📈 BOE hikes policy rate by 50bps as expected and says will tighten policy further if needed 👀 Eyes on Governor Bailey's presser 🔴 Follow live here!

Many traders buy the rumors and square their positions shortly after the decision is made. For instance, if the market believes that the European Central Bank will hike the rate; traders buy the Euro and close the position shortly after the announcement. On the other hand, if the expectation is a rate decrease, traders will short the Euro and square the position after the announcement.

If the market is expecting a rate hike, but the European Central Bank ends up cutting the interest rate, a short 1-2 hour trade selling the Euro may prove successful. If the market expects a rate cut, but the ECB comes in with an increase in the rate, a trader may want to place a short long position on the Euro for 1-2 hours.When the interest rate is increased

the European Central Bank is literally selling government securities to large financial firms. In turn, the financial organizations are paying in Euros for these securities. This effectively decreases the amount of currency circulating in the economy. A decreasing supply leads to higher demand, and therefore causes the value of the Euro to appreciate., the European Central Bank floods the market with Euros. This is done by the purchasing government securities from financial organizations.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Sticky inflation means the European Central Bank could be far from a policy pivotThe European Central Bank is set to hike interest rates again on Thursday, with policymakers in Frankfurt shifting their focus to core inflation and trying to predict when sky-high consumer prices might fall.

Sticky inflation means the European Central Bank could be far from a policy pivotThe European Central Bank is set to hike interest rates again on Thursday, with policymakers in Frankfurt shifting their focus to core inflation and trying to predict when sky-high consumer prices might fall.

Baca lebih lajut »

European markets head for positive open with central bank decisions aheadEuropean stocks are heading for a positive open as investors digest the latest move by the U.S. Fed and look ahead to decisions by central banks in Europe.

European markets head for positive open with central bank decisions aheadEuropean stocks are heading for a positive open as investors digest the latest move by the U.S. Fed and look ahead to decisions by central banks in Europe.

Baca lebih lajut »

Lebanon to devalue currency by 90% on Feb. 1, central bank chief saysLebanon will adopt a new official exchange rate of 15,000 pounds per U.S. dollar on Feb. 1, central bank governor Riad Salameh said, marking a 90% devaluation from its current official rate that has remained unchanged for 25 years.

Lebanon to devalue currency by 90% on Feb. 1, central bank chief saysLebanon will adopt a new official exchange rate of 15,000 pounds per U.S. dollar on Feb. 1, central bank governor Riad Salameh said, marking a 90% devaluation from its current official rate that has remained unchanged for 25 years.

Baca lebih lajut »

Gold demand surged to an 11-year high in 2022 on 'colossal' central bank buyingGold demand soared to an 11-year high in 2022 on the back of 'colossal central bank purchases, aided by vigorous retail investor buying,' according to the World Gold Council.

Gold demand surged to an 11-year high in 2022 on 'colossal' central bank buyingGold demand soared to an 11-year high in 2022 on the back of 'colossal central bank purchases, aided by vigorous retail investor buying,' according to the World Gold Council.

Baca lebih lajut »

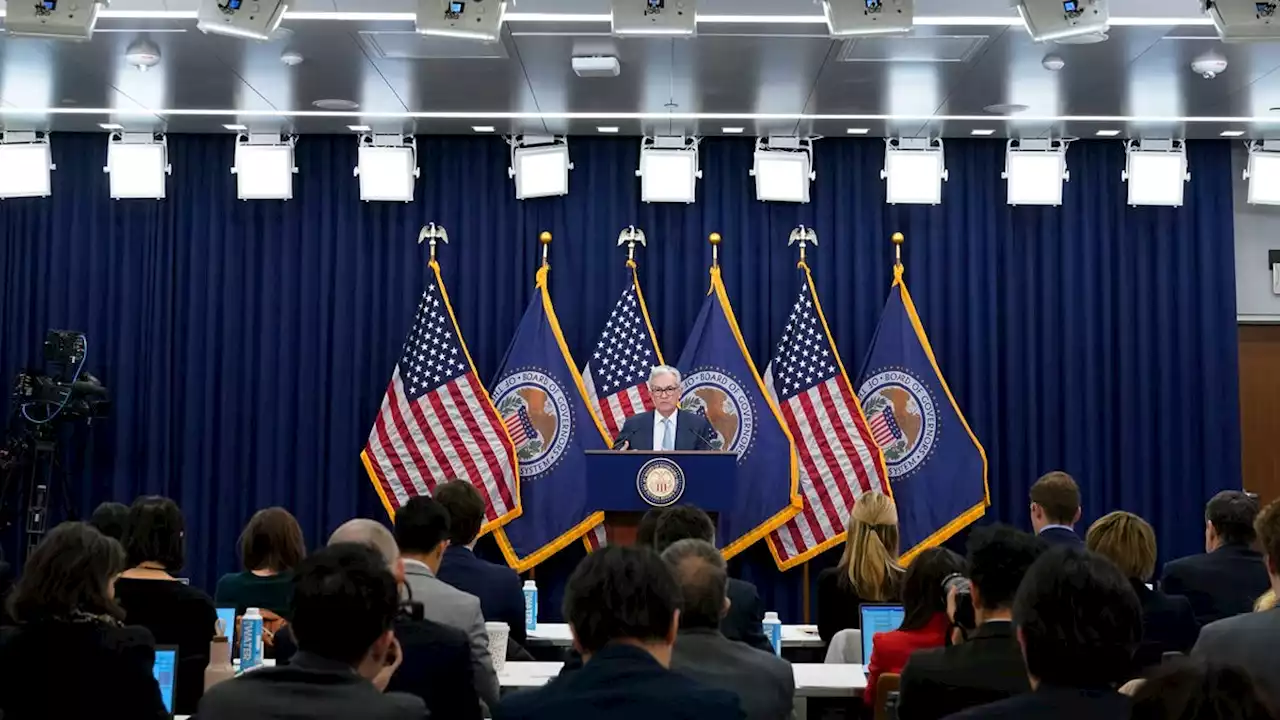

Fed interest rate decision today: Central bank hikes by 0.25 percentage point to tame inflationThe Fed raised its key interest rate by a smaller amount as it slowed its campaign for a second straight meeting. Chair Jerome Powell speaks next.

Fed interest rate decision today: Central bank hikes by 0.25 percentage point to tame inflationThe Fed raised its key interest rate by a smaller amount as it slowed its campaign for a second straight meeting. Chair Jerome Powell speaks next.

Baca lebih lajut »

ECB Preview: Forecasts from 14 major banks, another 50 bps hikeThe European Central Bank (ECB) is set to announce its decision on monetary policy on Thursday, February 2 at 13:15 GMT and as we get closer to the re

ECB Preview: Forecasts from 14 major banks, another 50 bps hikeThe European Central Bank (ECB) is set to announce its decision on monetary policy on Thursday, February 2 at 13:15 GMT and as we get closer to the re

Baca lebih lajut »