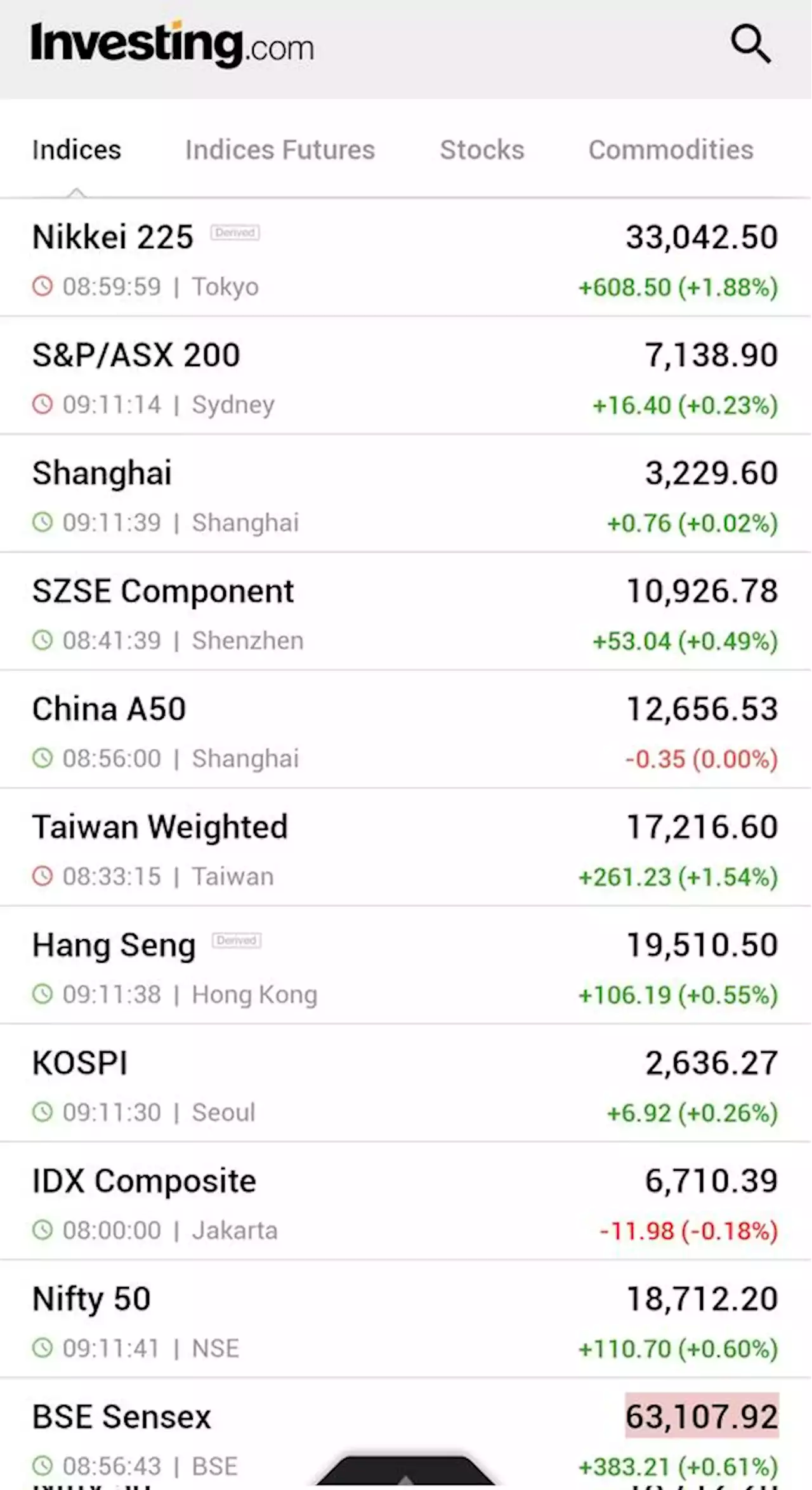

Asia shares track Wall Street rally with US inflation data, Fed in focus By Reuters⚠️BREAKING: *ASIAN STOCKS RISE ACROSS THE REGION AMID GLOBAL RALLY, NIKKEI JUMPS TO 33-YEAR HIGH 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Asia shares track Wall Street rally with US inflation data, Fed in focus By Reuters⚠️BREAKING: *ASIAN STOCKS RISE ACROSS THE REGION AMID GLOBAL RALLY, NIKKEI JUMPS TO 33-YEAR HIGH 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Baca lebih lajut »