Under the deal, stockholders of business-software company EngageSmart will receive $23 a share.

EngageSmart stock was surging Monday after the business-software company agreed to be acquired by private-equity firm Vista Equity Partners for $4 billion.

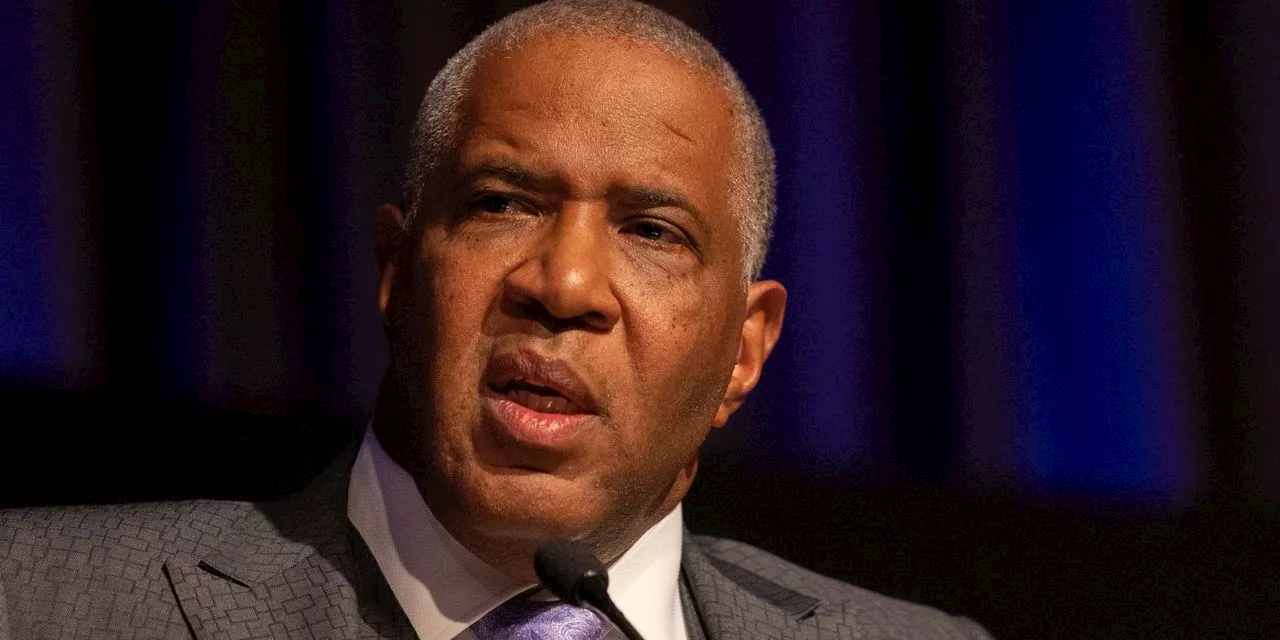

Shares of EngageSmart jumped 12% in premarket trading Monday to $22.55. Coming into the session, the stock has climbed 15% this year. “We believe the partnership with Vista and General Atlantic will enable us to continue investing in innovation and people to drive growth,” EngageSmart Chief Executive Bob Bennett said in the news release.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

1 Stock to Buy, 1 Stock to Sell This Week: Meta Platforms, SnapStocks Analysis by Investing.com (Jesse Cohen) covering: Nasdaq 100, S&P 500, Dow Jones Industrial Average, US Small Cap 2000. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

1 Stock to Buy, 1 Stock to Sell This Week: Meta Platforms, SnapStocks Analysis by Investing.com (Jesse Cohen) covering: Nasdaq 100, S&P 500, Dow Jones Industrial Average, US Small Cap 2000. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

Baca lebih lajut »

Vista Equity Partners Close to $4 Billion Buyout of EngageSmartThe private-equity firm would pay $23 per share for the customer engagement and payments software business

Vista Equity Partners Close to $4 Billion Buyout of EngageSmartThe private-equity firm would pay $23 per share for the customer engagement and payments software business

Baca lebih lajut »

EngageSmart to be bought for $4 billion in cash by Vista Equity PartnersTomi Kilgore is MarketWatch's deputy investing and corporate news editor and is based in New York. You can follow him on Twitter TomiKilgore.

EngageSmart to be bought for $4 billion in cash by Vista Equity PartnersTomi Kilgore is MarketWatch's deputy investing and corporate news editor and is based in New York. You can follow him on Twitter TomiKilgore.

Baca lebih lajut »

EngageSmart stock jumps toward a 1-year high after WSJ report that a $4 billion buyout deal was closeTomi Kilgore is MarketWatch's deputy investing and corporate news editor and is based in New York. You can follow him on Twitter TomiKilgore.

EngageSmart stock jumps toward a 1-year high after WSJ report that a $4 billion buyout deal was closeTomi Kilgore is MarketWatch's deputy investing and corporate news editor and is based in New York. You can follow him on Twitter TomiKilgore.

Baca lebih lajut »

Chevron to buy Hess Corp for $53 billion in all-stock dealChevron Corp said on Monday it will buy smaller rival Hess Corp in a $53-billion all-stock deal.

Chevron to buy Hess Corp for $53 billion in all-stock dealChevron Corp said on Monday it will buy smaller rival Hess Corp in a $53-billion all-stock deal.

Baca lebih lajut »