Equifax and blockchain company Oasis Labs will be offering a KYC solution for Web3. It will be a platform for decentralized ID management and anonymously issuing credentials.

The announcement made no mention of the exact technology which will underpin this offering and Cointelegraph’s request for comment was not immediately responded to by either company.

Both firms believe there hasn’t been a KYC solution tailored to Web3 with “strong privacy protection” and their proposed offering is set to address this gap by issuing anonymized KYC credentials to individuals’ wallets. This credential will be continuously updated according to the announcement and Oasis pledges its “privacy-preserving capabilities” will ensure data is processed in confidence whilst maintaining a trail on the company's blockchain.

Web3 firms offering similar solutions based around decentralized identity are Dock and Quadrata with each offering a product built around decentralized identity. The partnership could have some Web3 natives concerned considering the significant data breach Equifax suffered in 2017. Around 163 million worldwide private records were compromised with 148 million being U.S. citizens making it the 13th largest data breach in U.S. history

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

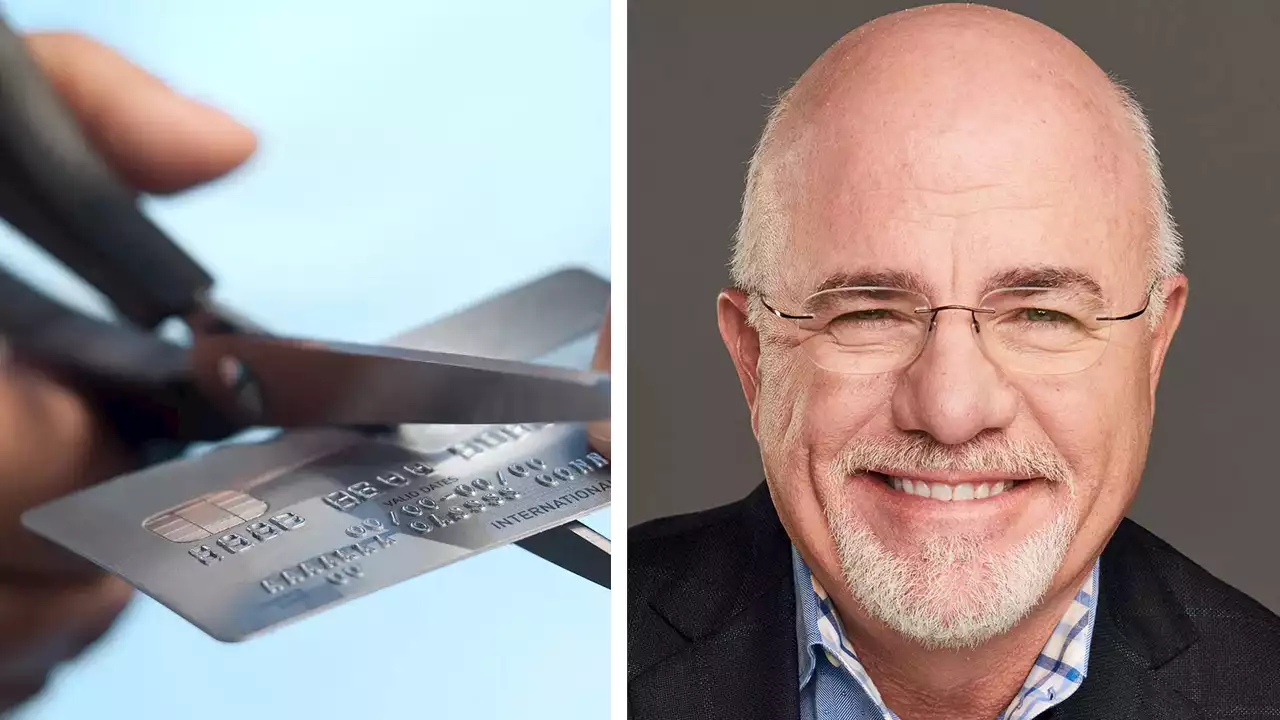

Credit cards can be a trap: Money expert Dave Ramsey’s best tips on cutting out cardsRamsey Solutions personal finance experts Dave Ramsey and George Kamel joined 'Fox & Friends' and shared tips with Fox News Digital on how to live without credit cards amid high interest rates and inflation.

Credit cards can be a trap: Money expert Dave Ramsey’s best tips on cutting out cardsRamsey Solutions personal finance experts Dave Ramsey and George Kamel joined 'Fox & Friends' and shared tips with Fox News Digital on how to live without credit cards amid high interest rates and inflation.

Baca lebih lajut »

HSBC Profit Falls on French Retail Disposal, Rising Credit ProvisionsHSBC reported a drop in third-quarter profit, caused by the planned sale of its French retail banking business and rising provisions against credit losses.

HSBC Profit Falls on French Retail Disposal, Rising Credit ProvisionsHSBC reported a drop in third-quarter profit, caused by the planned sale of its French retail banking business and rising provisions against credit losses.

Baca lebih lajut »

Op-Ed | Let’s give the Biden administration the credit it’s due for big infrastructure wins | amNewYork'As the United States economy continues to bounce back from the challenges brought on by the COVID pandemic, investments like the ones made through this bill in critical infrastructure will be key in keeping our country's future on the right track.'

Op-Ed | Let’s give the Biden administration the credit it’s due for big infrastructure wins | amNewYork'As the United States economy continues to bounce back from the challenges brought on by the COVID pandemic, investments like the ones made through this bill in critical infrastructure will be key in keeping our country's future on the right track.'

Baca lebih lajut »

For those battling credit card debt, a call to your credit company could help lower your billsManaging your credit card debt can be a tough fight, especially with high interest rates adding to the bill… Consumer Investigator Rachel DePompa has expert advice on how to negotiate a lower rate with your credit company.

For those battling credit card debt, a call to your credit company could help lower your billsManaging your credit card debt can be a tough fight, especially with high interest rates adding to the bill… Consumer Investigator Rachel DePompa has expert advice on how to negotiate a lower rate with your credit company.

Baca lebih lajut »

For those battling credit card debt, a call to your credit company could help lower your billsTed Rossman, Bankrate’s senior industry analyst, said you should look at your statement each month, and see how much interest you are paying. If your APR is 17% or more, call your credit card company and ask for it to be lowered.

For those battling credit card debt, a call to your credit company could help lower your billsTed Rossman, Bankrate’s senior industry analyst, said you should look at your statement each month, and see how much interest you are paying. If your APR is 17% or more, call your credit card company and ask for it to be lowered.

Baca lebih lajut »

AUD/USD could sustain a substantial drop to the low of 2020 at 0.5506 – Credit SuisseAUD/USD is set to remain under pressure. Therefore, economists at Credit Suisse expect the pair to potentially dive to the low of 2020 at 0.5506. AUD/

AUD/USD could sustain a substantial drop to the low of 2020 at 0.5506 – Credit SuisseAUD/USD is set to remain under pressure. Therefore, economists at Credit Suisse expect the pair to potentially dive to the low of 2020 at 0.5506. AUD/

Baca lebih lajut »