EUR/NOK: A sustainable return below 11.00 looks unlikely amid market turmoil – ING EURNOK Norway RiskAppetite Banks

“NOK is the least liquid currency in G10 and was therefore very exposed to the tightening in global financial conditions, market, and lately the turmoil in the banking sector. A hawkish Norges Bank cannot counter those characteristics of the Krone, but should European sentiment continue to stabilise, it can offer a breeding ground for recovery that can ultimately help Norges Bank limit imported inflation.

“Still, we think EUR/NOK will remain highly volatile, and a sustainable return below 11.00 will require a more substantial return of market confidence in the financial system: something that we may not see in the very near term.”Information on these pages contains forward-looking statements that involve risks and uncertainties.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

EUR/NOK dives to multi-day lows near 11.2000 post-Norges BankThe Norwegian kroner gathers extra steam and forces EUR/NOK to recede to multi-day lows near 11.2000 on Thursday. EUR/NOK weaker on NB rate hike EUR/U

EUR/NOK dives to multi-day lows near 11.2000 post-Norges BankThe Norwegian kroner gathers extra steam and forces EUR/NOK to recede to multi-day lows near 11.2000 on Thursday. EUR/NOK weaker on NB rate hike EUR/U

Baca lebih lajut »

EUR/NOK: The 11.00 level should be an important support near term – SocGenEUR/NOK has slid toward the 11.20 mark. Economists at Société Générale expect the 11.00 level to floor the pair. A move beyond 11.48 should result in

EUR/NOK: The 11.00 level should be an important support near term – SocGenEUR/NOK has slid toward the 11.20 mark. Economists at Société Générale expect the 11.00 level to floor the pair. A move beyond 11.48 should result in

Baca lebih lajut »

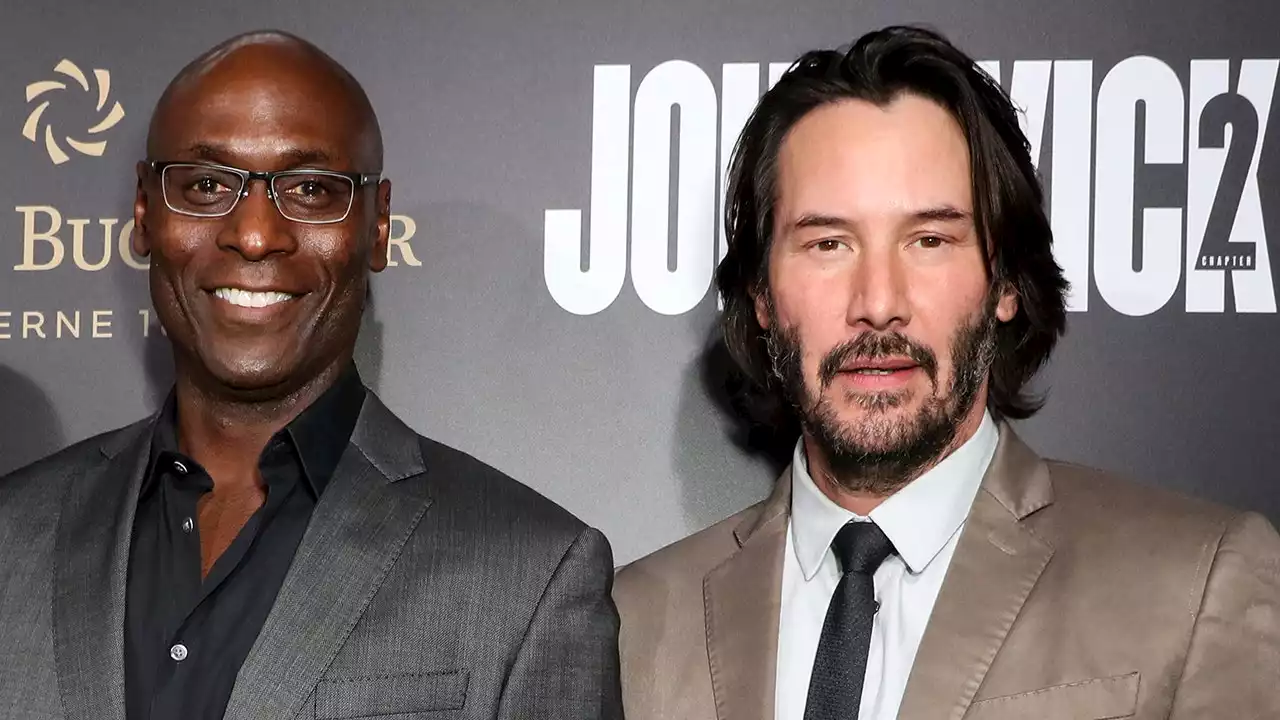

Keanu Reeves pays emotional tribute to Lance Reddick: ‘f---ing sucks he’s not here’'John Wick' actor Keanu Reeves, 58, remembered his late co-star Lance Reddick during the film franchise's red carpet premiere. Reddick died of natural causes on March 17.

Keanu Reeves pays emotional tribute to Lance Reddick: ‘f---ing sucks he’s not here’'John Wick' actor Keanu Reeves, 58, remembered his late co-star Lance Reddick during the film franchise's red carpet premiere. Reddick died of natural causes on March 17.

Baca lebih lajut »

EUR/GBP: Direction still seen as bullish over the coming weeks – INGEUR/GBP traded close to 0.8850 yesterday but dropped back below 0.8800 today after a surprise acceleration in UK inflation. Nonetheless, economists at

EUR/GBP: Direction still seen as bullish over the coming weeks – INGEUR/GBP traded close to 0.8850 yesterday but dropped back below 0.8800 today after a surprise acceleration in UK inflation. Nonetheless, economists at

Baca lebih lajut »

NOK to strengthen after the Norges Bank decision – INGEconomists at ING expect Norges Bank to hike the policy rate by 25 bps to 3.00% as they have been signalling. The Norwegian Krone is set to enjoy gain

NOK to strengthen after the Norges Bank decision – INGEconomists at ING expect Norges Bank to hike the policy rate by 25 bps to 3.00% as they have been signalling. The Norwegian Krone is set to enjoy gain

Baca lebih lajut »

GBP/USD: A test of 1.25 in the coming days is looking quite likely – INGThe Bank of England (BoE) is forecast to hike its key rate by 25 bps to 4.25%. In the view of economists at ING, GBP/USD is set to climb toward 1.25 i

GBP/USD: A test of 1.25 in the coming days is looking quite likely – INGThe Bank of England (BoE) is forecast to hike its key rate by 25 bps to 4.25%. In the view of economists at ING, GBP/USD is set to climb toward 1.25 i

Baca lebih lajut »