Dallas signals that it wants banks to be better lenders in poor neighborhoods | Opinion

Dallas has a simple message to banks that want to do business with the city. If you want the city’s more than $200 million in deposits, then you have to be serious about investing in minority communities and willing to open your books to prove it.” that would require banks competing for the city’s deposits to submit loan data showing how much they lend in minority neighborhoods and to submit reinvestment plans setting targets for future lending.

The reality is that Dallas’ proposal, while long on righteousness, is mostly symbolic and limited in scope. Regulatory oversight of banks rests with state and federal regulators, which leaves cities to cajole and incentivize investment choices. With no authority to demand where and how banks invest, the city is attempting to use its financial leverage to encourage banks to be more active lenders and participants in underserved neighborhoods as a condition of winning the city’s deposits.

Banks play essential roles in providing access to capital and in meeting the credit needs of communities and in some instances have been significant partners in the solution. But communities live and die based on the ability for residents to access capital and credit. The city is right to hammer home that point as frequently as possible and to remind financial institutions of their obligations to treat neighborhoods fairly.

In the long run, Dallas and other cities that face reinvestment challenges could benefit from a more robust Community Reinvestment Act. Passed in 1977, the milestone federal law required banks to fairly serve their customers and to stop redlining and other lending discrimination.

Dallas’ checkered past of systemic disinvestment deprived southern Dallas neighborhoods of access to bank branches, loans and economic development opportunities. Longstanding patterns of disinvestment will not be reversed swiftly, but positive change will come when financial institutions, the city and community groups work collaboratively to level the investment playing field.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Protesters gather in Dallas to decry Supreme Court’s draft opinion on abortionMore than a hundred people gathered outside the Earle Cabell Federal Building in downtown Dallas on Tuesday evening in protest of a leaked Supreme Court draft...

Protesters gather in Dallas to decry Supreme Court’s draft opinion on abortionMore than a hundred people gathered outside the Earle Cabell Federal Building in downtown Dallas on Tuesday evening in protest of a leaked Supreme Court draft...

Baca lebih lajut »

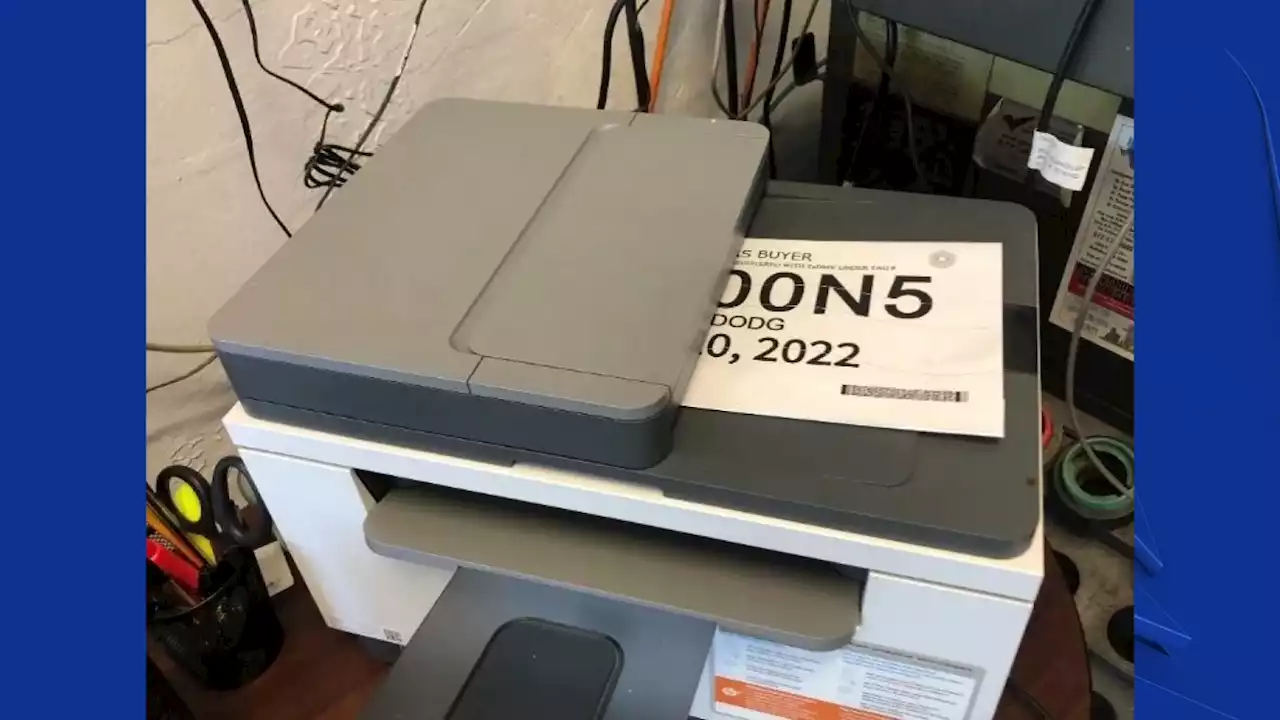

Dallas Police Shut Down Accused Fake Paper Tag DealerA man is in custody, accused of selling counterfeit temporary paper license tags in Dallas, police say.

Dallas Police Shut Down Accused Fake Paper Tag DealerA man is in custody, accused of selling counterfeit temporary paper license tags in Dallas, police say.

Baca lebih lajut »

Remembering Plato Karayanis, who headed the Dallas Opera for 23 transformational yearsKarayanis, the company’s general director from 1977 to 2000, has died at age 93.

Remembering Plato Karayanis, who headed the Dallas Opera for 23 transformational yearsKarayanis, the company’s general director from 1977 to 2000, has died at age 93.

Baca lebih lajut »

Sophisticated artifacts of a long-gone Middle American civilization, at the Dallas Museum of ArtA major exhibition assembles works from a Native American mound in Spiro, Okla., plus modern adaptations of past images and techniques.

Sophisticated artifacts of a long-gone Middle American civilization, at the Dallas Museum of ArtA major exhibition assembles works from a Native American mound in Spiro, Okla., plus modern adaptations of past images and techniques.

Baca lebih lajut »

Dallas police shut down fake paper tag mill, arrest Wayland Wayne WrightThe Dallas Police Department Auto Theft Task Force shut down a fake paper license plates tag mill and arrested Wayland Wayne Wright, 43, in connection to it.

Dallas police shut down fake paper tag mill, arrest Wayland Wayne WrightThe Dallas Police Department Auto Theft Task Force shut down a fake paper license plates tag mill and arrested Wayland Wayne Wright, 43, in connection to it.

Baca lebih lajut »

20th anniversary edition of Norah Jones’ debut album features Dallas high school recordingThe ‘Come Away With Me’ singer honed her chops at Booker T. Washington.

20th anniversary edition of Norah Jones’ debut album features Dallas high school recordingThe ‘Come Away With Me’ singer honed her chops at Booker T. Washington.

Baca lebih lajut »